Hanoi office market expands to the Secondary

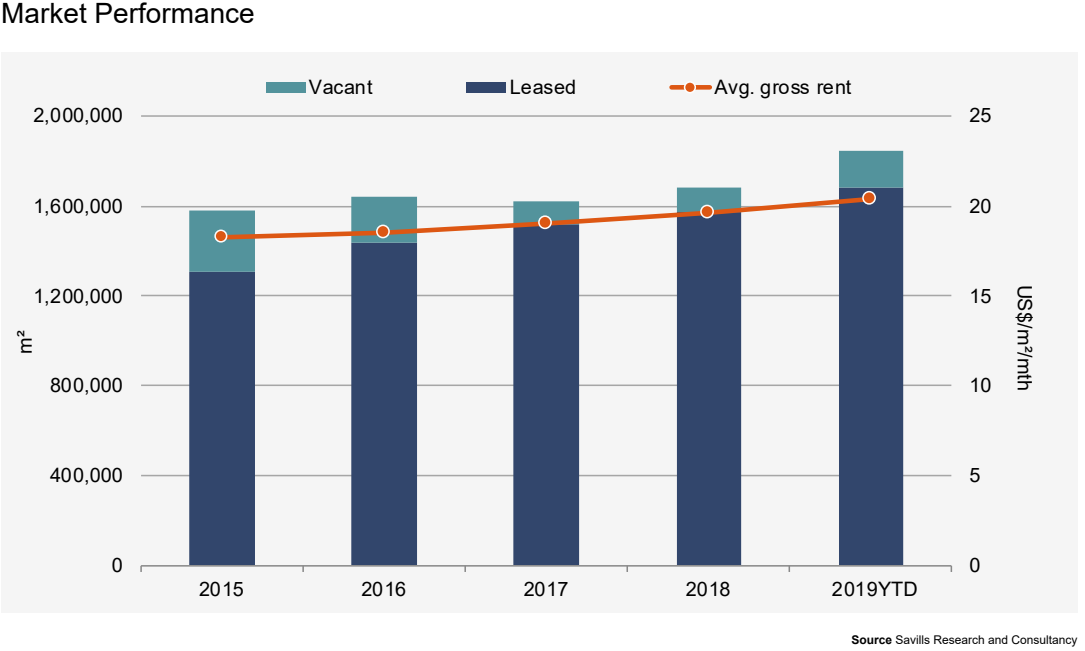

Total stock was approximately 1.8 million square meters, increasing 3 per cent from the last quarter and 10 per cent compared to the same period last year, with an additional 59,000 square meters from six new projects, most of which were Grade B (56 per cent), followed by Grade A (36 per cent). New projects were in the Secondary and the West areas. The West welcomed its first Grade A building in five years.

“Low Grade A vacancy rates coupled with a confident business sector are placing huge demand on existing office buildings – which will lend to an inevitable jump in rent. Experienced tenants are confirming their space needs now for the next rental cycle at higher quality office developments.” – Hoang Nguyet Linh, Associate Director, Commercial Leasing

Average rent continued to increase 1 per cent over the previous quarter and 4 per cent over the previous year, reaching a six-year high. Grade B and the West had the strongest growth. Occupancy was down 2 percentage points from the last quarter and also 2 percentage points from the same period last year due to new projects launches. New Grade B buildings offer higher rent than the market average and newer facilities.

In the first nine months of 2019, take-up was 107,000 square meters and positive across all Grades. Hanoi had 20,562 new businesses, up 9 per cent over year, with VND 263.8 trillion capital, up 28 per cent compared to last year. The majority of enterprises were micro (70 per cent) and small (29 per cent); these proportions are expected to continue, boosting demand for small and creative office space. Co-working spaces have been growing in popularity with various brands entering, such as Regus, Up, Toong, Cogo, Tiktak, CEO Suite, Dreamplex and WeWork.

