Sales momentum in condominium projects in Ho Chi Minh City continued to be positive in the third quarter, with more than 90 per cent of newly-launched units having been absorbed, according to CBRE Vietnam.

There were 13,386 units sold in the quarter, an increase of 191 per cent quarter-on-quarter and 113 per cent year-on-year. Most were at the Vinhomes Grand Park project in District 9, which was prepared for over a year before the first launch event and had the highest number of new supply in one launch phase, of nearly 10,000 units.

New supply saw a significant improvement compared to the first and second quarters but only came from ten projects, which does not indicate a recovery in the market as a whole. There were 13,072 units launched in the third quarter, an increase of 217 per cent quarter-on-quarter and 107 per cent year-on-year.

New supply in the first nine months of this year stood at 21,619 units, down 3 per cent year-on-year. Most new supply was launched in July and September, to avoid the “ghost month” of August. New projects generally achieved high sales rates, even though their primary price rose more than 10 per cent compared to old projects in the surrounding area.

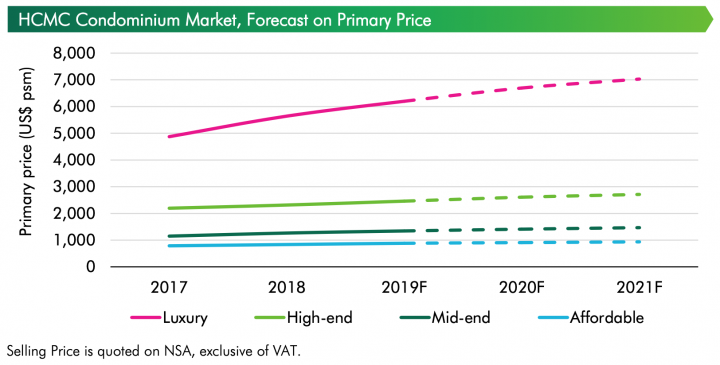

The mid-end segment accounted for the highest proportion of newly-launched units in the third quarter, at 87 per cent, followed by the high-end segment at 10 per cent. This proportion led to the most common selling price being around $1,378-$1,722 per sq m, which is equivalent to $94,718-$120,550 per two-bedroom unit. The third quarter saw one new launch in the luxury segment - The Crest Residence - with 240 units and a price of around $5,500 per sq m. There have been no new launches in the affordable segment for the last two quarters.

Thanks to the new wave of supply in the mid-end segment, the average price in the primary market was stable compared to the previous quarter and stood at $1,852 per sq m, an increase of 15 per cent year-on-year. Increases in primary price were observed across the market for both remaining stock and new supply. In terms of location, District 2 and District 9 recorded the highest price rise, of 5-10 per cent year-on-year.

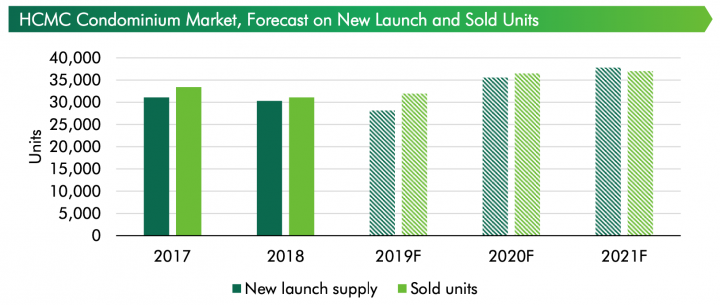

The market is expected to welcome 42,000 units in the last quarter of 2019 and in 2020 from new projects in fringe districts: in the west with AIO City, Akari City, and D-Homme, and in the south with subsequent phases of Eco Green Saigon and Sunshine City Saigon and new projects such as Sunshine Diamond River and Lovera Vista.

Primary prices will increase only slightly due to new supply. The luxury segment is expected to see prices increase 10 per cent year-on-year due to limited supply. Prices in the high-end and mid-end segments will increase 6 per cent and 5 per cent year-on-year, respectively, due to new supply and the high price level in 2019. The affordable segment will post modest growth of 3 per cent year-on-year.

“The condominium market has changed significantly since 2015,” said Ms. Duong Thuy Dung, Senior Director of Valuation, Research and Consulting at CBRE Vietnam. “These changes are important and necessary to build up a sustainable market. In 2019, the government’s stricter stance towards the real estate market and credit tightening have reduced low-quality supply and helped the market absorb the remaining inventory.”

“Despite limited official launch events, developers have still actively generated market interest via real estate expos, township development events, and topping out ceremonies in under-construction projects, etc. This slow period is being utilized by developers to review and adjust their business and product plans as well as land acquisition pipeline. With these activities, the market is expected to be more dynamic in the next few quarters.”