The office market in Hanoi and Ho Chi Minh City (HCMC) has many potentials for strong growth.

In the first quarter of 2019, the Vietnam’s economic momentum remained strong with GDP growth at 6.8%, anticipated to be the highest in ASEAN from 2019-2023 and mainly contributed by manufacturing and processing. The tourism sector has been growing rapidly with 4,5 million foreign visitors in Q1/2019 and not only tourist are seeing Vietnam as an interesting destination.

With its skilled, young (3rd in APAC), and affordable workforce, Vietnam has solid potential in terms of IT and economics, given also talent and opportunity spotted by foreign investors and major MNCs now growing their operations in Vietnam. Improved business environment and policies in Q1/2019 also contribute to the number of 28,400 newly established business with $16.5 million registered capital, increased by 6.2% year-on-year in the number of new businesses and 34.8% year-on-year in term of capital. The strong increase in number of businesses leads to high demand for offices.

Rising rent

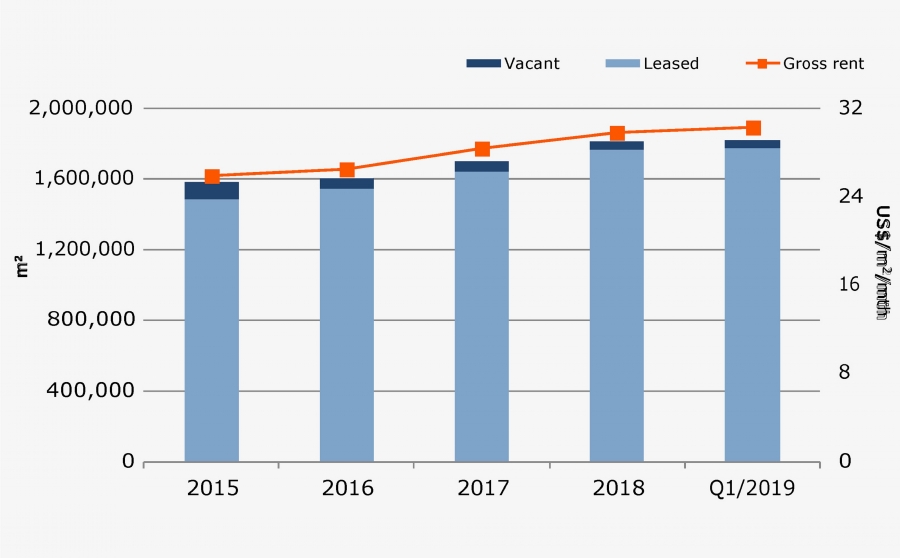

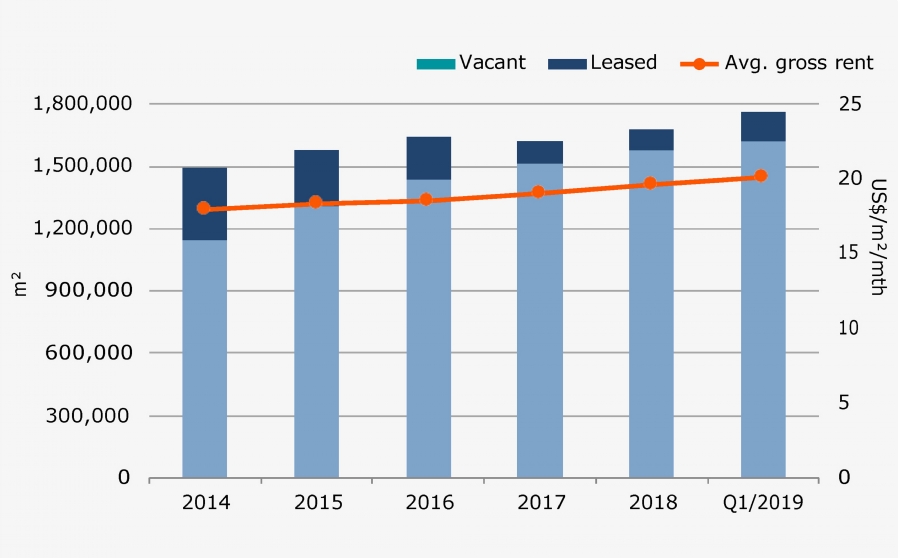

Regarding office sector, Savills said the first thing you can expect to see is the upward rental trends in both Hanoi and HCMC. Generally, Vietnam office market is a landlord market. This is given due to the fact of leveraging high demand and limited available stock, landlords have continued to raise rent and hold firm in negotiations. Not to mention the office occupancy runs at 92% in Hanoi and 98% in HCMC in Q1/2019, tenants have had to either accept the rental hikes or consider alternatives.

