Limited future office supply in HCMC

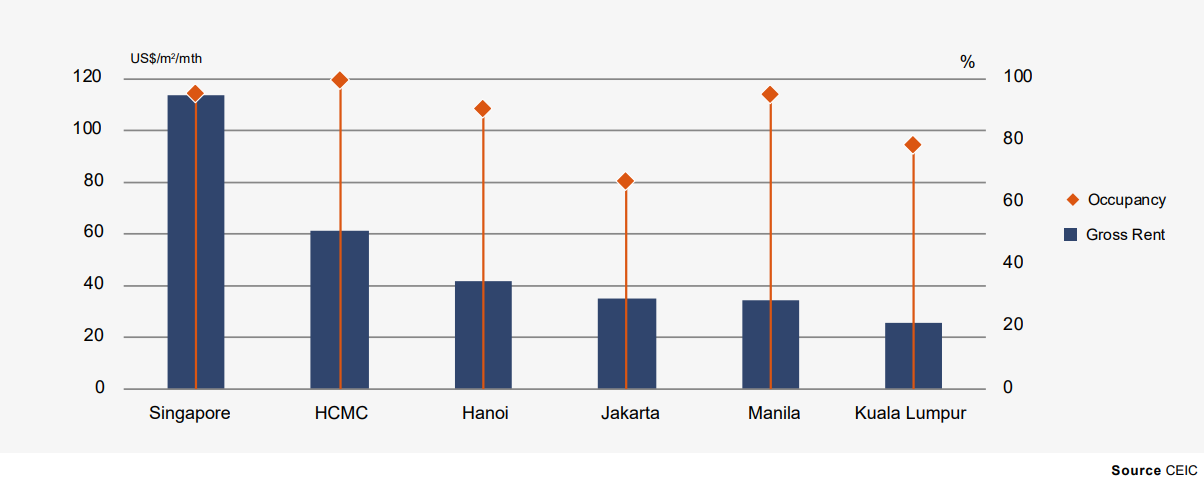

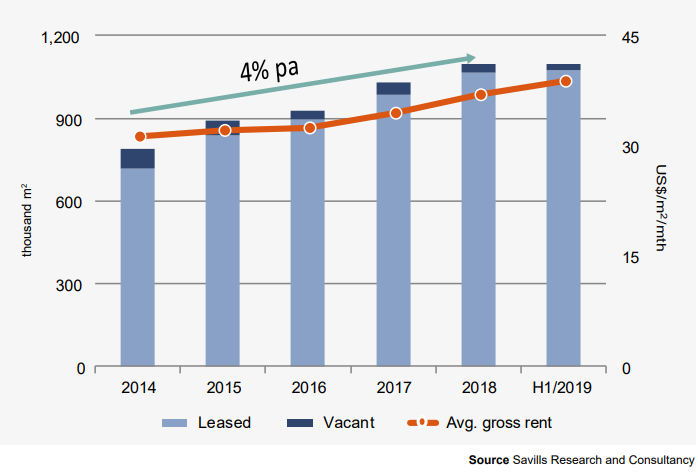

With overall occupancy of 98% and Grade A rental of US$60 per square metre per month, Ho Chi Minh City (HCMC) office market is one of the best performing within Asia. The strong performance is expected to continue, with just 20,000 square metre expected to enter pipeline in the next two years.

Tenants seeking new space or merely wishing to expand need to carefully weigh up their options as the near future will be marked by limited opportunities. Already companies who cannot afford the higher prices are relocating to fringe and decentralized locations.

Vietnam’s strongly emerging economy is transitioning rapidly, particularly the commercial sector. The Finance, Insurance and Real Estate sector (F.I.R.E) lags behind regional peers and so has a long way to grow, with massive office demand expected. With 100,000 square metre leased over the last two years, this sector had the highest take-up. The deregulation of the insurance industry has resulted in 20% performance average growth in demand, which will in turn flow though to office occupation.

The great excitement around Fintech in Vietnam pivots on the under penetration of Vietnam’s banking sector at 59 percent compared to Thailand at 86 percent. Alongside the maturity of the banking sector, greater office demand is also expected. The Information and Communication Technology sector (ICT) has had rapid take-up of around 50,000 square metre in the last two years and is expected to translate to higher office space requirements in the future.

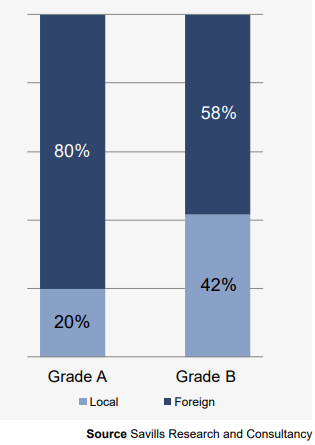

From 2017 until now, domestic (37%) and foreign (63%) firms have occupied similar amounts of Grade A and B space. However, 80% of take-up by international corporations was Grade A.

“Co-working has become more popular for enterprise solutions. Offering flexible space, co-working used to be popular amongst most start-ups, now more established corporations are considering this option as it provides flexible solutions.” - Tu Thi Hong An, Association Director, Head of Commercial Leasing.

Deals in HCMC have been dominated by Real Estate with 57% and ICT with 14%. Within the real estate sector, the majority breakdown is co-working spaces, such as WeWork. It will be interesting to see how WeWork’s apparent fairytale performance now unfolds that the CEO has replaced by a non-executive, the valuation slashed, and the IPO delayed. Disruption in the property industry continues as Proptech garners massive funding support of up to US$1 billion per month globally.