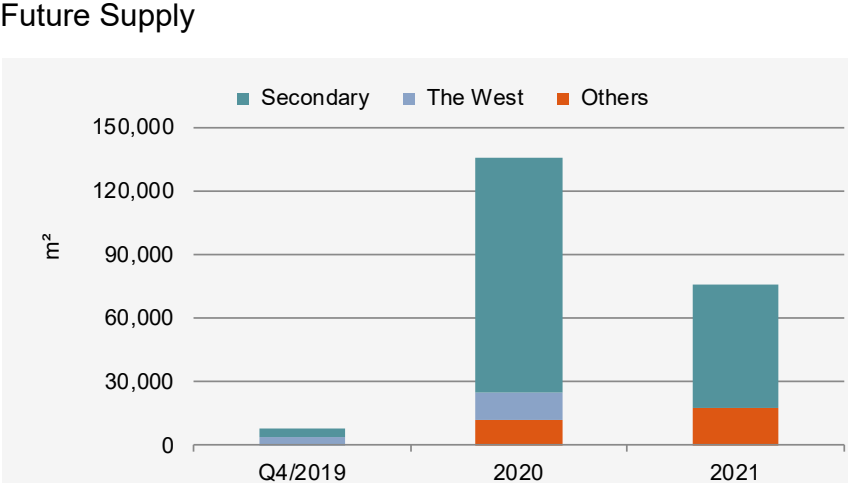

Until the end of 2021, new supply of approximately 205,000 square meters will enter, primarily in the Secondary area. New market entrants see Ba Dinh and Dong Da districts as a core business area with large and modern office towers. Due to infrastructure developments such as metro systems and key roads, connectivity with other business districts (CBD and the West), this area has seen increasing supply of dynamic amenities such as F&B, health and fitness, and other supporting services. The CBD expects no projects to come online in the near future.

