Robust retail turnover and international arrivals

Total retail sales of consumer goods and services reached a high growth in Jan-Sep period compared to the same period last year (11.6%), reflecting an increase in consumer demand. In terms of tourism, Vietnam remained an attractive destination for tourists with 12.9 million international visitors in the first nine months of 2019, an increase of 10.8% y-oy, according to the Vietnam National Administration of Tourism. Visitors from Asia still accounted for the largest proportion, with those from China, South Korea and Japan taking the lead.

CPI remained stable

Vietnam's average CPI inched up about 2.23% in 3Q19 and 2.5% in the first 9 months compared to the same period last year, which is the lowest 9-month average rise for the last 3 years. The increase in the first 9 months of 2019 was mainly due to: (1) The price of electricity was raised from March 20, 2019, along with the increase in electricity demand in hot weather; (2) Provinces lifted the price of health services according to Circular No. 13/2019 / TTBYT dated July 5, 2019, (3) A number of provinces adjusted up tuition fee for the new school year, leading to the price index in this group up 6.73% y-o-y. With this stable increase, Vietnam is likely to achieve the National Assembly's CPI target of 4% at end-2019.

F&B, fashion and lifestyle continue to drive market demand in Ho Chi Minh City

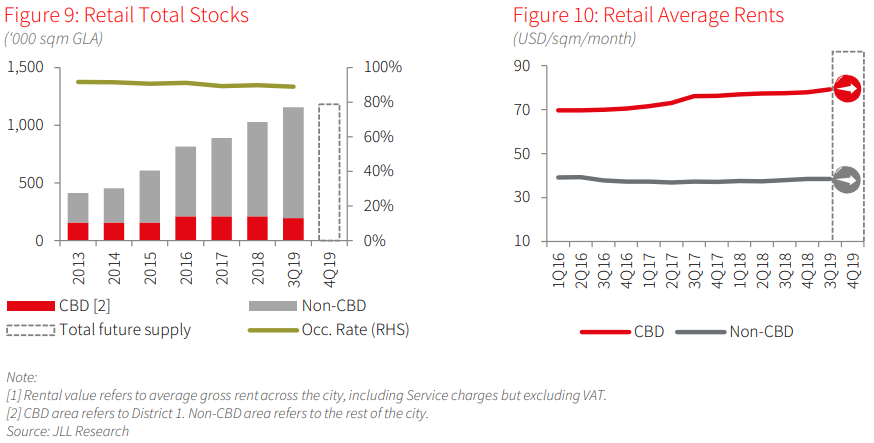

Positive demand continued to be seen in the market. The overall occupancy rate was recorded at approximately 89%. Performance in several centres that concluded tenant reshuffling and apply more flexible lease terms steadily improved. The good result recorded in these centres has urged the others to start their repositioning strategy and tenant reshuffling activity.

International affordable/mid-end brands and local chain stores in the F&B, beauty and healthcare, fast fashion and entertainment have showed encouraging performance and been preferred by most landlord as one of major footfall drivers. In an effort to induce customer spending, many tenants has started to collaborate with popular fintech apps, such as Momo, Grab Pay by Moca, Vnpay, and so forth to provide attractive promotion via e-wallet payment.

In 3Q19, total retail stock remained unhanged with no new supply coming online. Vacancy was relatively stable in both CBD and non-CBD sub-markets during recent quarters. It has become recently challenging for tenants having demand over 1,000sqm to find a suitable slot in existing malls. Almost all will have to wait for vacant space in new supply or in the centres currently undergoing renovation.

Average rental rate slightly increased on quarterly basis, up 0.2% q-o-q in repositioned centres , yet decreased on yearly basis by 2.6%, owing to lower-than-average rent in new completions in non-CBD over the last four quarters, namely Estella Place, Gigamall and TNL Plaza.

In 4Q19, Crescent Mall Phase 2 will be put into operation, adding up about 25,000sqm GFA into the total stock. Other projects in the pipeline have postponed the opening date owing to the slower-than-expected development progress.

F&B, fast fashion and lifestyle sectors will continue to be key demand drivers on the market. International brands will still eye on Vietnam’s market thanks to young demographic and the rise of middle income population.

Hanoi retail demand is driven by changes in leasing strategy

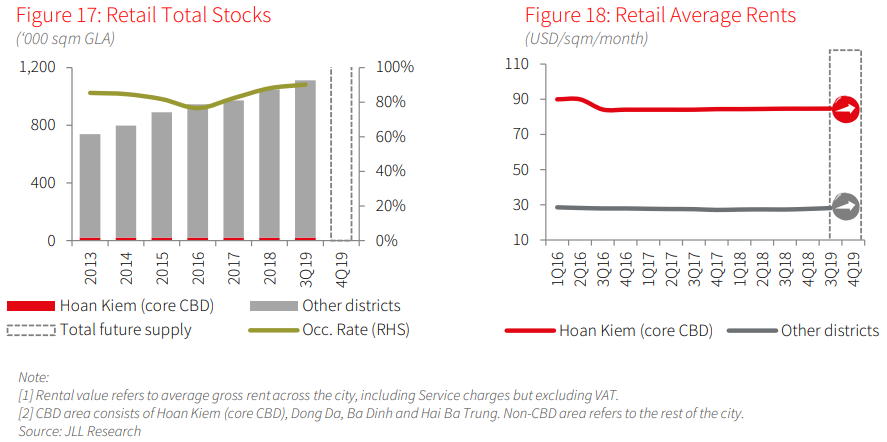

The occupancy rate in 3Q19 fell to 90.3% as a number of shopping centres started to renovate and changed strategies in tenant mix, in addition to a few anchor tenants leaving, such as Auchan in Mipec Riverside Shopping Center. As a result, the market recorded a negative absorption during this quarter.

Retail spaces that had focused on building brand images and adopted good leasing strategies still posted strong performance with high occupancy rate, while other malls were struggling to retain customer. For example, AEON Mall, Vincom Metropolis, Vincom Tran Duy Hung, all performed well and had less than 5% vacant space for lease.

During 3Q19, total supply of Hanoi retail space remained stable with no new opening. Thanh Xuan and Hai Ba Trung continued to keep the first and second spot in term of total retail spaces with two Vincom Mega Malls in Royal City and Times City, respectively. Hoan Kiem, despite being the heart of Hanoi, was far behind in term of retail supply, and this trend is expected to remain in the future, as new malls tend to require large development sites.

The overall market rent was kept at USD 29.3 per sqm per month, increasing 2.8% y-o-y. In comparison to 3Q18, department store saw the highest rental growth, mainly due to Lotte Department Store setting high price following their renovation. In addition, rent in retail spaces outside of Hoan Kiem District, where many had trendier retail concepts, also climbed up by 3.4% y-o-y, showing a soaring interest of consumers.

Rent is expected to stay the same or inch up slightly in short-term, as positive economic condition helps drive consumer demand and purchasing power. There are new completions expected to come on stream in 4Q19 and 2020, Hanoi retail market is likely to further expand as a result.

As competition intensifies, all retail operators, regardless of location and age should expect further pressure in securing tenants. While new malls are expected to bring in new concepts to establish themselves in consumer minds, existing malls need to keep up with the market trend in order to retain stable performances.