Ho Chi Minh City faces difficulties despite positive demand

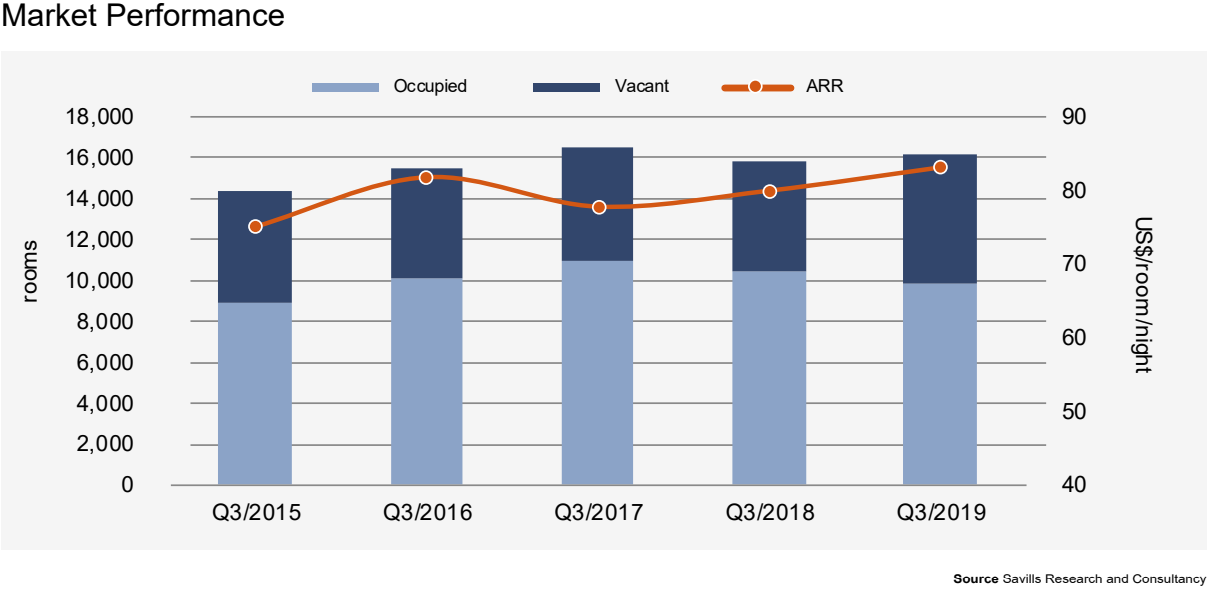

According to the market research firm Savills, the market supplied approximately 16,200 rooms. Holiday Inn & Suites Saigon Airport in Tan Binh district entered, providing 350 rooms. Total stock was unchanged from the last quarter due to the partial closure of 253 5-star rooms and the withdrawal of 157 3-star rooms in District 1.

This quarter there were numerous renovations, especially in upscale segments. Traditional players including Caravelle, New World and Renaissance are undergoing comprehensive refurbishments which could take more than a year to finish.

“Strong interest remains from international brands seeking a presence in the gateway city. The slightly lower occupancy reflects the low season, however with more rooms added led YoY down. The longer term trends are emerging.” – Troy Griffiths, Deputy Managing Director

According to HCMC’s Tourism Department, the city attracted more than 6.2 million foreigner visitors in the first nine months of 2019, up 14 per cent over the same period last year. This growth was 3 percentage points higher than the national average, indicating rising accommodation demands.

Overall occupancy dropped 2 percentage points from the previous quarter and 5 percentage points from the same time last year due to the slow down of the 4- and 3-star segment as a result of surging home-stay supply supported by online platforms. Competition is tough as HCMC has the most online stock in Vietnam.

Average room rate (ARR) growth in the 5-star segment was the main cause for the rise in overall room rates. Market-wide ARR reached US$83 for a room per night, increasing 3 per cent over the last quarter and 4 per cent year over year. Despite a shift-share effect with emerging destinations with international airports, 5-star hotels in HCMC have limited price competition but could even see a rise in ARR after the completion of renovations.

