Ho Chi Minh office vacancy rate increased sharply due to an influx of new supply

Ho Chi Minh City office market welcomed three new office buildings of both Grade A and B in the third quarter of 2019, Lim Tower 3, Sonatus and Etown 5, an addition of 82,666 square meters of net leasable area (NLA), which increased the total market supply to more than 1,300,000 square meters NLA. Up to this point, Lim Tower 3 was the first new Grade A office building launched to the market since the last quarter of 2017. As of September 2019, Grade A stock reached 414,113 square meters NLA from 16 buildings while Grade B supply increased up to 894,201 square meters NLA from 65 buildings.

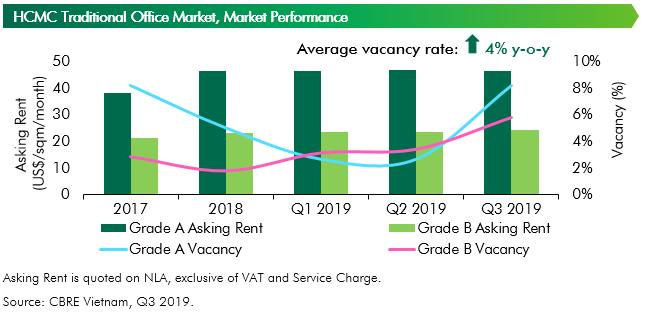

Abundant new supply has curbed the rental growth rate, especially for Grade A segment. In the third quarter of 2019, the average rent of Grade A was recorded at US$46.6 per square meter per month, much higher compared to the average rental rate of the market (approximately US$27 per square meter per month for both Grade A & B), showing a slight decrease of 0.3 percent from the last quarter and an increase of only 2.4 percent from the same period last year.

“Looking back at our forecast from the beginning of the year about the market trend of fringe CBD and decentralized-Grade B offices preference, in quarter 3, Grade B rental rate continued to increase by 2.7 percent compared to the previous quarter and up by 5 percent to the previous year despite of a large influx of new supply into this segment. In addition to the comparative advantage in terms of rental rate (compared to their Grade A counterparts), recently added Grade B offices also enjoyed high construction quality and favorable locations even though most of them are in the fringe-CBD and decentralized areas” - Ms. Duong Thuy Dung, Senior Director of CBRE Vietnam.

As the market added more leasing spaces, the vacancy rate of both grades increased significantly. Grade A vacancy rate hit 8.2 percent, an increase of 5.6 percentage points (ppts) over quarter and 4.5 ppts over the same time last year while that for Grade B reached 5.7 percent, up by 1.4 ppts since the previous quarter and 3.6 ppts since the same period last year.

From Q4 2019 to the end of 2020, HCMC’s office market is expected to welcome more than 190,000 sqm NLA from 10 buildings, which consist of 2 Grade A projects – UOA Tower and Friendship Tower, and 8 Grade B buildings – Phu My Hung Tower, DHA, Viettel Tower B, Opal Office Building, CII Building, 257 Dien Bien Phu Tower, Cobi Tower 2 and The 67 Tower. As such, Grade A vacancy rates by the end of 2019 and 2020 are expected to reach 10 percent and 14 percent, respectively. On the other hand, vacancy rates of Grade B in the same periods are projected to increase to 6.6 percent and 7.4 percent, respectively.

In terms of rental growth, Grade A rent is expected to remain relatively flat in 2020 with growth rate of only 0.6 percent over year due to an influx of new buildings that will lead to higher vacancy rate, which is affected by the decentralized Grade A offices’ rents coming online in 2020. On the contrary, with more room for rental growth, Grade B rent is expected to increase more in the next few years despite the intensified competition. Particularly, from the end of 2019 to 2020, Grade B rent is forecasted to increase with an annual growth rate of 1.8 percent.

