Friendship Tower, a Grade A building in Ho Chi Minh City’s District 1, was officially topped out on August 16 and handover is expected in the first quarter of next year. Located on Le Duan Boulevard, one of Ho Chi Minh City’s most famous and prestigious thoroughfares, and with construction by Coteccons, it has been structurally complete for nine months and meets all safety and quality requirements.

Developed by CZ Slovakia Vietnam, the building provides 21 floors and four basements with a total gross floor area (GFA) of more than 25,000 sq m and offers ideal office space for dynamic Western companies operating in Vietnam and Southeast Asia as well as Vietnamese companies doing international business. “Our hard work and effort have seen construction progress on track for handover in the first quarter of 2020, offering tenants a flexible and modern working environment in a prestigious District 1 location,” said Mr. Nguyen Trong Hung Son, Finance Manager of CZ Slovakia Vietnam. “The on-time topping out is another milestone underlining our commitment to delivering a high-quality office building.”

Vibrant future

In Ho Chi Minh City, the Alpha Town Grade A office building, one of two projects from Alpha King Real Estate Development, will open in 2020 and offer a 1,680 sq m floor plate on 35 floors and five basement levels, totaling approximately 72,109 sq m of GFA. In addition to AtlasSpace, which will offer flexible workspace and state-of-the-art facilities, Alpha Town will appeal to a unique collection of tenants considered best-in-class and in a broad range of industries, from brand agencies to financial institutions.

In Hanoi, meanwhile, CapitaLand’s Capital Place, the capital’s first international Grade A office development, announced in July it will be completed in the third quarter of 2020. Located in the commercial area of Ba Dinh district, it will provide approximately 121,000 sq m of GFA in two 37-story towers. Inspired by local legend, the likeness of a dragon was incorporated into its façade and lighting scheme, delivering a striking modern look both day and night.

The premium Japanese office building Leadvisors Tower, developed by LeadvisorSanei Hospitality Holdings, will open in the third quarter of this year. In a prime location on Pham Van Dong Boulevard - Ring Road 3, which is now being expanded into an arterial road to the flourishing new urban area and business district in the west of Hanoi, Leadvisors Tower covers an area of 28,000 sq m. Its total net leasing area (NLA) is approximately 20,000 sq m, with a floor plate ranging from 750 sq m to 970 sq m that suits various leasing requirements for commercial, office, and showroom.

The country’s office market will become extremely vibrant in the future with a variety of Grade A office projects launched. From the second quarter of 2019 to the end of 2021, Ho Chi Minh City’s office market is expected to welcome 14 new office buildings with more than 300,000 sq m, of which half is Grade A offices, according to a CBRE quarterly report released in July. Meanwhile, the Grade A office segment in Hanoi will see many new projects with a total of 260,000 sq m opened this year and next. “Over the past few years, the market has witnessed the opening of several Grade A projects in Hanoi and Ho Chi Minh City and all are sizable projects in prime locations, thus drawing market attention,” Ms. Nguyen Hoai An, Director of CBRE Hanoi, told VET.

Market signals

According to CBRE, there are 15 and 20 Grade A projects in Ho Chi Minh City and Hanoi, respectively, providing 383,000 sq m NLA and 435,000 sq m. The asset class has enjoyed healthy occupancy in both cities. As at the second quarter of this year, average occupancy in Grade A office buildings in Ho Chi Minh City and Hanoi were 97 per cent and 92 per cent, respectively. Ms. An said the performance of the upscale market and solid demand provide motivation for developers investing in the Grade A segment. “This segment not only attracts local developers but also foreign developers entering and developing projects under international standard,” she added. “While demand, especially from the FDI sector, is still healthy, there is lack of quality space for these high-profile tenants. Moreover, the space from existing projects is gradually being absorbed, so there is potential for new projects entering the market.”

Meanwhile, Alpha King said that there being just 35 Grade A office buildings in Vietnam indicates the complexities of developing to Grade A criteria in super prime locations. Such developments require the best available construction methods and quality and should meet the highest standards of health and safety and sustainability. Mr. Richard Leech, Senior Director, Commercial, at Alpha King, believes this high demand represents potential for the development of the Grade A office segment. “High profile tenants demanding quality workspace that enhances their brand reputation and respect among their peers will attract the best talent,” he noted. “These companies also demand superior property management services in an environmentally-friendly building that ensures the wellness and safety of its employees.”

