Occupancy continues to improve

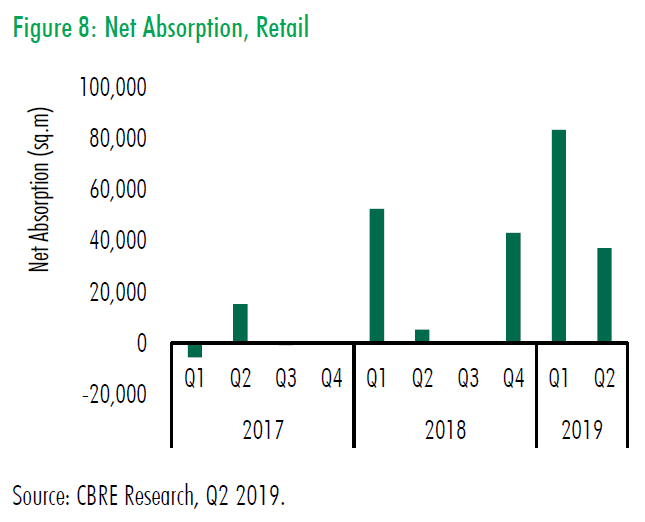

In Q2, HCMC welcomed one new project (TNL Plaza, District 4) and one expansion (Aeon Celadon City, Tan Phu District) in non-CBD area, adding a total of 47,179 sq.m new supply to the market. The total accumulated supply is now sitting at 1,050,000 sq.m from 58 projects, the highest city supply across Vietnam, followed by Hanoi at the second place with 930,000 sqm. Currently, all other cities in Vietnam have less than 100,000 sq.m of modern retail NLA each.

TNL Plaza is the retail podium of The Gold View, consisting of limited retail trades yet sufficiently facilitating the project’s residents. As of Q2 2019, TNL Plaza already welcomed Starbucks, Wayne’s Coffee, Jmart, DNP Game zone amongst several local F&B brands. In the next two months, the podium is expected to include Familymart, California Fitness and Lotte Cinema in its tenant mix.

Following the success of Aeon Celadon City over the last five years (occupancy rate always higher than 95%), the developer increased its NLA by 36,000 sq.m. The shopping centre added quite a few new brands to its tenants mix, some of which are first-timers in Vietnam retail market. Notably, Decatholon took over 2,600 sq.m of the shopping center’s first floor, selling over 14,000 products lines from 70 sports. Delamibrands, an Indonesian specialty retailer, also brought several of its brands such as Jaspal, Et cetera, Colorbox, etc. In Q2 2019, occupancy of this retail project is a bit short of 90%; the occupancy is expected to improve in the future with more F&B brands, Kids and entertainment (TimeZone).

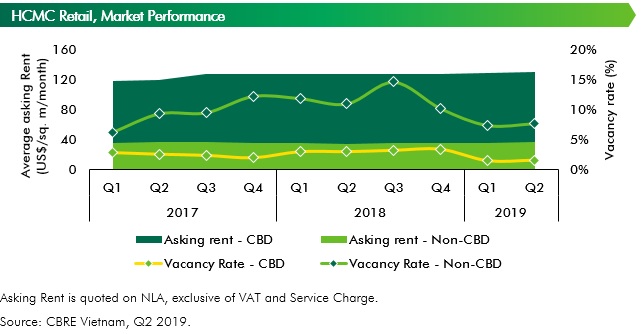

Average asking rents in CBD increased by 1.5% q-o-q (1.9% y-o-y), equivalent to US$130.6/sq. m/month, thanks to improving demand for CBD space given limited supply. Even though the high rental rates in the CBD area may cause some closures, the vacant spaces are usually taken up very quickly. New leases in the CBD in Q2 2019 include Starbucks, Missguided, Grand Jete, Ha Di Lao Hot Pot, etc. New foreign tenants most of the time consider CBD for their first stores. Meanwhile, non-CBD average asking rent increased by 1.2% q-o-q (4.1% y-o-y), reaching US$36.1/sq.m/month, thanks to openings of good quality projects in the past year such as Estella Place, Vincom Center Landmark 81, Giga Mall, etc.

Vacancy rate in CBD was still at low level of 1.6%, due to limited new supply. The vacancy rate in non-CBD was also low at 7.7%, a slight uptick of 0.4 percentage points from last quarter, due to the opening of TNL Plaza which was only 50% full as of Q2 2019. quarter. This project already had a pipeline of coming tenants and therefore, its occupancy will improve in next coming months. Other districts with small increase in vacant spaces are Tan Phu District, District 7, Binh Thanh District, etc. with 1,000-2,500 sq.m of new new vacant spaces each.

Future projects construction shows some delay

In the second half of 2019, the market is expected to add four more projects to its current supply, totalling over 130,000 sq.m. For the period of 2020 onwards, CBRE recorded that over 363,000 sq.m of future supply is under construction. The market will become more competitive, both for CBD and non-CBD areas. However, short term delay was witnessed in construction progress at some under construction projects and therefore, the future completion is expected to be less than 10% (lower than previously forecast: 15%). The vacancy rates, as a result, are not going to hike significantly as previously forecast. Rental rates are expected to increase by 2-3% in H2 2019.

Beside the openings of good quality projects as mentioned earlier, the market witnessed the struggle of others. Due to large number of residential projects being built and handed over in the last three years, many retail podiums of these projects were not put into good used: some are left emptied and some are not effectively operated. As a result, the retail component, which once was used as one of selling points for the residential projects, now hardly added any value to the current residents.

According to CBRE, retail component is too great of a component to ignore, especially when Vietnamese consumer confidence index is among global top and the country’s retail sales is recording very positive increase. On top of that, local and foreign retailer groups, such as Vingroup, Lotte, Saigon Co.op, and Aeon, all have expansion strategies in Vietnam, even in second and third tier cities. Most recently, Saigon Co.op has acquired all supermarkets owned by Auchan, signifying the exit of the French retailer after three years in Vietnam. Notable changes are expected in Vietnam retail market in the short future.