Luxury projects in District 1 and District 3, selling prices are expected to increase from 5%-7% per year. (Photo: Vinhomes Central Park, HCMC)

Ho Chi Minh to sustain positive market sentiments

To tap high demand from end-users, many developers have prepared the land bank in city fringe districts and surrounding provinces including Binh Duong, Dong Nai and Long An. The focus on those provinces are in line with Ho Chi Minh City (HCMC) proposed master plan. Lower tier segments are expected to be active in 2019 and onward continues from large-scale projects. Regarding locations, the eastern part of HCMC is expected to be the highlight, especially District 9 and Thu Duc District.

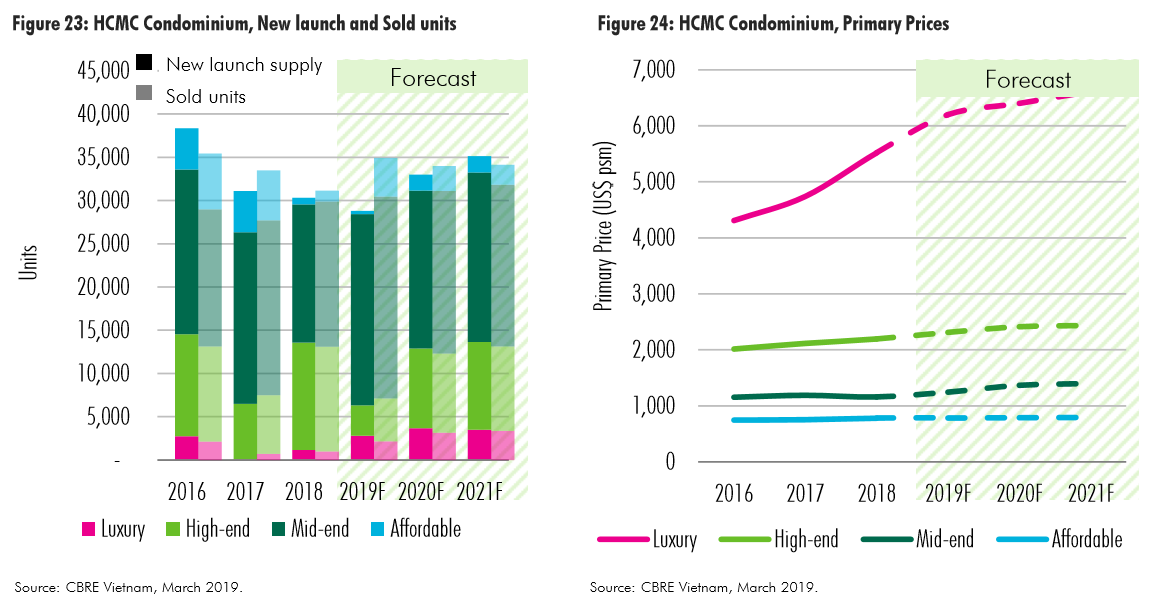

Over the next three years, HCMC is expected to welcome approximately 90,000 units. New launch in 2019 will be slightly lower than 2018 due to slow licensing process. By 2020, with the removal of restriction for condominium development in central area, new launch supply will reach 33,000 units. In 2021 together with the completion of Metro Line No. 1, the market is expected to have additional 35,000 units.

Mid-end segment is expected to reach 75% of 2019 new launch supply, the highest number since 2007, thanks to large scale projects in the East and the South. In 2020, launches of luxury and high-end segment are expected to increase by 35% y-o-y thanks to new projects in District 1 and Thu Thiem area. Affordable segment expects to maintain a stable growth rate.

Ho Chi Minh City condominium market performance. (Source: CBRE Vietnam)

Selling prices in mid-end and affordable segments are expected to post modest growth rates from 1%-3% due to high competition from a large volume of supply. High-end projects in District 2 and District 7 are expected to see higher selling prices, representing 5% y-o-y growth. For approved luxury projects in District 1 and District 3, selling prices are expected to increase from 5%-7% per year, due to scarcity of land bank in the city centre. This growth rates are similar to 2018 in most segments.

Secondary market will be more active in 2019 thanks to shortage of new supply, especially in District 1, 2 and Thu Thiem area. Projects in these areas can achieve up to 30% price growth compared with launched prices.

Buyers are becoming more discerning on both units and projects quality. They are more concerned on safety issues and management quality. Infrastructure issues such as potential flooding and traffic congestion, condominium management services are keys to influence buyers’ decisions. Product enhancements will be the key to improve sales performance for projects targeting endusers. While large-scale townships will offer wide range of amenities, single projects are expected to pay more attention to unit design and building specifications.