HCMC’s office market performance in Q1/2019. (Source: Savills Research & Consultancy)

Hanoi’s office market performance in Q1/2019. (Source: Savills Research & Consultancy)

Decentralization continues

Another notable trend that should be mention is the decentralization in both cities. Tenants are moving from the old CBD to newer business areas - Midtown and the West in Hanoi, where has the largest future supply. Demand drivers include improved infrastructure (e.g. metro lines), increasing commercial and residential developments, as well as large affordable spaces. Comment on this situation in HCMC, Miss Tu Thi Hong An, Head of Commercial Leasing, Savills HCMC said: “HCMC office market has now matured with multiple commercial objectives in play. Tenants are scouring the market to balance expansion pressure at reasonable cost. With uncertainty in the delivery of pipeline, then future decentralized opportunities may come into play”.

The boom of co-working space

The second theme that is now impossible not to take into consideration is the booming and evolution of co-working concept. This all-encapsulating phenomenon is a response by landlords who recognise that their buildings and their offer, both in terms of services and their leasing proposition, need to become more customer centric, provide more flexible options to meet dynamic needs of occupiers. The function of an office is changing alongside the development of new technology and working styles. With remote work becoming more common, co-working spaces are now booming globally. HCMC has seen rapid expansion of co-working spaces over the last two years, at over 90% pa to reach over 37,000 m2 as of studied period. Some of notable players in HCMC include WeWork, UP, Dreamplex, Regus, Compass and Kloud. All of them are anchor tenants in many office buildings.

New SPACES center in Belvedere Building, Hanoi.

Whereas in Hanoi, Co-working spaces have grown in popularity with Regus, UP, Toong, Cogo, Tiktak, CEO Suite. Cogo will expand in FLC Twin Towers, Sun Plaza Ancora and more (2019), Rehoboth will open three centers in Hanoi (2019 onwards) and Toong will integrate into “Wink” hotels (2019 onwards). Earlier this year, Regus open a new center in Hanoi CBD under the Spaces brand - an international flexible workspaces brand with its first location in Amsterdam. This new center brings to the market a very good structure and international standard amenities. The industry is expected to steadily expand due to demand from both domestic and global firms, who are looking to minimize costs, increase flexibility and establish a foothold in the market.

Environmental certification

In recent years, the concepts of ‘wellness’ and ‘environmental certification’ have been attracted interest of tenants. But now is when we will see this actually start to affect occupational decisions. Savills noted tenants will be looking to drive productivity, and for office-based businesses this will mean an increasing focus on what makes staff work efficiently while continuing to ensure they enjoy working for their employer.

The last few years have seen a significant rise in the value of achieving official ‘green standard’ certification. This trend was recently seen at Maple Tree Business Centre, Deutsches Haus and Etown Central which all gained LEED certificates. Green and sustainable properties are more cost-effective, comfortable and designed with respect to the environment. Savills expects green certification will become more widely used in new properties. By Q1/2019, 28% of future stock currently under construction in HCMC will possess LEED certificates.

Alpha Town, HCMC.

However, there is reversed situation in Hanoi as Mr. Bui Trung Kien, Associate Director, Head of Commercial Leasing comments that the ‘green standard’ has only been widespread in HCMC. A very good example to be mentioned is Refico Building or Alpha Town. Alpha Town is the only LEED Gold Grade A development by a foreign developer in HCMC CBD. The roofdeck of this building presents an open air community space with options for event, workout, and yoga. Meanwhile, we have not seen any projects that are incorporate this green standard at the moment. However, some investors are now trying to incomplete this concept into their projects. We can actually expect in the entrance of this wellness concept in Hanoi market in future.”