2019 is another record year for industrial and logistics real estate in Vietnam when foreign direct investment (FDI) into manufacturing remain positive. This trend is not a surprise when cost of production in China continues to rise, expediting relocation process to alternative locations in Southeast Asia, including Vietnam.

In fact, recent surge of demand for setting up production plants in Vietnam has made the country’s industrial property market, which is still dominated by raw land supply, become more vibrant than ever, according to CBRE.

Industrial parks in major cities and provinces has been rapidly occupied in the context of surging demand. The average occupancy rates of industrial parks in northern and southern localities were over 92 percent and 80 percent, respectively, at the end of 2019.

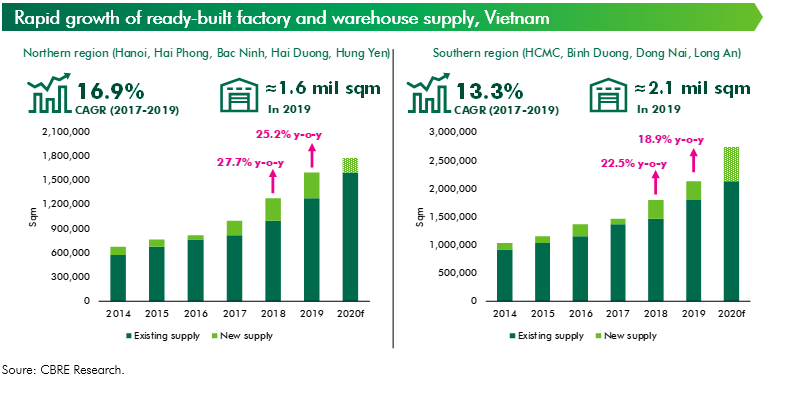

When there is limited vacant land, developers of existing industrial parks tend to switch to ready-built factories, which are more time and cost efficient to tenants who prefer a speedy setup. Over the last two years, a significant growth of ready-built factory supply was observed in major industrial zones of Vietnam.

In 2019, southern regions and cities in Vietnam, including HCM City, Binh Duong, Dong Nai and Long An, welcomed about 380,500 square meters of ready-built factories, up 18.9 percent year-on-year.

Meanwhile, the new supply in the northern region, including Hanoi, Hai Phong, Bac Ninh, Hai Duong and Hung Yen, was 321,420 square meters – up by 25.2 percent y-o-y.

"The export-orientated manufacturing industry is the backbone of Vietnam’s economy, with various large businesses such as Samsung, Pou Chen Group, THACO Group and VinFast who have established their big footprints in the industry," Le Trong Hieu, director of the Industrial & Logistics Services at CBRE Vietnam said at a conference held in Hanoi earlier this week.

The most important impact of their production plants in Vietnam was forming and developing hubs for support industries and suppliers, he said.

Since the first launch of Samsung factory in Bac Ninh province in 2009, the Korean giant has not only actively brought its foreign suppliers into Vietnam but also localize rapidly its network of Vietnamese vendors. Currently, there are 210 Vietnamese vendors for Samsung, of which 42 companies are Tier-1 suppliers and most of their factories located within 45 km from main Samsung’s factories in Bac Ninh, Thai Nguyen and HCMC.

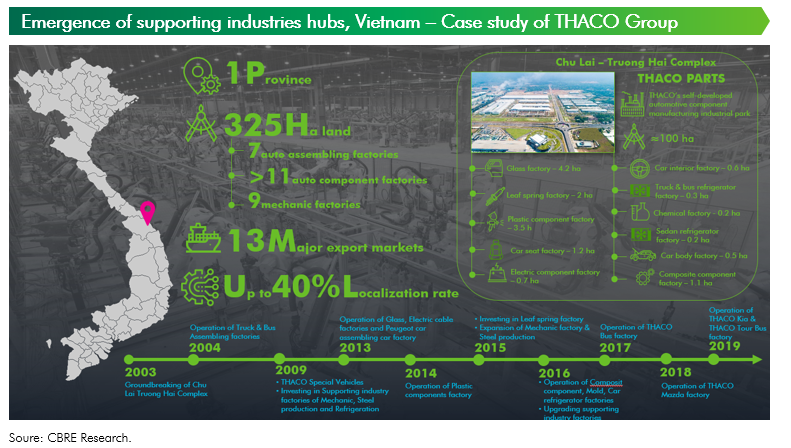

In the automotive industry, Vietnamese private conglomerates, including THACO and Vingroup, have ambitious plans to create manufacturing complexes with concentrated chains of suppliers, according to CBRE Vietnam.

For THACO Group, 325-ha Chu Lai Truong Hai automotive complex in Quang Nam province comprising 100-ha automotive component industrial park has been a successful development case of domestic player in automotive market. Targeting to 40 percent of localization rate, THACO partners with experienced foreign suppliers to co-develop more than 11 component manufacturing factories (land size varies from 0.2 ha to 4.2 ha) to not only provide auto parts for its assembling factories but also to export.

Even though VinFast is a newborn in its industry, it is not an underdog in the competition. To gain a head start by taking a shortcut, Vingroup launches VinFast’s 335-ha automotive complex in Hai Phong which is the home of the most modern auto and auto parts manufacturing factories in Vietnam. In which, 20,000 – 200,000 sqm ready-built factories form a hub of auto parts production.

In general, emergence of supporting industry hubs has been widely observed in Vietnam. Either concentration in a specialized industrial park or dispersal within 40-km radius from main assembling factories.

"Industrial property developers can now open ready-built factories focusing on support industries, along with the application of technology in industrial property management," Hieu said.

Leading developers in ready-built factory sector such as BW Industrial, KTG Industrial, An Phat Holdings has been already catching chance to welcome a new wave of components manufacturers and suppliers following the relocation trend in recent years. In fact, rapid-occupied leasing area of ready-built factory is a strong basis to believe that the outlook of this type of industrial property is very positive.

Dang Trong Duc, KTG Industrial’s Sales Development Director under the Khai Toan Group (KTG), said Vietnam's industrial real estate sector had seen strong development in recent years, especially 2019, due to globalization, political stability and infrastructure development, including highways and system of seaports.

Hieu from CBRE Vietnam said: "The strong development of the domestic industrial property market in 2019 was mainly due to the Government’s large investment in infrastructure, including seaports, highways and airports.

"Vietnam has signed free trade agreements with many partners to promote exports, increasing demand for production and warehouse facilities in Vietnam.

“In addition, the US-China trade war has promoted Vietnam’s industrial property,” said Hieu. This has made companies in China want to move to neighboring countries, avoiding US taxes.

Moreover, the cost of production in China continued to rise, expediting the relocation process to alternative locations in Southeast Asia, including Vietnam, he said.

Large proportion of industrial property supply, both land and ready-built factory, located in major Southern/ Northern cities and provinces (classified as Tier-1 area) with surging demand support market performance increasing rapidly. Expansion of supply has been led by completion of critical infrastructure projects, especially expressway network and ports. More competitive land cost as well as lower occupancy rate are making emerging industrial areas in surrounding provinces (classified as Tier-2 area) become more attractive to investors and developers.

Looking forward, there will be increasing number of industrial development and investment in Tier-2 provinces. Most of the large land bank in these areas are agricultural land, which requires conversion of land use. Therefore, foreign developers and investors are recommended to cooperate with local enterprises to smoothen the land acquisition and legal process.