Recent progresses seen at prime sites in core districts and Tay Ho area signal the return of luxury after two years absent of new supply. (Photo: Vinhomes Metropolis)

Hanoi is enhancing resilience

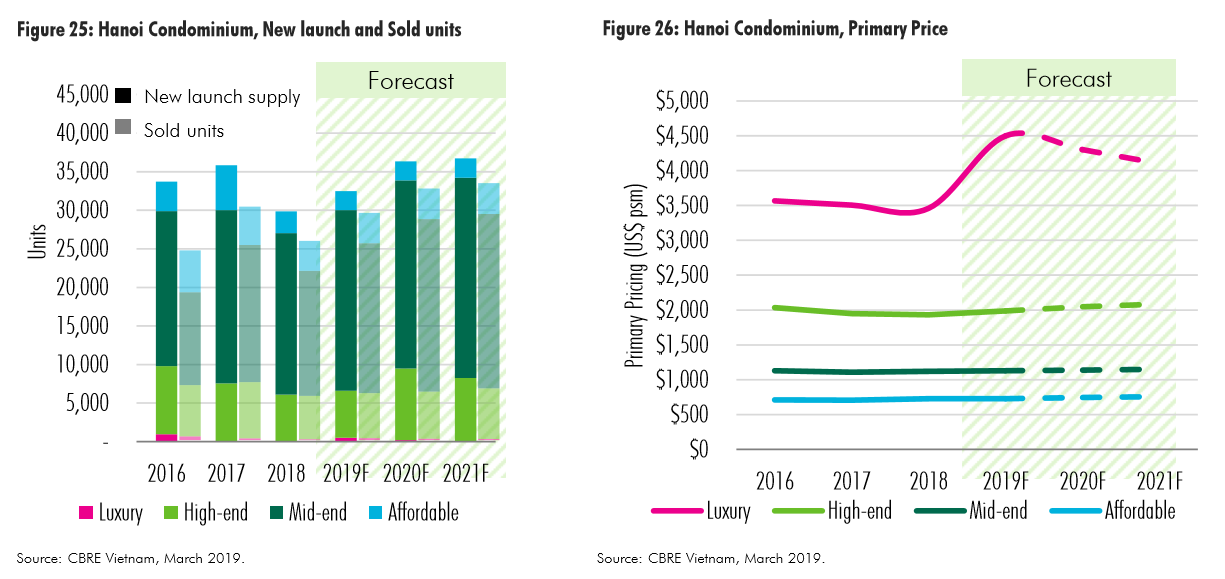

Over the past few years, Hanoi condominium market has been expanding further and further away of more than 10 km to the CBD. The market has witnessed increasing new supply from suburban districts such as Dong Anh and Gia Lam. In particular, the share of suburban districts to total new supply has increased from 11% in 2016 to 20% in 2018. This trend is expected to continue from 2019 onwards since there is limited land bank at core districts such as CBD or Midtown. Additionally, it also highlights that the future supply will be more focused on large-scale townships instead of small to medium scale projects as seen commonly in the past. While customers are more discerning, the projects launched from townships have certain advantages in terms of amenities and landscaping. However, the total volume of supply from these large-scale projects will challenge their developers to set proper phasing to avoid pressure on selling efforts.

Hanoi condominium market. (Source: CBRE Vietnam)

The level of new supply is expected to stay at above 32,000 units in 2019 – a relatively similar volume as seen from 2016 – 2018. The mid-end segment still dominates the market with forecasted share to new supply of around 65 – 70% pointing out that Hanoi market is end-usersoriented. Sales performance, thus, is forecasted to reach 28,000 – 30,000 units in 2019. While mid-end products are common in condominium market, recent progresses seen at prime sites in core districts and Tay Ho area signal the return of luxury after two years absent of new supply. Luxury primary pricing is expected to reach around US$4,500 psm much higher in comparison with previous launch levels of US$3,5000 $4,000. For high-end segment, it is expected that there will be more product upgrades and offerings from both local and international developers to meet the demand of investors and high-income end-users. Pricing growth of mid-end and affordable segments is predicted to be modest at around 1-2% in 2019 given strong pipeline from these segments.

In terms of demand, local end-users are forecasted to continue to drive the demand, supporting the absorption of mid-end and affordable stocks. Investors, on the other hand, will seek opportunities at locations with higher rental yields than current market average of 5%. The projects with close distance to industrial parks, expat communities are those drawing attention of these investors. Noticing the different needs of each buyer group, developers are more focusing on design and concept differentiation and marketing strategies to promote the project’s uniqueness. While there are many similar products available in the market, there are opportunities for developers to introduce new standards quality and unique product’s features.