Booming co-working spaces in Ho Chi Minh City

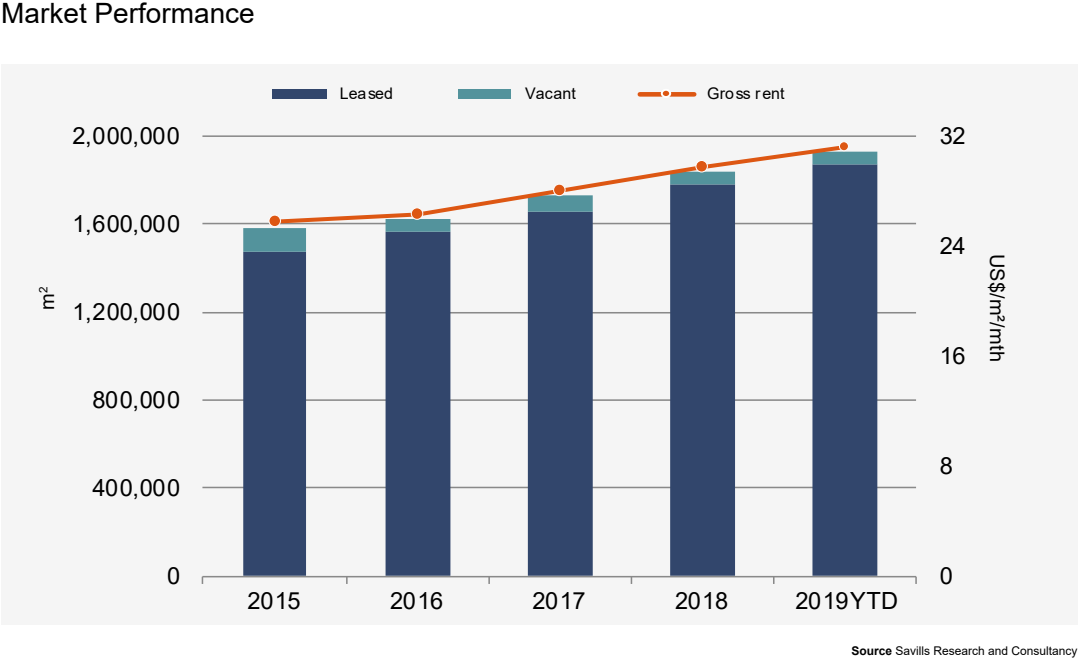

After no new stock for three quarters, Grade B supply reached over 870,600 square metres, up 5 per cent quarter-on-quarter and 6 per cent year-on-year. New Grade B projects accounted for 77 per cent of new stock this quarter, due to the entry of SOFIC Office Building (21,400 square metres) and E-Town 5 (17,000 square metres), both in the non-CBD.

Average gross rents were up 2 per cent compared to the last quarter in all Grades, reaching US$32 per square metre per month. Grade A had the greatest yearly improvement, with significant increases in both occupancy (2 percentage points) and rent (7 per cent). Landlords reported rent increases based on high market demand.

HCMC ranked 41st among the 50 fastest growing co-working markets in the world by Co-working Resources. Co-working operators are rapidly expanding, taking multiple floors in future projects before handover. Co-working is no longer a model attracting only start-ups or SMEs; established corporations are switching to this model due to the flexibility offered. Big tenants such as WeWork and Up Co-working leased large areas of 2,000-5,000 square metres in new projects.

“Large occupiers seeking to renew leases or relocation are struggling to find large, uninterrupted floor plates due to the extremely limited amount of available stock.” – Tu Thi Hong An, Associate Director, Head of Commercial Leasing

As of the third quarter of 2019, co-working operators focused on the CBD with 52 per cent leased area of all office space in downtown HCMC, including projects under construction. Grade B accounted for 36 per cent of total co-working space, the highest among all Grades. With limited CBD supply expected, co-working space operators are showing interest in secondary areas with a large amount of new suppy.

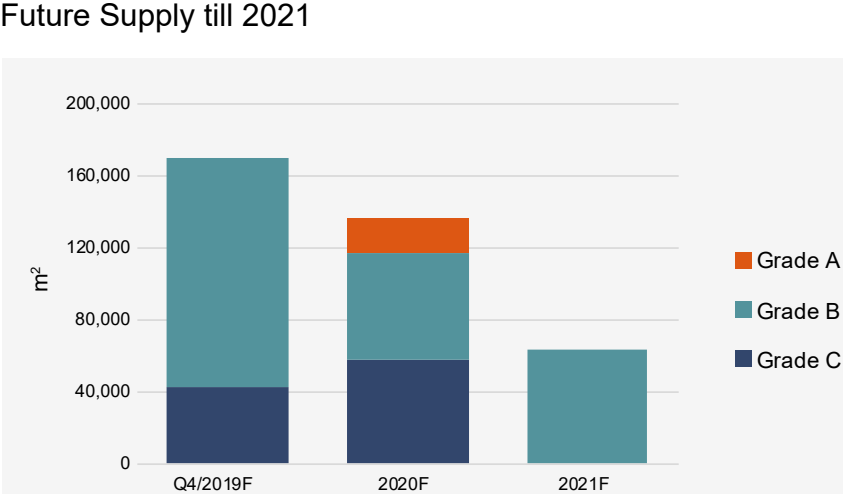

By the end of 2021, the market will receive nearly 369,100 square metres. The non-CBD will account for 55 per cent of future supply with over 203,800 square metres, of which, large-scale projects of over 20,000 square metres will account for 50 per cent, indicating a shift to the non-CBD.

District 1 will have 40 per cent of new supply; 89 per cent will be the CBD. A notable project is Friendship Tower, the only Grade A project currently under construction. Located on the main street of Le Duan and developed by CZ Slovakia, this building is expected to come online in the first quarter of 2020 and has attracted numerous tenants; including a co-working operator taking up 1,400 square metres across two floors.