(Photo: CBRE Vietnam)

Infrastructure improvements, including the construction of Metro Line No.1 and the opening of the Ho Chi Minh City - Long Thanh - Dau Giay Expressway, have significantly changed the development landscape in Ho Chi Minh City’s eastern area since 2012, according to the latest report from CBRE.

In terms of location, given the lack of land availability for residential developments and the difficulties in obtaining freehold tenure, new supply in central districts (including Districts 1 and 3) has been limited. Recent developments have tended to concentrate on neighboring areas such as Districts 2, Binh Thanh, 4 and 7. The southern area ranked first in terms of new supply in 2018 (with 53 per cent), thanks to mid-end and high-end projects in Districts 7, 8 and Binh Chanh. The eastern area accounted for 29 per cent of new supply, with the majority in District 2.

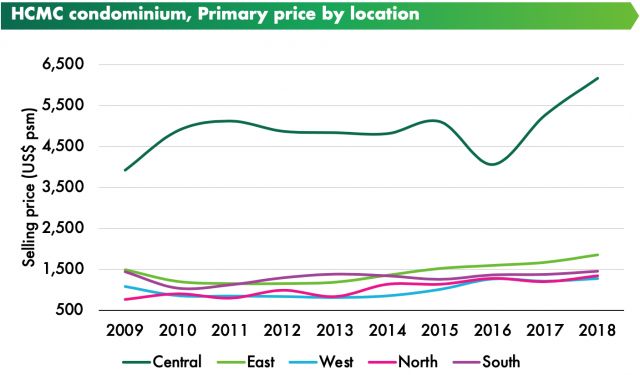

The average selling price in the primary market in the fourth quarter was $1,709 per sq m, an increase of 6 per cent quarter-on-quarter and 10 per cent year-on-year. This significant increase was due to new supply in the luxury segment in the quarter and the selling prices of these projects were higher than the current price level. Some projects in the segment recorded selling prices of $7,000-$8,000 or more per sq m. In terms of location, the average selling price in the eastern area was $1,838 per sq m, an increase of 11 per cent year-on-year, second behind only the central area.

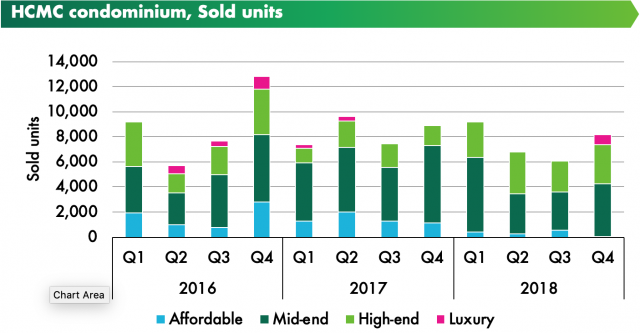

2018 ended with the number of newly-launched condominium units nearly equal to that in 2017. This is a positive result given that many projects had to change their development timeline during the year. In the fourth quarter, the market welcomed an additional 8,112 units, up 28 per cent quarter-on-quarter, bringing total supply for the year to 30,792 units and total accumulated supply since 1999 to 260,247 units. In general, diversification of unit type, unit size, and price helps keep the market’s absorption rate high while average selling prices increase.

The proportion of the mid-end and affordable segments decreased last year compared to 2017, with the mid-end segment accounting for 52 per cent of total supply compared to 64 per cent in 2017 and the affordable segment accounting for only 2 per cent compared to 15 per cent. There was a lack of projects with launching prices below $800 per sq m, and some large projects in the mid-end segment delayed their launch to this year.

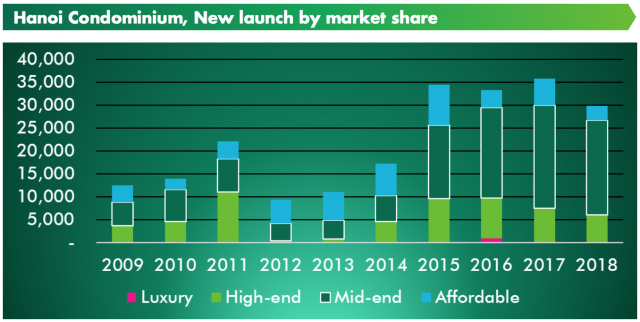

Similarly, Hanoi’s condominium for sale market continued to maintain a high level of new launches last year, of around 30,000 units. The market has further shifted towards the mid-end segment, with 70 per cent of new launches compared to 63 per cent in 2017 showing that end-users are still a major source of demand in the capital. Notably, the market saw the launch of large-scale townships including VinCity Ocean Park and VinCity Sportia, adding vibrancy in the last quarter of the year.

In terms of location, the trend towards decentralization continued in 2018, as only 2 per cent of new supply was launched in the city’s four core districts. Hanoi’s residential market has also expanded to suburban areas, with an increasing number of new projects launched in locations outside of a 10-km radius from the CBD. Projects in suburban districts such as Thanh Tri, Hoai Duc, and Gia Lam accounted for 20 per cent of total new launches last year.