Vacancy rate slightly picked up but expected to be temporary due to renovation work at some malls

There is not any new retail property opened in the first nine months of 2019. In the review quarter, Parkson C.T Plaza (Tan Binh District) changed ownership, renovated and was renamed to Menas Mall. Currently, the third and fourth floor of the mall were closed for fitting out. Also in the same review quarter, Parkson Saigontourist was still under renovation and planned to re-open in 2020. As a result, only Parkson Hung Vuong Plaza was still in operation while the other Parkson projects were either closed or going through significant changes.

As of the third quarter 2019, Ho Chi Minh City (HCMC) has a total of 57 retail projects with total net leasable area (NLA) of 1,043,000 square meters, due to the closure of one department store for renovation which decreased total existing supply. Shopping centers were the most prominent format in HCMC, accounting for more than 80 per cent of total supply while department stores in HCMC accounted for 3 per cent of the total supply and the remaining was retail podium.

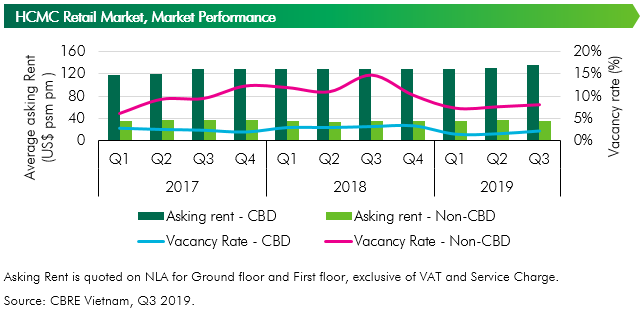

As of September 2019, rental rate was US$135.5 per square meter per month in the CBD and US$35.8 per square meter per month in the non-CBD. Average rental rate in the CBD increased by 3.7 per cent over the previous quarter, while monthly rents outside the CBD decreased by 0.9 per cent compared to the last quarter. On annual basis, non-CBD rental rate increased slightly by 0.2 per cent and CBD rental rate increased by 5.8 per cent.

Vacancy rates increased in both sectors, by 0.6 percentage points in the CBD and by 0.5 percentage points outside of the CBD, compared to previous quarter. CBD and non-CBD vacancy rates were around 2.5 percent and 8 percent, respectively.

By retail format, occupancy rate did not have any change in Department store and Retail podium format. In the shopping centre format, renovation and tenant mix revision undergoing in some projects had temporarily picked up the overall vacancy rate; however, vacancy rates in these projects were expected to improve in coming quarters.

Large pipeline in the near future

According to a CBRE survey, over 550,000 square meters NLA of retail supply are expected to come online over the next four years. In 2020, it is estimated that 237,000 square meters of new NLA will be in operation; these NLA will come from eight projects across HCMC market.

Although the number of new international brands entering the market in the July to September period was limited, retail market in both HCMC and Vietnam was still considered attractive to international retailers and developers, thanks to the country’s growth of young population and changes in their shopping behaviors. Most retailers tend to choose HCMC to open their first stores when entering the country, according to CBRE.

Vietnam’s retail industry has seen several major deals from international investors in the review quarter. Japanese fashion entity, Stripe International, acquired Vietnamese women’s footwear brand Vascara, two years after its acquisition of another local fashion brand, NEM. Also, Amazon has also set up a subsidiary and officially established office in Vietnam, aiming to provide support for small and medium enterprises, besides individuals who participated in its online commerce platform. BGF, a South Korean retail group, is planning to enter the Vietnam market in 2020 by opening a convenience store chain named CU, CBRE quoted Insider Retail Asia as saying.

In terms of consumers’ behaviors, Food and Beverage, Fashion and Accessories, Entertainment, Convenience store and Beauty and Health segments are expected to strongly attract retailers and continue to be among top attraction categories in the near future. In some shopping centers, renovation was under progress to target these changes in consumption trends.

In the third quarter of 2019, CBRE noticed some short-term delays at some under-construction projects, and as a result, total of 2019 new completion would be lower than previously estimated. In the last quarter of 2019, Crescent Mall Phase 2 (Crescent Hub) will be opened: the second phase has a total NLA of 16,000 square meters and will be connected to the 45,000 square meters Phase 1. In the new phase, the developer focused on F&B, Fashion & Accessories and Entertainment.

In 2020, HCMC is estimated to receive 237,000 square meters of new retail space being put in operation; these NLA will come from eight projects across HCMC market. In particular, Vincom Mega Mall Grand Park, with 48,000 square meters of NLA will the biggest retail project to be opened in 2020; the project is the retail component of Vinhomes Grand Park, a 271 ha township by Vingroup in District 9, East of HCMC.