Ho Chi Minh City traditional office market

HCMC office market received no new supply in Q2 2019 for both grades. By 2H 2019, HCMC office market’s total supply achieved 1,225,648 sq.m NLA from 15 Grade A buildings & 63 Grade B offices. HCMC’s office stock is about 116,352 sq.m NLA lower than which in Hanoi.

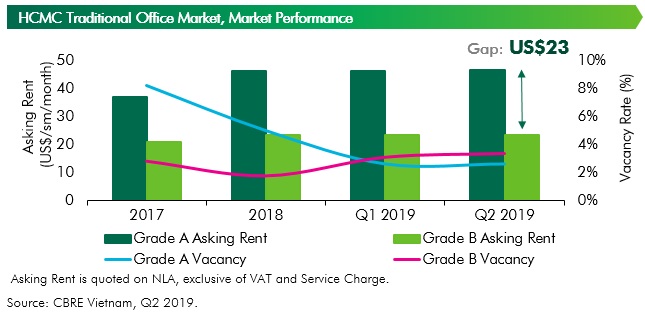

Due to limited supply in the 1H 2019, rents of both Grade A & Grade B continued to increase but at a moderate pace, especially Grade A. As of Q2 2019, the average asking rent of Grade A was US$46.7 psm pm, a slight increase by 0.9% q-o-q and 2.9% y-o-y. Grade B rental rate was US$23.5 psm pm, an increase by 0.3% from the previous quarter and 4.7% from the same period last year.

The moderate rental growth of office market in the 1H 2019 was mainly driven by a large amount of new supply expected to come online in the 2H 2019. With six new office buildings (one Grade A and five Grade B), providing more than 130,000 sq.m NLA to the currently limited office stock, existing landlords will have to face with stiff competition in the near future. However, the rental growth prospects of these two grades might turn into different directions. While Grade A rental growth will be limited by its currently high rental rate associated with intense competition with other Grade B offices and the upcoming new supply, Grade B rental growth seems to have more room to increase further as this segment’s rental rate is just half of the figure of Grade A.

Generally, HCMC office market still observed healthy performance with vacancy rates of both Grade A and Grade B lower than 4% due to limited supply in the 1H 2019. As of Q2 2019, Grade A vacancy rate remained low at 2.6% due to limited stock and delayed construction at some new buildings, no change from the previous quarter and a slight decrease by 2 ppts comparing to Q2 2018. Landlords of Grade A offices were also upgrading facilities of the buildings to retain tenants from relocating to other places. On the other hand, Grade B vacancy rate reached 3.4%, slightly up 0.3 ppts q-o-q and 0.5 ppts y-o-y due to a few contractions happened in the decentralized offices.

Demand for office space continued to be high, especially after the trade dispute between China and the US. The trade war has urged many manufacturing and logistics companies from overseas to actively seek office spaces for shifting from China to Vietnam. Such signs were shown through the increase of new letting inquiries received by CBRE in Q2 2019, accounting for 29% of the total leasing inquiries by purpose, up by 21 ppts y-o-y. Almost 40% of the new letting inquiries were contributed by manufacturing & logistics companies and 50% of those have their offices placed in China. Besides Manufacturing & Logistics, Technology sector was also recognized as a large demand driver with 15% of the total leasing inquiries received by CBRE in the reviewed quarter. These tech firms expanded rapidly, and they sought spaces for consolidation purpose.

From 2H 2019 to the end of 2021, HCMC office market is expected to welcome 14 new office buildings with more than 300,000 sq.m NLA. Half of the new supply is Grade A offices. Welcoming a wave of new supply in the next three years, the market is forecasted to have higher vacancy rates for both office segments. Due to one new Grade A supply will be launched by the end of 2019 and the move-to-Grade-B trend is still on-going, Grade A vacancy in 2019F, 2020F and 2021F is expected to reach 10%, 14%, 20% per year, respectively. Meanwhile, Grade B vacancy will increase to 6.6%, 7,4%, and drop to 3.9% in the same period due to a large Grade B supply coming on stream this year.

