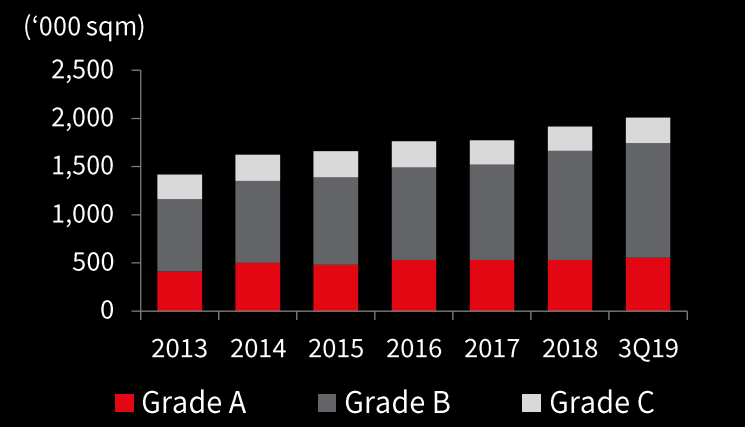

Total supply of Grade A, Grade B, and Grade C in Hanoi in the first three quarters (3Q) this year reached exactly 2 million square meters (sq.m), according to JLL – a global real estate services firm specializing in commercial property and investment management.

Among the segments, Grade B had the largest portion, followed by Grade A.

In terms of location, nearly 60% of total Grade A and Grade B stock in the market is located in central-business district (CBD) (the three districts of Hoan Kiem, Ba Dinh and Hai Ba Trung), JLL said in a report released mid-October.

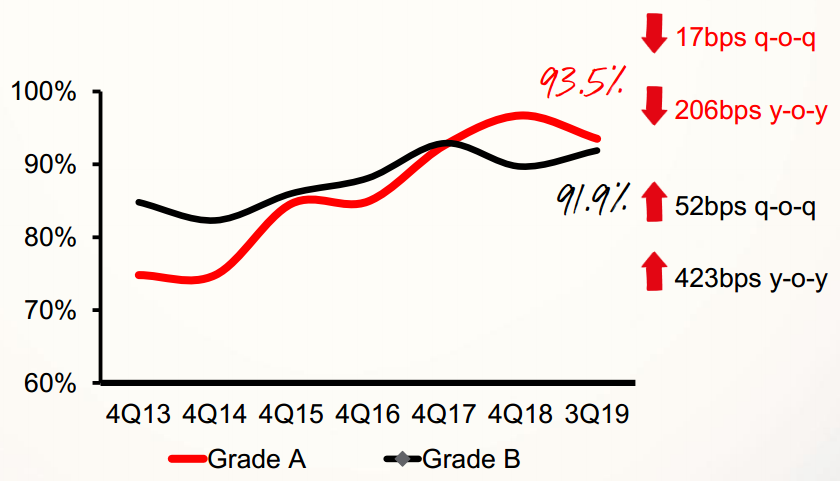

Between January and September, Grade B segment witnessed a sudden increase in occupancy with 423 basic points (bps) from the same period last year while Grade A fell 206 bps on year during the nine-month period.

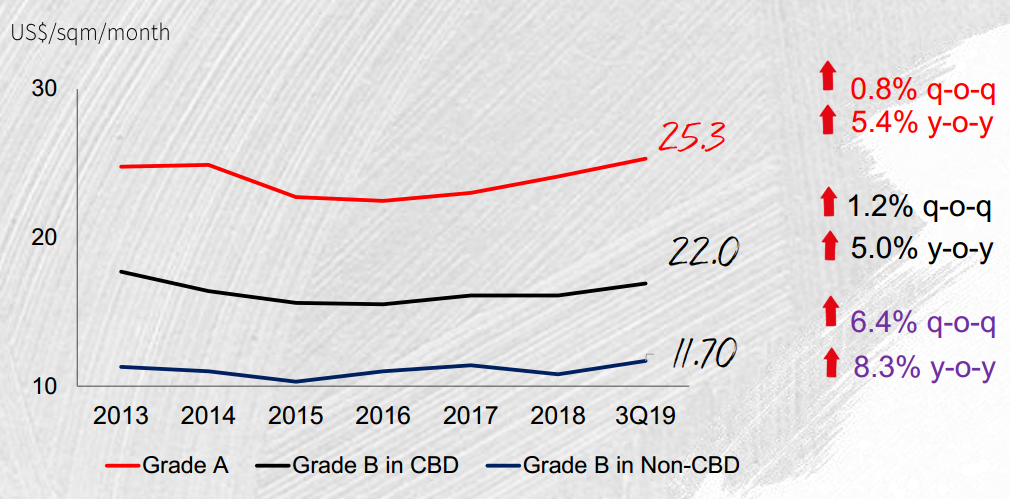

Average rent was reported up for all segments with an increase of 5.4% at US$25.3/sq.m for Grade A, 5.0% (US$22/sq.m) for Grade B, and 8.3% (US$11.7/sq.m) for Grade B in non-CBD.

Outlook

JLL has outlined a vision for Hanoi’s office market with the supply of all segments from the fourth quarter 2019 onward.

Accordingly, notable projects which will be launched in the future include Conico Tower and Tan Hoang Cau Tower in Dong Da District supplying 15,000 sq.m and 33,600 sq.m, respectively from the remaining of 2019.

From 2020, the stock would be added 95,000 sq.m from Capital Place and 30,500 sq.m from Oriental Plaza, both in Ba Dinh District.

Given high supply, JLL forecast the market will be set with new standards as tenants have different options and new experience. Large supply entering the market would impact market sentiment, JLL affirmed.

As a result, new supply helps to soften rental rate. Meanwhile, Grade B sub-market continues to expand in terms of both supply and demand. Flexible spaces continue to expand and offer more options for tenants.