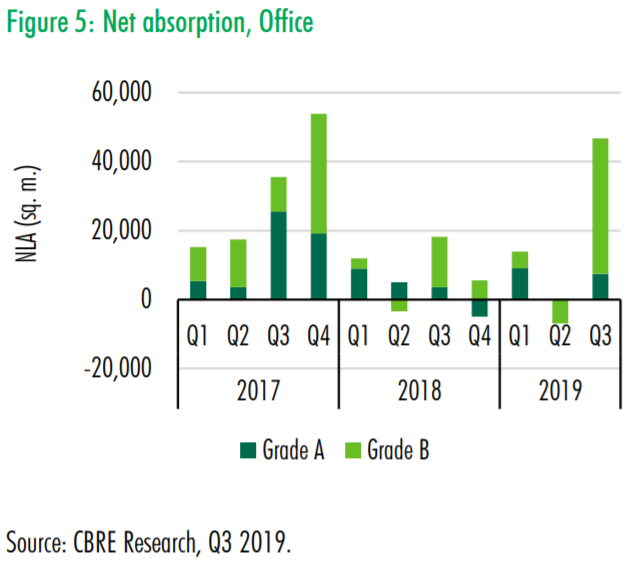

Technology sector has made big strides when surpassing Flexible Workspace in the number of major transactions closed and collected by CBRE in the third quarter of 2019 with 21 percent, followed by 17 percent of Flexible Workspace. These occupiers tend to absorb large space of more than 500 square meters and up to 8,000 square meters. Due to the expansion of flexible workspace and the boom of technology associated with a wave of new supply, the net absorption rate of the market striked up to nearly 50,000 square meters NLA from both Grade A and B segments.

In the future, Technology and Flexible Workspace will continue to dominate the office demand in HCMC thanks to the boom in new start-ups and the thriving of technology industry of Vietnam in recent years. Additionally, while the office market will be more competitive with many new buildings, occupiers will benefit from more diversified options as well as gaining advantages and negotiation power over landlords.

Hanoi new office supply to reach 5-year record high

In the third quarter of 2019, one new Grade B project (Doji Tower) was completed, adding 3,000 square meters of NLA to the Hanoi office supply. In the last quarter of the year, it is expected that there will be four projects coming into operation, making 2019 one of the years with the largest office completions, totaling 133,000 square meters of new supply added.

