Vinhomes Golden River - a symbol of luxury living.

Price growth across the world’s leading prime city housing markets slowed significantly in the second half of 2018, which recorded its smallest annual increase since the global financial crisis, according to the latest data from the Savills world cities prime residential index.

The index appears to be hitting a high plateau, Savills said. The index rose by just 2.3 per cent across 2018 as a whole, slowing to a marginal 0.4 per cent in the second half of the year. This compares to annual growth of 3.3 per cent in 2017. Rental growth also slowed across the index, leaving average world city yields for prime residential assets at a 10-year low of just 3.2 per cent.

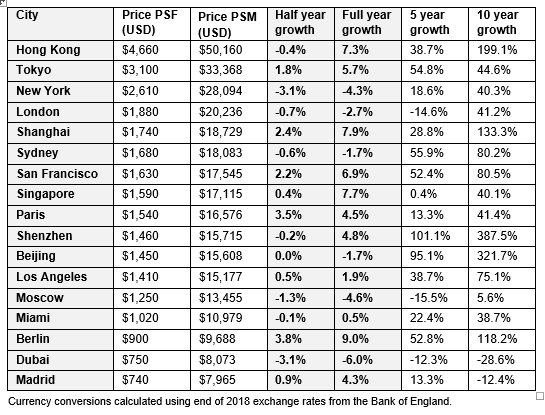

The data witnessed strongest growth of 9 per cent in Berlin, but only Paris saw stronger growth in H2 2018 than H1. Meanwhile, Hong Kong remained world’s most expensive city, with an increase of 7.3 per cent in 2018, and over 199 per cent during the past 10 years.

“Prime residential real estate values are settling into a pattern of slower, steadier price growth and we do not expect to see a repeat of the double-digit annual price growth seen pre GFC,” said Sophie Chick, director, Savills world research.

“Back in 2007, spiraling global wealth generation and competition for trophy assets in established and emerging world cities, saw our prime sales index rise by 15.4 per cent in the year. But while growth is now expected to slow, we expect the search for security of tenure and title in cities where the world’s high net worth individuals wish to live and do business, to underpin values.”

World cities’ stories

The weakening Big Apple story asides, major themes across the index are of cooling measures taking the heat out of price growth. As the result of Brexit, the London market is stalled while demand for lower value mainland European cities are boosted. At the same time, West Coast city tech economies continue to rise.

Pricewise, Hong Kong remains in its own league, dominating the stats for the last 10 years. Average prime residential values now stand at US$4,660 per square foot, which are 50 per cent higher than the following Tokyo. New York (US$2,610 psf) and London (US$1,880 psf) complete the top four ranking, while Shanghai secures the fifth spot from Sydney, where values slipped -1.7 per cent in the face of cooling measures, tighter lending criteria and increasing taxes.

“Without doubt, the world’s wealthy will continue to want to hold one or more world city prime residential properties as part of their investment portfolio, both as a store of wealth and as a base for work and leisure,” said Sophie Chick.

“But as cities reach maturity on the world stage there will be less potential for rocket-fuelled price growth and we expect prime residential markets to settle a more steady growth trend over the foreseeable future.”

“There will be exceptions as new global cities emerge or economic conditions improve. In the short term, it’s the European cities that are likely to see the highest rates of price growth, benefitting from Brexit, lower prices and renewed confidence in markets like Spain.”

Capital values price per square foot/meter and price movements in local currency – cities ranked by value. (Source: Savills)

Vietnam cities’ stories

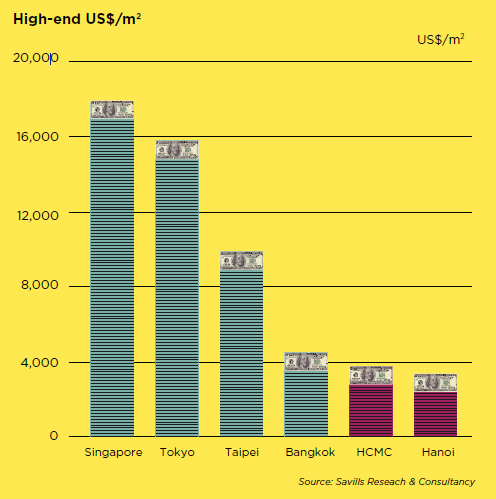

According to Savills Vietnam’s spotlight “Vietnam residential: Where to from here”, apartment prices in HCMC and Hanoi are generally still lower than regional peers such as Kuala Lumpur and Bangkok, despite much stronger growth rates in HCMC when compared with these markets.

Regional high-end prices. (Source: Savills Research & Consultancy)

Mr. Neil Macgregor, Managing Director Savills Vietnam said: “The average price across the broader market is expected to continue to increase, albeit at a somewhat slower pace, with price increases linked to higher development standards and continued strong residential demand driven by urbanization, the rapid growth of the middle class, as well as new infrastructure.”

“New home prices in Ho Chi Minh City’s CBD now average around USD5,500 to USD 6,500/sqm, a fraction of the eye watering levels seen in Hong Kong where prices are at all-time highs. With many countries also introducing cooling measures, resulting in higher taxation, the relatively low taxation in Vietnam appears increasingly attractive to buyers both at home and abroad. It is not surprising therefore that demand for investment properties in Vietnam has increased significantly since 2015, when the new housing law opened the market to international investors. With the distinct shortage of prime property in Vietnam’s key cities, many buyers can see the potential for significant capital gains over the longer term. Whilst in the meantime, rental yields in excess of 5%, represent an attractive investment versus falling returns elsewhere in the region.”

“At the luxury end of the market there is tremendous upside and opportunity for long term investment, with buyers set to benefit from potential capital appreciation as Vietnam continues its remarkable growth story. Although there is still a long way to go for the Vietnam property market to reach the dizzying heights of Hong Kong and Singapore, Vietnam is well on the way to becoming Asia’s next tiger, with strong economic growth, a rapidly growing middle class and, for the time being at least, relatively affordable pricing.”