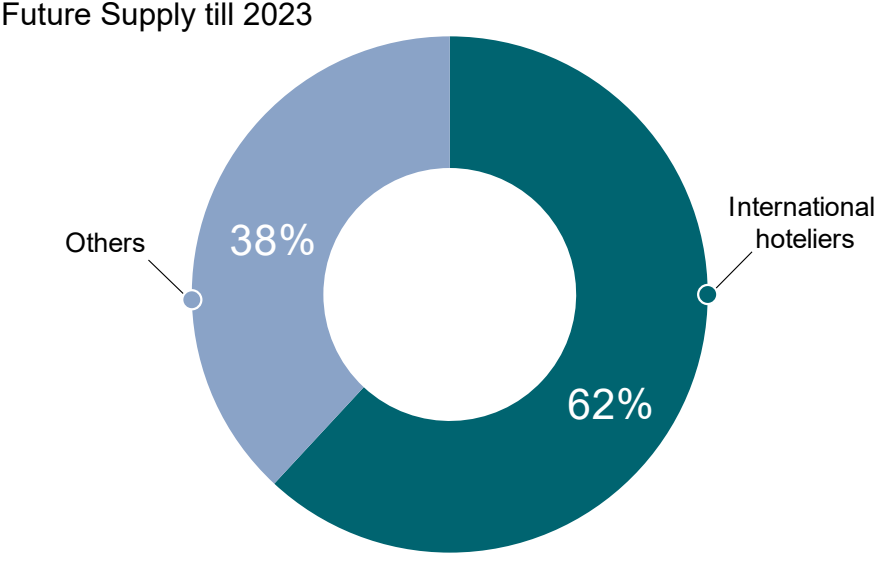

The low penetration rate of international brands has drawn significant investment interest with a strong branded pipeline ahead. In HCMC, 62 per cent of the total 5,000 future keys will be managed by well-known hoteliers, including Hilton Saigon (350 rooms), Mandarin Oriental Saigon (228 rooms) and Holiday Inn & Suites Saigon High Tech (300 rooms). Former 3-star properties are being upgraded with completion dates beyond 2019. These prime sites were acquired by branded chains and will compete in the mid-scale segment, notably De Charm Saigon, Aristo and The Odys.

(Source: Savills Research and Consultancy)