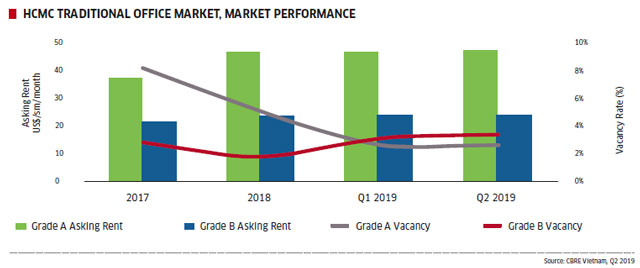

According to CBRE, as at the second quarter, the average asking rent for Grade A space in Ho Chi Minh City was $46.7 per sq m per month; a slight increase of 0.9 per cent quarter-on-quarter and 2.9 per cent year-on-year. In Hanoi, asking rents at Grade A buildings in the second quarter rose 5.3 per cent year-on-year, to $26.4 per sq m per month (excluding VAT and service charges). “The Grade A office sector remains an attractive investment asset for property developers, even though capital recovery may take longer than other products such as residential,” Mr. Son said.

From 2020 to 2021, the wave of new supply will help ease pent-up demand for leasing office space in Ho Chi Minh City, according to CBRE. Hence, rental growth in Grade A offices is expected to be only 4 per cent in 2019, compared to 15.8 per cent in 2018, while vacancies will continue to fall slightly, to 4 per cent in 2019. In Hanoi, given healthy demand, rental growth at Grade A buildings is expected to be 4 per cent year-on-year this year. “The outlook for the Grade A segment has improved significantly in recent years,” said Ms. An. “While stronger demand is evidenced in Ho Chi Minh City, Hanoi is also expected to perform strongly, especially Grade A.”

Vietnam’s commercial real estate market has been developing for almost 20 years now, with certain trends catching up with what’s happening in the rest of the region, so the main challenges lay in accelerating urbanization in the two cities of Ho Chi Minh City and Hanoi, leading to a shift in commercial hubs and certain older buildings risking becoming obsolete due to an inability to accommodate the ever-changing requirements of occupiers.

Ms. An pointed out that international office occupiers would typically require column-free floor plates, raised floors, abundant parking, high security, and wellness facilities on site, among other things. “However, the number of buildings that can accommodate such requirements is only limited to recently-completed buildings, putting pressure on older buildings to undergo renovation and offer competitive rental policies,” she added.

Moreover, in the CBRE report released in July, the office market revealed a shortage of Grade A office supply. For example, Hanoi’s CBD welcomed its first Grade A project in five years. Ms. An explained that due to the nature of an emerging market, Vietnam has witnessed major fluctuations in supply volumes, leading to a situation of high supply for a certain period of time and then an absence of supply in another period.

Effect of co-working space

First emerging in 2015, the office market has witnessed the strong expansion of the co-working, or flexible workspace, model in both Hanoi and Ho Chi Minh City. Many analysts have said that this is the trend in Vietnam’s real estate market and will put pressure on the Grade A office segment. But, conversely, co-working space operators are one of the target tenants for Grade A office space.

The Executive Center, a premium flexible workspace provider in Asia-Pacific, became the first tenant at Friendship Tower, securing 1,442 sq m over two floors for their second location in Ho Chi Minh City. Mr. Son said the growth of the co-working space sector actually benefits Grade A office buildings like Friendship Tower and complements office space solutions.

Alpha Town has also leased a sizeable portion to Atlas Work Space, who will then lease to a specific type of flexible workspace user while at the same time providing Alpha Town occupants with an array of facilities, from food and beverage outlets to fitness centers and spas. “We believe that there is both a market for co-working and traditional office space, and the two together will only enhance the experience for the office space user and attract the country’s top companies and talent to work at Alpha Town,” Mr. Leech said.

According to CBRE, there are also some changes in the locational strategy of co-working providers to target different types of customers and tenants. Some co-working providers have chosen Grade A or new Grade B buildings as new venues targeting corporate clients, to whom they provide workspace solutions and more flexible leasing options. However, tenants in this segment also require professional buildings and management, leading to an expansion of co-working chains in office buildings. Thus, co-working space providers have now become one of the major sources of demand in the office market for both the Grade A and Grade B segments, benefiting the traditional office market.