Vietnam possesses an economy with stable growth and steady income per capita has been growing at some 12 per cent a year over the past 10 years, giving the retail sector great potential for growth.

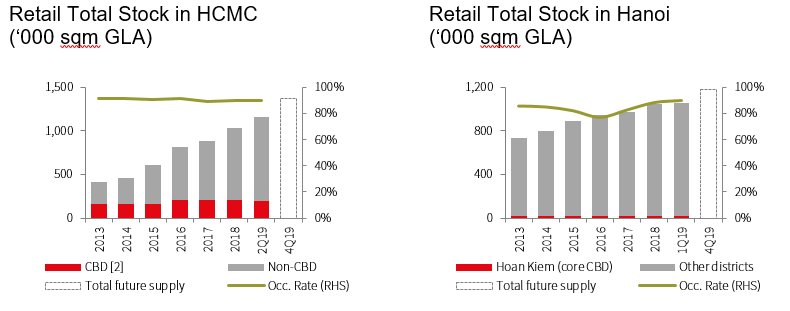

According to JLL’s Vietnam Property Market Brief Quarter two 2019, rental demand for the retail space is still growing steadily. The total retail supply in Ho Chi Minh City and Hanoi is more than 2 million square metres of gross floor area (GFA), with occupancy rates reaching 90 per cent and 88 per cent, respectively. Vietnam possesses an economy with stable growth and steady income per capita increase of 12% every year over the past 10 years, which give the retail sector great potential for growth. But not all types of retail real estate can take advantage of this potential. Commercial podiums underneath residential properties is a good example.

As per the view of the professional services firm, non-CBD retail podiums are experiencing long-term vacancy – some are not developed or suffer from very low occupancy rates, casting a shadow on the property and developer’s brand image.

Initially built to provide a full range of utilities for residents of the property, retail podiums are struggling for several main reasons, with the first one being most residential developers do not have experience and expertise in developing retail real estate, hence could not create a concept for the retail blocks which would appeal to their own residents and people in the surrounding areas.

Meanwhile, with a floor area of about 10,000-15,000 square metres in average, with the core frame attached to apartment blocks above, it is difficult for developers to meet the conditions of the retail companies, supermarkets and showrooms to transfer or lease the entire area.

In some residential areas, the number of apartment projects can be quite dense, so it is difficult for the current operating companies in the area to open a new location with proximity to existing ones.

Some developers have tried to divide the space into kiosks, ranging from 15 to 20 square meter and issued long term lease through resale. The divided space is thus managed by different small businesses with no plan on concept, brands, and management.

"Consultant units could not negotiate with various kiosk owners to create a unified strategy. The only solution is that one party will buy out and create a single clear strategy for all kiosks.” Ms. Trang Bui, Head of Market, JLL Vietnam commented.

For developers, commercial podiums are successful when they achieve high rents and good occupancy rates. For those who possess commercial centres, they require good business with their sales must be higher than that of regional trade centres. Contrary to popular belief, not all good position will certainly bring success for commercial podiums, but it also depends on the needs of residents and the neighborhood.

“There are many possible solutions to the current podiums supply stagnation. Investors should not be eager to expect high rents, but focus on providing utilities for residents,” noted Trang, adding that some shopping centres after being renovated and upgraded have recorded an improved performance thanks to a new look and a more effective list of tenants.

JLL also suggests changing the purpose of the commercial podium, depending on the location where developers can renovate the podium according to the needs of residents or surrounding areas. For example, the central podiums can become coworking office space or retail experience space which are set aside for product display.

In addition, the strong growth of e-commerce and technology companies boosts demands for new real estate types, such as data centers and last mile delivery storage. This demand offers a range of potential solutions for podiums in non-CBD or are not suitable with the traditional retail sector.

Before 2016, mall operators tended to prioritize big retail brands as key tenants as a way to add value. But landlords’ strategies have changed as non-retail service providers now promise to bring them benefits and the ability to fill areas on higher floors in commercial centers, he said. They have one big factor working in their favor: fitness, co-working and education are categories that cannot easily shift online en masse anytime soon. Investors that put in a nominal investment in a vacant space to adapt it for a non-retail tenant can create long-term interest and occupied space.

“We anticipate that this will be one of the key trends over the next ten years, retail podiums throughout the city will need to re-position themselves to remain attractive in this fast-moving and dynamic sector. Failure to adapt and remain present will undoubtedly lead to high vacancy levels,” JLL concluded.