Condotel developers must think long-term when it comes to shouldering early burdens before eventually making profit. (Photo: Tien Thanh)

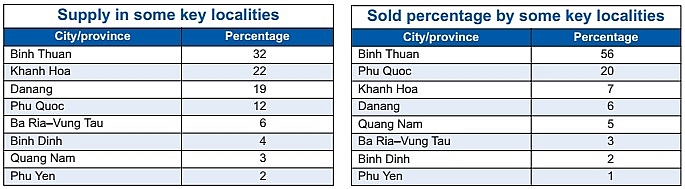

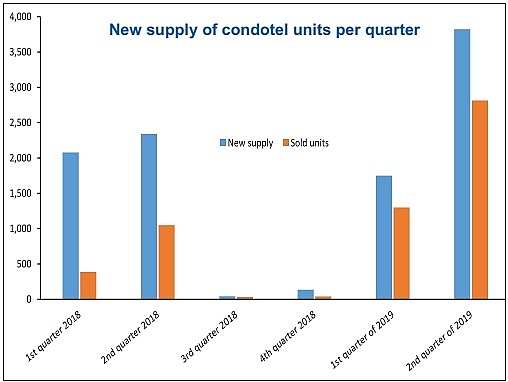

According to the latest figures from the Vietnam Association of Realtor (VAR), over the halfway point of 2019, around 11,800 condotels units were launched onto the market, but only 3,000 of these were successfully sold. Specifically, in the first and second quarters, the transaction volume reached 1,569 and 1,398 condotels, respectively. This is a low level with previous years.

Nguyen Van Dinh, vice chairman of the VRA, provided several main reasons that are hindering condotels units from successfully being sold.

“Firstly, the supply of new condotels has been limited since last year when the government requested that developers temporarily halt their sales and wait for the completion of the legal framework,” Dinh explained. “Secondly, developers and investors became more doubtful when investing into this new type of property.”

The third reason was the tightened credit from the State Bank of Vietnam also reducing the liquidity of condotels. In addition, according to Dinh, condotel units are now offered at higher prices which cause many buyers to hesitate buying them in the first place.

“Moreover, due to lack of a legal framework, investors and buyers are confused about related regulations such as management and operation skill of the developers, as well as the experiences of developers to make condotels efficiently,” Dinh added.

So far buyers mostly believe the prestige of the current developers, especially those who already boast many projects and operate them in an efficient manner.

Nguyen Van Duc, deputy director of Dat Lanh Real Estate Company, said the downturn of condotels could have been foreseen.

“Many buyers thought that condotels could bring about a profit from 10 to 15 per cent, a higher yield than any other segment. However, it could not reach that level as soon as the projects are put into operation,” Duc said. “Developers can burden losses in the beginning, but it is hard to ensure that they can maintain high percentages of occupancy in the long term.”

Duong Duc Hien, director of residential sales at Savills Hanoi, said that the lack of legal framework has discouraged many buyers and investor to fund the segment. “Buyers lack confidence in the legal status of condotels, even if they mostly trust in the profits which they could gain from this type of property,” Hien said.

According to Savills statistics, many condotel units are now sold with reasonable prices between VND700 million ($30,500) and VND1 billion ($43,500) each.

“If you buy a condotel unit with the cost of VND1 billion ($43,500) in a fast tourism development area, then you can earn around VND20 million ($870) of leasing fees per month,” said Hien.

“This is an attractive yield because if you buy an apartment for VND2-3 billion ($87,000-$103,500) in cities and lease, you can earn around VND11-15 million ($480 to $650) per month,” Hien continued. “Therefore despite the downturn, condotels for tourism leasing remain a notable profit channel right now.”

In the long term, condotels remain a strong option in Vietnam for some, especially in the situation of the speed of the country’s tourism development, and upgrades to the infrastructure system through a range of mammoth projects.

Nguyen Hoang, director of research and development at DKRA Vietnam said, “the increase during the second quarter over the first quarter of this year was mainly due to one new project named Apec Mandale Wyndham Mui Ne, invested in by IDJ and Apec Group, which has offered more than 3,000 units to the market.”

Figures from DKRA showed that three new condotel projects were launched in the quarter to the market with more than 3,800 units, accounting for 218 per cent of the previous quarter.

According to Dinh from the VRA, localities with convenient transport systems such as Phu Quoc, Danang, and Quang Ninh are highly appreciated in second home development. Other strong destinations currently include Thanh Hoa, Quang Binh, Quy Nhon, Phu Yen, and Binh Thuan.

Professor Dang Hung Vo, former Deputy Minister of Natural Resources and Environment, said that although the number of Vietnamese second home products remains low compared to countries like Thailand, Vietnam is gaining a very positive percentage of tourism development at more than 30 per cent per year, a globally-impressive statistic.

“In a long-term vision, the supply of condotels in Vietnam cannot exceed demand. The current reduction is only happening locally and over a short time. The main reason for reducing transactions is the incomplete policies and laws,” Vo stressed.

The sale of condotels is expected to be brighter by the end of the year when the Ministry of Construction, the Vietnam National Tourism Administration, and local authorities can introduce legal regulations to deal with condotel products.