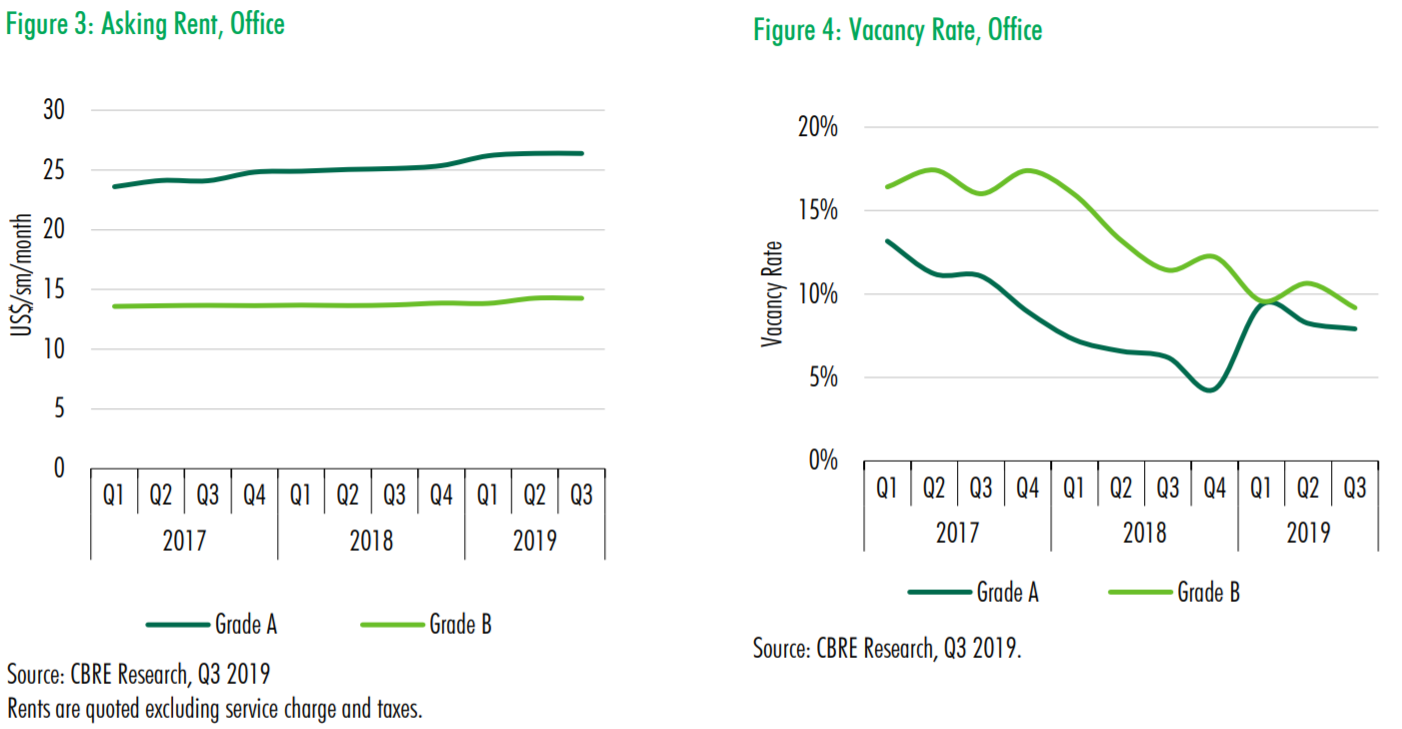

Generally speaking, the Hanoi office market still observed healthy performance in both Grade A and Grade B. Asking rents of Grade A buildings in this quarter were stable in comparison with the previous quarter but up 5 percent from the same period last year, averaging US$26.4 per square meter per month (excluding VAT and service charge). Similarly, Grade B’s average asking rents increased by 4.4 percent compared to the previous year, reaching US$14 per square meter per month. In terms of vacancy rates, Grade A’s vacancy rate declined by 1.7 percentage points over the same time last year, staying at 7.9 percent. Meanwhile, although there was one new project during the review quarter, Grade B vacancy lowered to 9.2 percent, down 2.3 percentage points in comparison with last year.

In terms of demand, net absorption was around 60,000 square meters in the first nine months of 2019. Demand is mainly from emerging industries with requirement for large leased areas including IT and flexible workspaces.

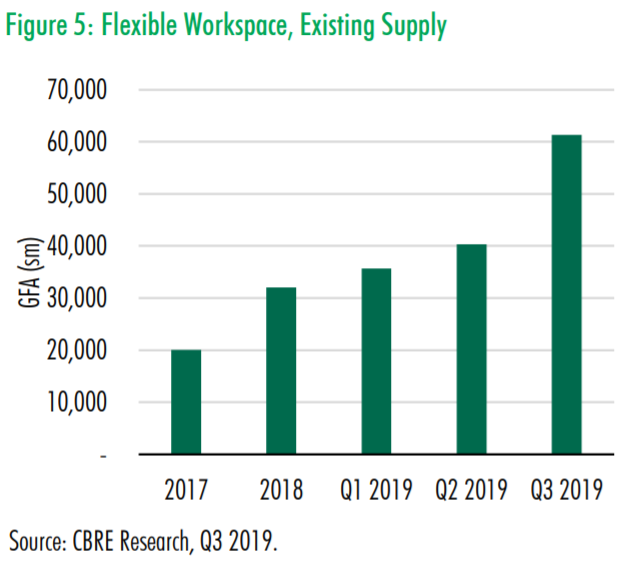

As of the third quarter of 2019, the flexible workspace supply in Hanoi reached more than 60,000 square meters, nearly double that of 2018. The strong expansion of this model requires operators to diversify services to sustain occupancy. For instance, some operators have cooperated with IT firms to operate the workspace under build-to-suit model.