In the near future, the supply of condotel projects in Da Nang will continue to expand.

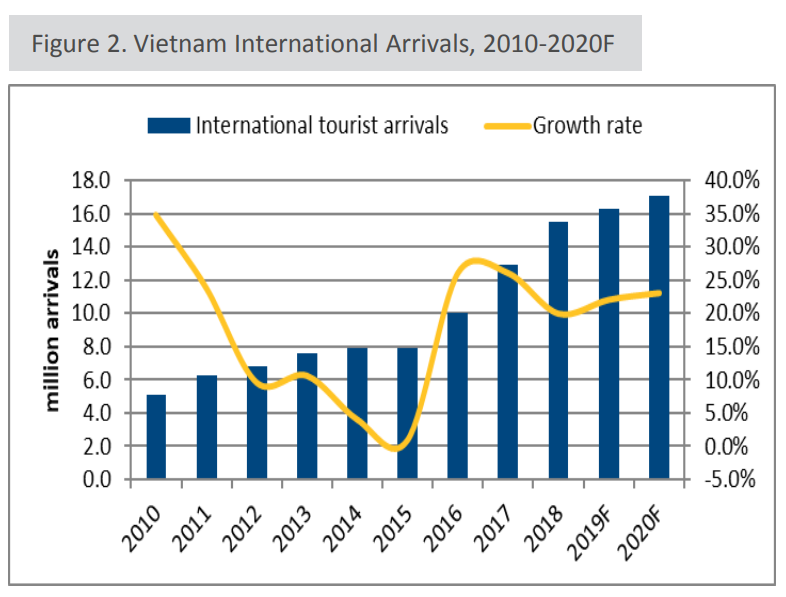

International arrivals

International visitors to Vietnam in 1Q2019 was approximately 4.5 million, up by 7% from that of 1Q2018. In this period, Asia continued to be Vietnam’s largest tourism market with 3.4 million visitors, followed by Europe with 685 thousand arrivals. North America, Australia, and Africa rounded out the top five tourism destination for Vietnam with 293 thousand, 119 thousand, and 11 thousand visitors, respectively.

(Source: Colliers International)

Performance

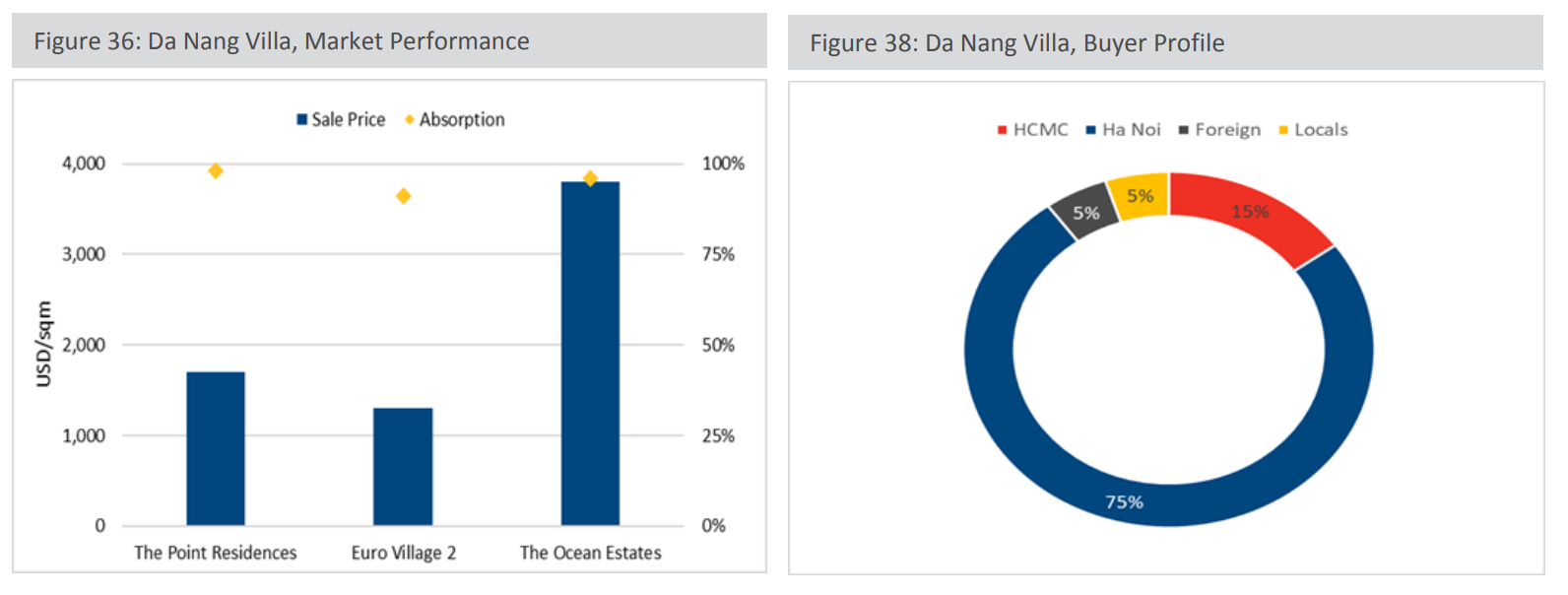

The average absorption rate among condotels in Da Nang remained high at over 80% thanks to continued trust from investors in condotels’ potential for long-term returns. Condotels in Hai Chau District recorded the highest absorption rate at almost 90%, followed by Son Tra District and Ngu Hanh Son District at 73% and 71%, respectively. The average primary price among condotel units in Da Nang reached USD 2,250 per sqm by the end of March 2019.