In terms of rental growth, Grade A will slightly increase in the first two years (2019F and 2020F) with the average growth rate of 3% and 0.6%, respectively. However, Grade A rents will then drop down by 2% in 2021F when its vacancy reaches 20% by that year. On the contrary, with comparative rentals and larger room for rental growth, Grade B rents will continue to increase higher in the next three years despite the competitive context of the market. Particularly, from 2H 2019 to 2021, Grade B rents will be up by 2.26%, 1.81%, and 2.58%, respectively.

In the future, office market will witness the demand restructuring. Flexible Workspace, Technology-related Firms and Insurance Companies will replace Finance/Banking to become the three key demand drivers of the market. Moreover, Manufacturing Companies might recover its position as the main occupier for office space as well if there is no changes or negative signs happening on Vietnam’s political-economics in the future.

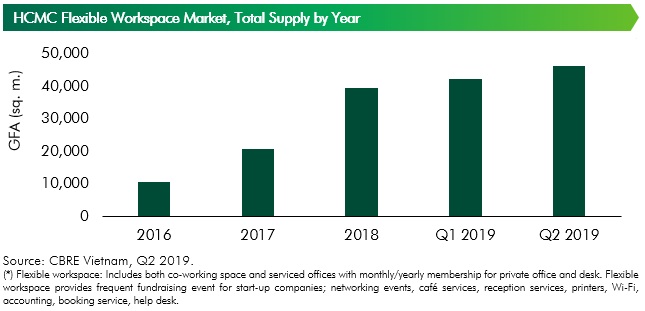

Ho Chi Minh City flexible workspace

Flexible workspace market in H1 2019 was still on its fast growth momentum. In the reviewed quarter, the market supply increased 10% q-o-q and 101% y-o-y with more than 4,000 sq.m GFA from five new venues – Up Deustches Haus (D.1), The Hive - Huynh Khuong Ninh (D.1), Compass Office - Landmark 81 (Binh Thanh), Leo Palace 21 (D.1) and Kafnu – Saigon Pearl (Binh Thanh).

Although flexible workspace expanded rapidly, its performance was still recorded healthy. In the reviewed quarter, rental rates of private office sector has slightly decreased by 3.9% q-o-q due to some high-end serviced offices wanted to attract more tenants to fill up their left-over rooms. Nevertheless, its occupancy was still as high as 80%.

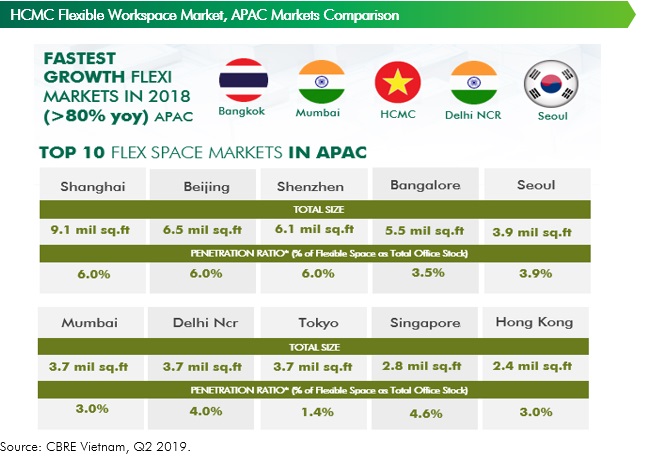

As of Q2 2019, the total market supply reached 46,266 sq.m GFA, increased by 101% from the same period last year. This figure is projected to be a twofold increase by the end of 2019, lifting the penetration rate of flexible workspace up from 2% in Q2 2019 to 5% by Q4 2019. According to the CBRE Global Research on Flexible Workspace, HCMC market is ranking in top 5 developing markets with the CAGR of more than 80% per year.

The accelerated enlargement in the future of flexible workspace market was mainly driven by the growth of build-to-suit workspace, also known as the enterprise solution. Many flexible workspace operators are now adopting this build-to-suit service such as Up coworking space, WeWork, Toong, etc. However, only Up coworking space showed its active role in the market.