Tenants should expect higher rents or be prepared to negotiate strongly or decentralize. With most companies only committing to three-year leases, most will fall within the bookends of the present strong cycle. Renewal options will come under the microscope and those without capped upward movement should expect increases. It will be a testing time for poorly written leases that have not fully considered the future.

Multinational corporations (MNCs) seldom operate in isolation and have the choice of regional locations to base business. Vietnam is evolving rapidly, however, operations capability may not be in step, available office space is an example. If domestic and export demand are both growing then a local base is logical, provided it be affordable; otherwise, an alternate location within the region will become more appealing.

From a capital markets perspective, many of the MNCs conducting insurance will be turning out profits and will be repatriated to home countries. If there were investment options available in Vietnam, then these profits could be committed locally. However, ongoing paralysis in administration currently precludes a wide choice of investment opportunities.

Hanoi expects a dynamic Grade A and B office market

Average occupancy has remained at 93% for the past two years. With the exception of one recently launched building, Grade A projects were limited while existing buildings in the CBD are rapidly ageing and lack modern facilities. As high-quality office space is more attractive to foreign tenants, interest for Grade A is anticipated to increase in line with good FDI and vigorous M&A activities. Demand for Grade B will remain high due to affordability.

Savills expects a dynamic Grade A and B market in upcoming years, particularly in the Secondary and Western areas. The low vacancy and limited future CBD supply mean tenants are relocating to Midtown and the West. Many lease expiries will need to accept rent increases.

“Technology and Start-ups accounted for most office absorption over the last year, mainly in Ba Dinh and Cau Giay. Even with limited supply, Hoan Kiem and Ba Dinh still attract high demand. Key selection criteria include location, rent, building quality and technology,” - Hoang Nguyet Minh, Associate Director, Commercial Leasing.

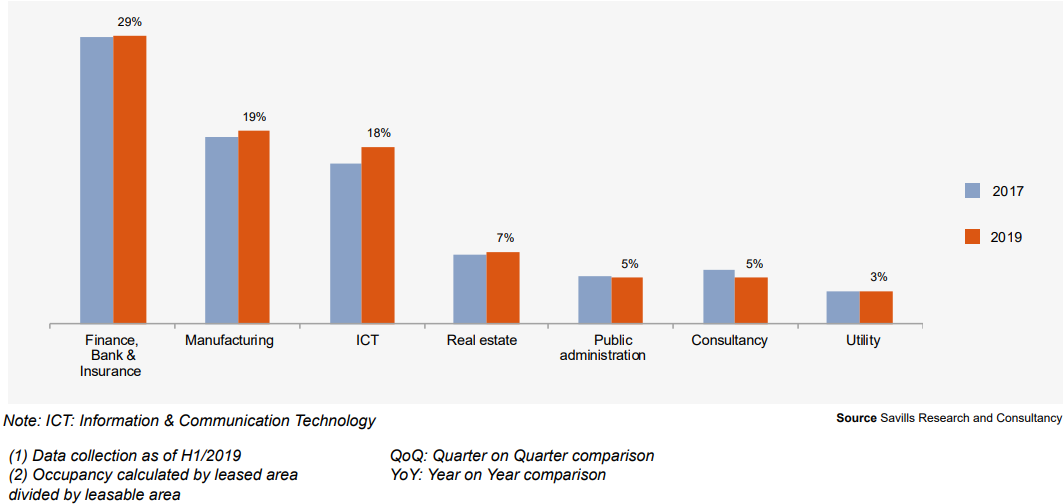

Finance, Bank & Insurance tenants occupied the largest proportion of leased areas (29%), followed by Manufacturing (19%) and ICT (18%). These three sectors increased their shares from 2017 to 2019, particularly ICT at 2-ppt growth. Finance, Bank & Insurance had the highest CBD and Secondary area share whilst ICT and Manufacturing were the greatest in the West. Many large F.I.R.E enterprises and government offices have relocated from the CBD to the Secondary and the Western areas.

Tenants of ICT and Finance, Bank & Insurance industries leased the largest average size. Occupiers of over 1,000 square metre accounted for 9% of tenants but a considerable 53% of leased area.

Compared to 2017, the proportion of Vietnamese and foreign tenants in Grade A & B segments has remained relatively stable at 43% and 57%. However, most foreign tenants prefer superior space with higher rent. In the first half of 2019, 68% of the leased area in Grade A buildings was occupied by international tenants. Major international occupiers included Korean and Japanese companies.

The CBD will have no new infrastructure for the next ten years; metro developments and the upgrade and expansion of Ring Roads 2 and 3 are prioritized for the West and the Secondary areas.

Previously only appealing to start-up companies, co-working spaces are now considered by established corporations. Brands such as Regus, Up, Toong, Cogo, Tiktak, CEO Suite, Dreamplex and WeWork all have locations in Hanoi. Within the past 12 months, Up opened four new sites with a total scale of 15,500 square metre while Toong launched three new spaces providing 7,000 square metre. In the past 24 months, Cogo opened five new outlets supplying 11,500 square metre.

As co-working spaces are still new to the market, growth is set to accelerate in the coming years. The entry of international operators will usher in a period of M&A, a trend that is already occurring in other markets in the Asia Pacific. Foreign investors have contributed to 17 business sectors in Vietnam with a focus on manufacturing, which typically creates demand for office space. The M&A market is expected to grow strongly due to favourable economic environment as well as rising demand for human and investment capital.

A wide range of modern technologies and techniques could be applied to the workplace to boost productivity and staff satisfaction. Additional amenities are expected to suit the needs of new generations of occupiers.