The Ho Chi Minh City’s apartment for sale market is stepping into the growth slowing stage of the price cycle.

Owner-occupied demand remained sustained amid dwindling sales

Take-up in 1Q19 was more than 4,300 units, notable lower by 51.5% q-o-q, in tandem with supply slump. Owner-occupier drove demand with high sales recorded in those projects targeting this group of buyers.

In 1Q19, the slower investor demand became more evident after a period of strong growth. The current high price level made the premium apartment a less attractive investment channel, regarding both capital and rental yield perspective.

Sluggish new supply in 1Q19

Official launches reached more than 4,500 units from eleven projects in 1Q19, half the level of the previous quarter due to the prolonged construction approval experienced recently. This was also the lowest level of new launches since the market rebounded in 2014, a result of slow approval procedure recently.

The market trend toward more sustainable mode with prominent proportion of new launches coming from Affordable and Mid-end projects has continued in the review quarter.

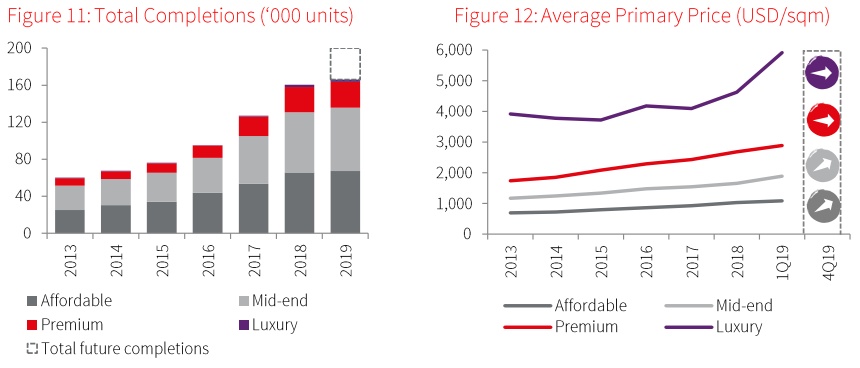

Ho Chi Minh City apartment market performance. (Source: JLL)

Prices elevated, driven by exceptionally high prices in luxury launches

The high-end segment, including premium and luxury projects, registered an exceptionally high price level thanks to the entrance of some new luxury projects in CBD area, pushing the market-wide price to increase by 22.7% y-o-y. The primary price for a sqm in HCMC in 1Q19 hanged around the USD $2,028 threshold.

On a project basis, primary prices maintained flat or slightly improved after a period of strong growth. Chain-linked growth in priaces recorded at 2.9% q-o-q and 7.5% y-o-y, with good improvement across the board.

Outlook

As the prevailing delay in approval procedure is expected to continue, the projected supply pipeline in 2019 is subject to greater uncertainty, vary between 30,000-45,000 units. The number of new launches in 2019 will heavily depend on the improvement of procedure and the developers’ ability to acquire relevant legal documents to officialy launch the projects.

Projects that can manage to be officially launched and focused on owner-occupiers will still record good sale rate, underpinned by strong bookings recorded over the soft launches of new projects in 2018. Prices should increase further but at a slower pace.

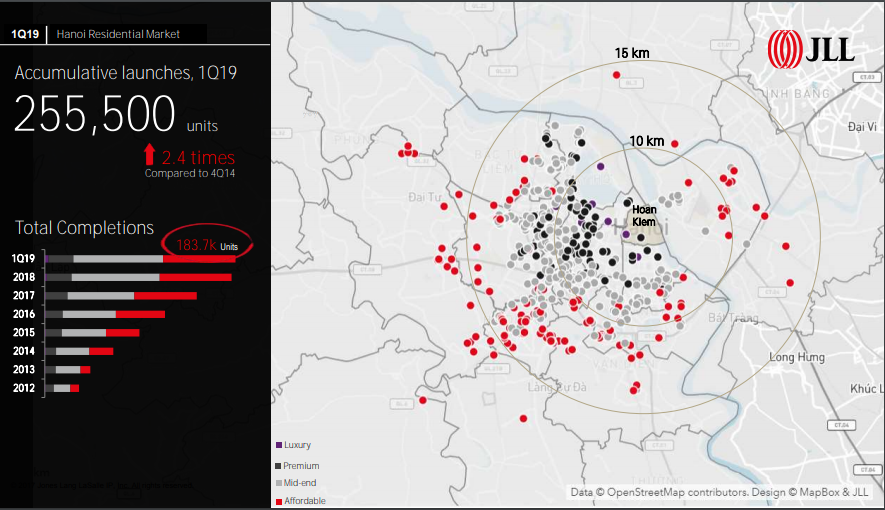

More and more mid-end residential projects are being built in Hanoi.

Meanwhile, Hanoi`s real estate market showed good movements in all segments, mostly apartment with record high supply in the last five years.

Strong take-up level with Affordable being the main contributors

Take-up witnessed a remarkable upsurge of more than 13,600 units, up 65% q-o-q. Of the total, affordable segment made up nearly 76% of residential property sales, nearly double the 4Q18’s figure. Notably, the majority of the absorption was seen in either completed projects or projects nearing completion.

Genuine buyers mostly drove sale while demand from investors slowed down in recent quarters. Besides, developers have approached new product strategy by lowering unit size to fit the budget of young owner-occupiers.

Strong new supply from large scale projects

Nearly 11,500 units were newly launched to the market during the review quarter, up 24.7% q-o-q, the record high level over the last five years. Notably, 75% of total new launches was contributed by two large scale projects of Vingroup, namely Vinhomes Gia Lam Ocean Park and Vinhomes Dai Mo Phase 1.

The eastern suburban area has been emerging as favourable spots for affordable housing developments owing to ample availability of land and reasonably low-priced.

Residential market in Hanoi over past few years. (Source: JLL)

Price uptrend slowdown

Prices growth softened in the primary market, with an increase of less than 1.6% q-o-q, resulted from rising levels of affordable housing stock. Premium segment was among the best performers, growing by 5.2% q-o-q thanks to restricted available stock and strong demand of foreign buyers. Price appreciation was recorded in projects with high construction quality and in convenient location.

Outlook

Until the end of 2019, an average of 10,000-20,000 units are set to be launched each quarter, dominated by affordable submarket to capture the unmet housing demand from the lower income groups.

The increase in launches towards the city’s east and south can be attributed to the enhanced infrastructure activity and the first metro line will soon come into operation.

Prices uptrend will continue to strengthen but at a slower pace in the coming quarters.