Hanoi - a popular destination for international visitors

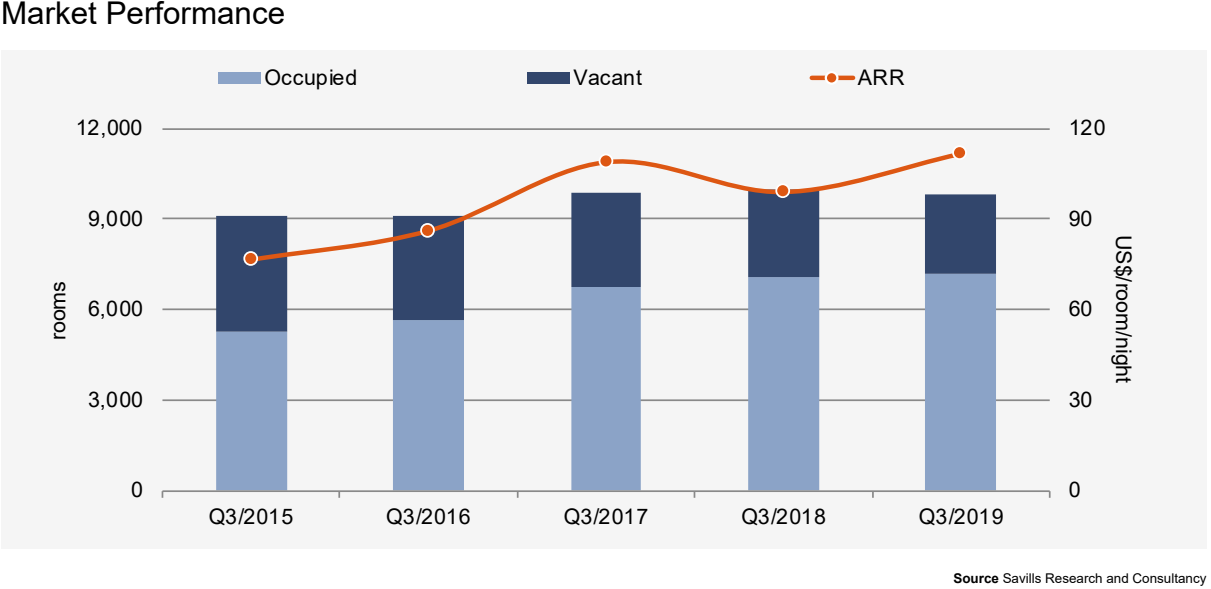

Total stock was approximately 9,800 rooms from 65 hotels (16 five-star, 18 four-star, 31 three-star), down 1 per cent compared to last year due to the downgrade of three 3-star hotels. Average occupancy was up 2 percentage points over the previous year while the average room rate was up 13 per cent from last year; revenue per available room increased 16 per cent year over year.

“A healthy 9.6 per cent year over year increase in international arrivals from major FDI source countries (SK, China, Japan) continues to support growth in the 5-star hotel performance, however, the rate of increase is less dramatic than the previous 2 years. The Formula 1 next year will fuel short-term arrivals in the second quarter of 2020 and will overwhelm the 4- and 5-star market. Business and leisure travel remains strong – getting pollution under control will keep it this way.” – Matthew Powell, Director, Savills Hanoi

Although the West’s ARR is second after the Secondary area, it was the market leader with 82 per cent occupancy and revenue per average room (RevPAR) of US$103 for a room per night. Five-star hotels had the best performance with a high average occupancy of 82 per cent and ARR of US$142 per room per night. The RevPAR of the 5-star segment was US$117 per room per night; 4-star was US$54 and that of 3-star was US$30 for a room per night.

In the third quarter of 2019, Hanoi had approximately 7.2 million visitors, up 4 per cent compared to the last quarter. There were 1.5 million international visitors, up 2 per cent from the previous 3-month. In the first nine months of 2019, Hanoi welcomed more than 21.5 million visitors, increasing 9.4 per cent from the same period last year and 4.7 million international visitors, up 9.6 per cent. South Korea surpassed China to become the top international source market.

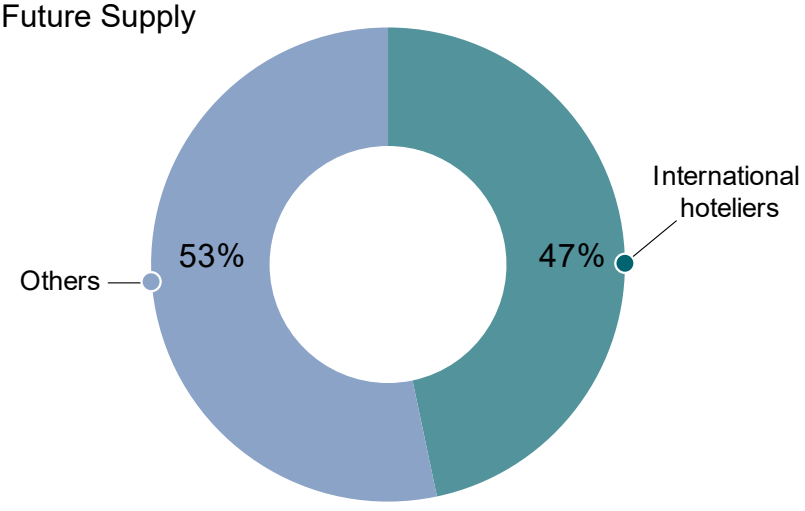

From 2019 onward, 5,000 new rooms will enter; nearly 50 per cent will be managed by reputable international brands such as Marriott International, Accor, Hyatt, Four Season and Hilton. In the third quarter of 2019, international hotels outperformed domestic accommodation with occupancy of 80 per cent, whilst ARR and RevPAR was double that of domestic hotels.