(Source: Colliers International)

On average, the asking price for second-home villas in Da Nang range from around USD 1,100 per sqm to more than USD 2,200 per sqm. Key success drivers for these properties are the developer’s reputation, attractive sales policies, and proximity to the beach. Across the city, more than 95% of the second-home villa supply has been sold out.

Supply

Due to the unclear future of regulations which govern the status of condotels, the market in Da Nang has slowed down in 1Q2019. Buyers are becoming more cautious of developers’ promises of lofty returns, and developers themselves are also taking caution before introducing new products. In Ngu Hanh Son, Son Tra, and Hai Chau districts, large-scale luxury projects are the main attractions.

The second-home villa supply is extremely limited in Da Nang with only 60 projects, all of which are located in Ngu Hanh Son and Son Tra districts.

Demand

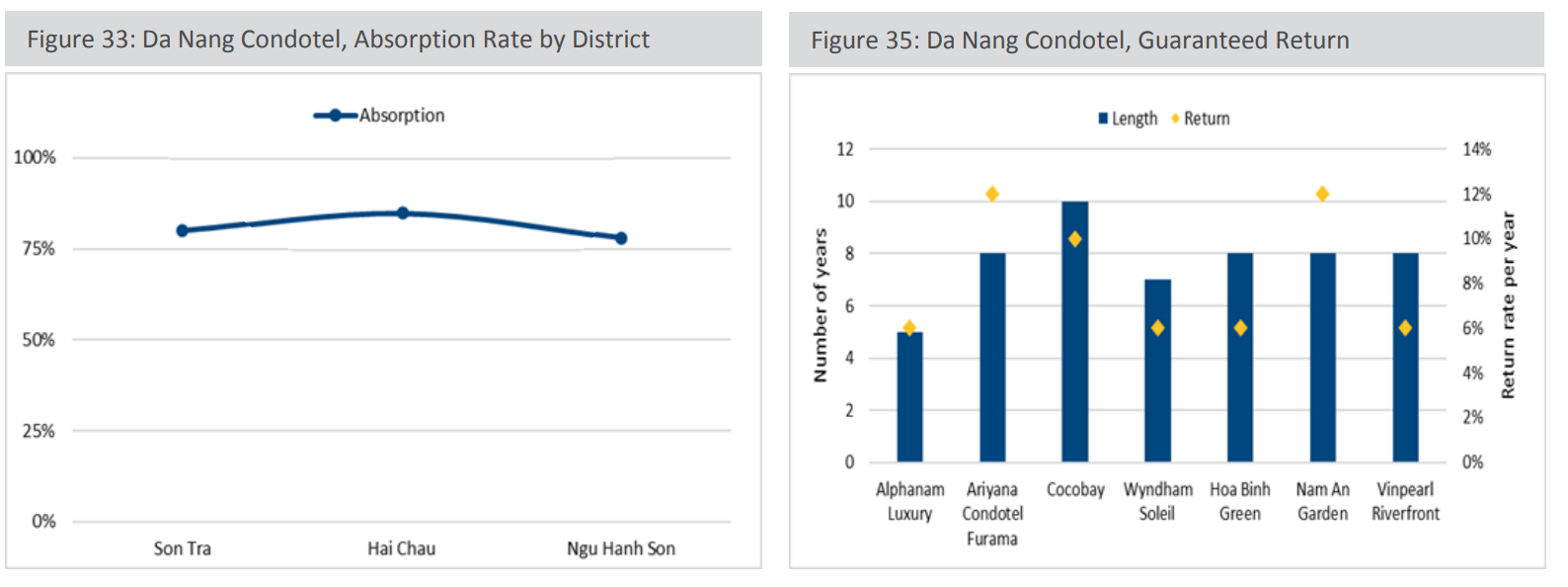

The demand for condotels came mostly from investors from northern Vietnam, particularly Ha Noi, who accounted for more than 80% of total buyers of condotels in Da Nang thus far. This is because Da Nang is seen as an up-and-coming coastal city, advance transportation infrastructure, a large increase in the number of direct international flights to and from Da Nang International Airport, and the steady rise in the number of visitors to the city.

(Source: Colliers International)

The lack of supply is exacerbated by the high demand for second-home villas which, similar to condotels, comes mostly from people from northern Vietnam. Buyers from Ha Noi account for over 80% of all second-home villa purchases, while buyers from HCMC account for 5%. For these buyers, the developer’s reputation, quality of facilities, and high potential for long-term returns are important factorsin the decision-making process.

Outlook

Although the future of condotels in Vietnam are still unclear, investors evidently have persistent interest in the potential for future returns. In the near future, the supply of condotel projects in Da Nang will continue to expand, which will lead to fiercer competition among condotel developments. Thus, new projects will have to differentiate themselves from the rest by unique design and attractive sales policies.

Announcements for future supply of villas have not been made, so it is expected that the current lack of supply will persist in the near future.