The West office submarket continues to expand

In the second quarter of 2019, two Grade B buildings entered the market, namely FLC Twin Towers and Leadvisors Tower providing around 29,000 sq.m and 20,000 sq.m each, NLA. Both buildings are in the West area making this submarket continue to be the major office supply hub of Hanoi with 50% of the total office stock as at Q2 2019.

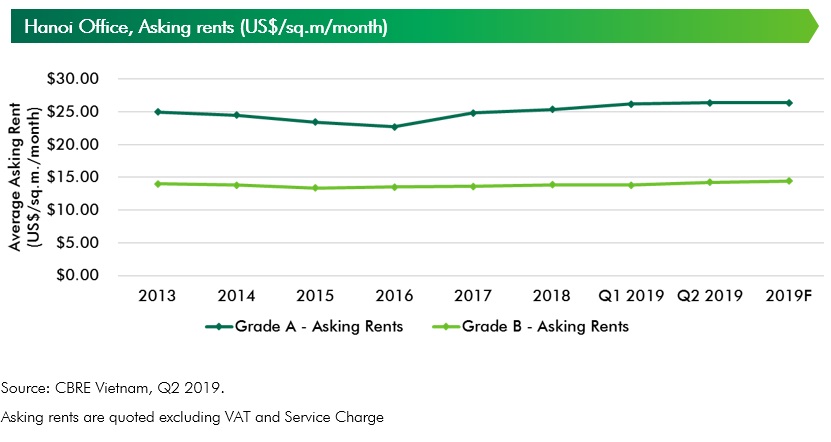

Generally speaking, Hanoi office market still observed healthy performance in both Grade A and Grade B. Asking rents of Grade A buildings in this quarter posted an increase of 5.3% y-o-y, achieving US$26.4/sq.m/month (exclusive of VAT and service charge). Similarly, Grade B’s average asking rents increased by 4.6% y-o-y reaching US$14.3/sq.m/month.

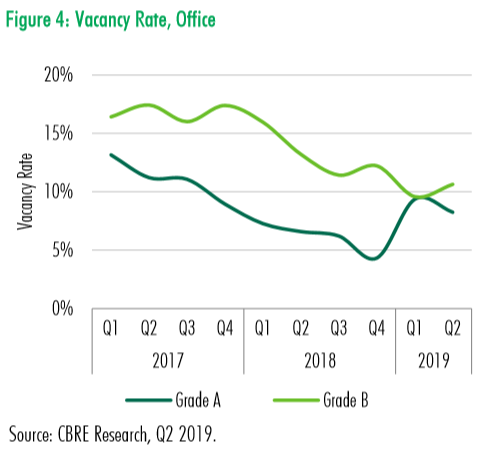

In terms of vacancy rates, Grade A’s vacancy rate declined by 1.7 ppts staying at 8.2%. Meanwhile, although there was new significant launch during the quarter, Grade B vacancy only increased by 2.6 ppts reaching 10.6%.

During the review period, Hanoi office market saw relatively strong demand, primarily from local IT/Tech and flexible office providers with net absorption of 21,500 sq.m. Among industries, IT/Technology sector was recognized as a key demand driver, accounting for 27% of the total leasing inquiries to CBRE during 1H 2019. Existing tech firms expanded rapidly, while new Japanese and US tech firms sought spaces for their new office.

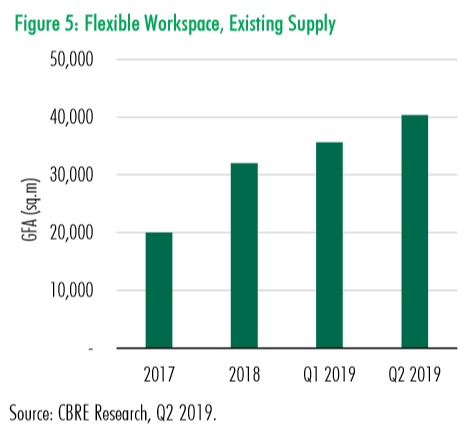

Approximately 260,000 sq.m is expected to be opened during 2019 - 2020. Providing that future office buildings are in the major office clusters either in West or Midtown and healthy leasing demand across sectors, rental rates are expected to continue upward trend in both grades. In Q2 2019, the flexible workspace continued to expand significantly in Hanoi.

Providing the opening of two new venues, the total supply reached more than 40,000 sq.m in Q2 2019, up by 56% y-o-y. It is expected the total supply will reach 85,000 sq.m at the end of 2019 and penetration rate will increase from current level of 3.5% to 7%. On the back of strong demand for build-to-suit model, flexible workspace is forecasted to expand strongly from 2H 2019 and become a major source of demand for traditional office space.

