(Photo: Viet Tuan)

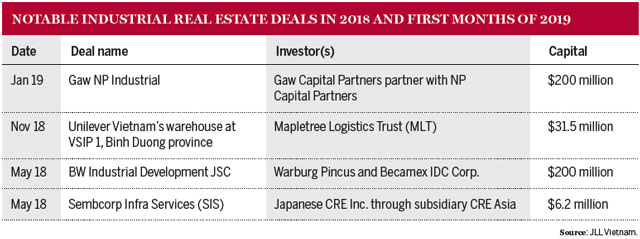

Gaw Capital Partners partnered with NP Capital Partners in January to launch the $200 million Gaw NP Industrial fund, which will invest in industrial properties in strategic locations in Vietnam to meet strong demand from export and import businesses and companies servicing booming e-commerce and new retail activities. “Gaw NP Industrial looks forward to harnessing the soaring demand for high-quality warehouses, ready-built factories, and built-to-suit facilities through its strong project pipelines as well as through M&A opportunities,” Mr. Vo Sy Nhan, Co-founder and CEO of Gaw NP Industrial, told VET.

According to the latest report from real estate consultants JLL, M&A activities in Vietnam’s real estate market have resulted in many major deals in recent times, with industrial real estate M&A activities emerging strongly. Observers have said that improving the business environment and market transparency has made Vietnam’s industrial real estate market more attractive to foreign investors.

M&A WAVE

In the south, Mapletree Logistics Trust (MLT) spent VND725.1 billion ($31.5 million) last November on acquiring warehouses from Unilever Vietnam. The Unilever VSIP Distribution Center is a Grade A logistics facility located at the Vietnam - Singapore Industrial Park 1 (VSIP) in Binh Duong province. Upon completion of the acquisition, the property will be leased to Unilever Vietnam for ten years with annual rent increases. The acquisition adds Unilever, a global leader in fast-moving consumer goods (FMCG), to MLT’s tenant network. “The addition of this facility, MLT’s fourth property in Vietnam, will enhance our ability to tap into the rising demand for quality logistics facilities in one of the region’s fastest-growing markets with strong domestic consumption,” a representative from Mapletree told VET.

Global private equity fund Warburg Pincus and industrial real estate developer Becamex IDC Corp officially launched a joint venture, BW Industrial Development JSC (BW Industrial), in May 2018. With over 200 ha of projects under development and initial investment of more than $200 million, BW Industrial is the largest “for-rent” industrial and logistics developer in Vietnam. “BW Industrial will continue to expand in Vietnam in the coming years to promote the promising development of Industry 4.0 in Vietnam,” said Mr. CK Tong, Managing Director of BW Industrial.

Among major M&A deals, one of Japan’s largest management companies specializing in real estate properties for logistics operations, CRE Inc., through its subsidiary CRE Asia, agreed to invest $6.2 million in Sembcorp Infra Services (SIS) in a share subscription agreement. The new capital from CRE Asia and bank borrowings will fund the development of an additional 30,000 sq m of warehouse space in Vietnam by SIS. In January, meanwhile, the 100 per cent foreign-invested Schindler Vietnam Co., Ltd., belonging to the Jardine Schindler Group (Switzerland), signed a land sublease contract with the Hiep Phuoc Industrial Park JSC (HIPC) in Ho Chi Minh City to build a 10,000 sq m manufacturing factory. “M&A activities are growing in Vietnam’s industrial real estate market, a sign that institutional investors are continuing to increase their allocations to the segment,” said Mr. Stephen Wyatt, General Director of JLL Vietnam.

IDEAL MARKET

Foreign investors are actively seeking opportunities to invest in Vietnam’s industrial real estate market through M&A deals. Analysts have said that the global trend towards shifting production locations sees Vietnam viewed as one of the most favorable destinations for foreign investment in Southeast Asia. The country has become an attractive destination for many foreign investors largely due to its friendly policies encouraging FDI, its political stability, and its strong economy.

FDI disbursement rose 9.1 per cent year-on-year in 2018 to $19.1 billion, according to the Foreign Investment Agency. Furthermore, Vietnam has been taking initiatives to improve its transparency to the next level, according to JLL’s Global Real Estate Transparency Index released in February. “Given Vietnam’s impressive economic growth, the booming of modern means of retail such as e-commerce, new economies, and waves of FDI into manufacturing facilities, demand for high-quality industrial property is expected to reach new heights,” said Mr. Nhan. “Therefore, Vietnam has attracted strong interest from foreign investors into industrial real estate over the last three years with more still to come.”

Vietnam also possesses an advantage in labor costs, which are 43 per cent lower than in Thailand and 10 per cent lower than in Indonesia, according to figures from the Ministry of Planning and Investment (MPI).

In addition, JLL’s quarterly report released in early April noted that industrial properties in Vietnam are still attracting attention, with large amounts of FDI coming mostly from Japan, South Korea, and Hong Kong and, increasingly, from China. “Its advantages make Vietnam more attractive to foreign investment into industrial properties,” Mr. Nhan said.

IMPACT OF CPTPP

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has a range of impacts on the foreign investment wave to the real estate market in general and industrial real estate in particular. “Vietnam is an ideal destination for foreign investors thanks to the free trade agreements the country is party to, like the CPTPP,” according to Mr. Nhan.

Real estate analysts said that with the aim of eliminating tariffs on goods among member countries, stipulating a number of commodities in the framework of the CPTPP is an important factor helping Vietnam’s real estate market become more attractive. This also encourages corporations from other countries to select Vietnam as a source of raw materials for factories, warehouses and business facilities.

Mr. Wyatt told VET that the industrial market is an area that will benefit greatly from the CPTPP. “The trend of cooperation between domestic and foreign real estate enterprises has made major strides forward in recent years, of which foreign investors are constantly expanding the level of investment in industrial and logistics real estate in Vietnam,” he said. “The agreement could also significantly influence large-scale infrastructure projects in the region and may pave the way for private investment.”

The JLL report also noted that occupancy rates in industrial parks are quite high. For example, occupancy averaged 74 per cent in the top five most dynamic cities and provinces in the Northern Key Economic Zone in the first quarter of 2019, led by Hanoi and Bac Ninh and Hung Yen provinces. “Along with abundant supply, demand also improved, with occupancy rates in both land and factories to remain high and grow thanks to FDI from Asian investors and efforts to improve and encourage investment by the government,” said Mr. Wyatt. “As a result, rents will continue to increase and that requires investors act more aggressively.”

Not all is rosy, however, as foreign investors have been facing challenges and obstacles in tapping into the local market. Gaw NP Industrial has observed that major concerns and difficulties foreign investors have been dealing with include a lack of cleared industrial land, proper master planning, and infrastructure connections, while land prices keep rising to levels that end users and tenants can’t afford. Mr. Nhan believes that obtaining permits and approvals also take up much more time than the private sector expects.

Regarding the development of the industrial real estate market in 2019, JLL forecasts it will be the hottest sector this year, backed by continued movements from China and the positive impact of the CPTPP and the EU-Vietnam Free Trade Agreement (EVFTA). “The prolonged approval process may impact new developments in 2019, so sourcing for ‘clean’ and ‘clear’ projects that are ready for development will be a challenge for investors in the upcoming year,” said Mr. Wyatt. “However, we believe that the reform of regulations will help improve transparency, making Vietnam’s real estate market even more attractive to foreign investors.”