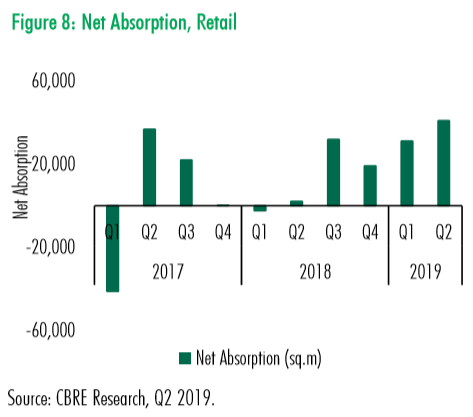

Positive retailmarket performance in CBD and non-CBD

The first half of 2019 ended with four new retail projects at emerging locations in non-CBD area. As a result, the total retail supply increased by approximately 65,700 sm to just over 930,000 sq.m. Two new projects, Vincom Plaza Skylake and Vincom Center Tran Duy Hung, are located in the major retail cluster of Hanoi – Midtown and the West – accounting for just over 60% of total supply in the market. The remaining new projects, Sun Plaza Ancora and Sun Plaza Thuy Khue, added around 29,900 sm NLA to the North and the South.

Looking into the second half of 2019, two new retail projects are expected to come online with total scale of 80,800 sm, including Aeon Mall Ha Dong and FLC Twin Towers, reaffirming the leading position of Midtown and the West as a major retail cluster.

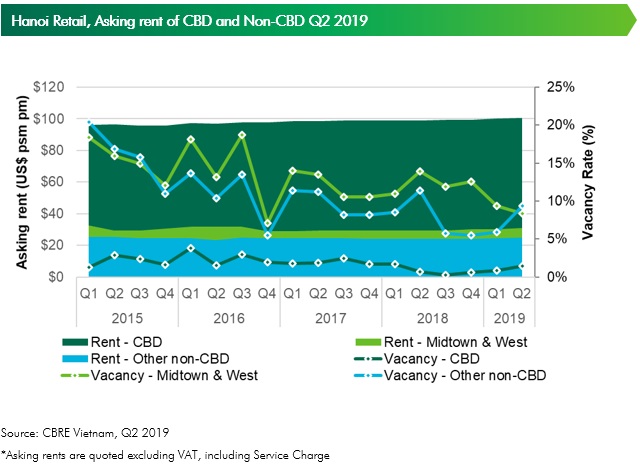

Ground floor rents for retail space in CBD picked up slightly in Q2 2019, reaching average US$100.7/sq.m/month, up 1.6% y-o-y and 0.7% q-o-q. As no new supply in CBD is expected to open in 2019, average asking rents in this area will continue to post positive growth in the coming year while vacancy will continue to stay as low as below 2%.

Ground floor rents in the largest retail supply cluster, namely Midtown and the West increased to US$31.0/sq.m/month in Q2 2019, up 6.2% y-o-y, as the market continued to see more high-quality supply from reputable developers in this area.

Vacancy in Midtown and the West stood at 8.3% during Q2, down 5.6 ppts y-o-y and 1.1% q-o-q. Ground floor rents in other non-CBD area grew moderately by 3.4% y-o-y to US$25/sq.m/month whereas vacancy up by 2.7 ppts y-o-y to 9.4% with the openings of two new projects by Sun Group, Sun Plaza Ancora in Q1 and Sun Plaza Thuy Khue in Q2.

On the demand side, Vietnam market experienced very positive consumer sentiment with the Consumer Confidence Index peaked at 129 after reaching similar level in Q3 2018. More importantly, the rising effect of e-commerce and millennials’ changing shopping habits are expected to reshape the future of retail in general and the local market of Vietnam in particular.

New shopping malls should be expected to have modern design and focus on customers’ experience while bringing technology into delivery services and online platform. The active convergence of online and offline retail strategies is forecasted to strengthen in the near future to boost retail sales and at the same time attract potential consumers.

Looking back, there has been a contradictory scene of success and struggle among retail stories in Vietnam during the first half of 2019. While various F&B chains continued to outperform and keep expanding in the local market, supermarkets continued to see the consolidation trend with the exit of French supermarket chain Auchan, who sold its portfolio to locally owned Saigon Co.op. Earlier last year, Vingroup also acquired Fivimart chain from Aeon group, making it the supermarket leader in Hanoi. In March 2019, online fashion arm of Central Group, Robins.vn, was announced suspended, following the closure of online website vuivui.com operated by Mobile World in December 2018.