(Photo: Khanh Chi/VET)

New supply and absorption for hospitality properties in the south of Vietnam saw a dramatic change in the first half of this year, both for ocean villa and condotel products, according to real estate consultants Danh Khoi A Chau (DKRA)’s Ho Chi Minh City Residential Real Estate Q2/2019 report released recently. The report also reviewed elsewhere in the southern region.

Southern real estate market in Q2

The southern market welcomed six new hospitality projects in the second quarter, supplying 1,734 ocean villas, up eight-fold against the first quarter. The rate of new supply reached 93 per cent (1,614 units), an increase of 19-fold. This supply came mainly from a major project in south-central Binh Thuan province, which alone accounted for about 68 per cent of supply and about 87 per cent of the market’s primary absorption.

For condotels, DKRA Vietnam recorded three new condotel projects for sale to the market with 3,824 units, equaling 218 per cent quarter-on-quarter and 164 per cent year-on-year. The absorption rate reached 74 per cent, equal to 217 per cent quarter-on-quarter. This is the best number in more than two years. Primary supply and absorption rate are concentrated mainly in coastal cities and provinces of Binh Thuan, Khanh Hoa, and Da Nang.

Ho Chi Minh City’s real estate market in the second quarter received plentiful new supply in the hospitality real estate segment, with a positive absorption rate. Townhouses and villas saw slight growth, while the land segment was maintained at a stable level, with not many signs of sudden changes. Supply of apartments continued its downward trend and reached a new bottom since 2016.

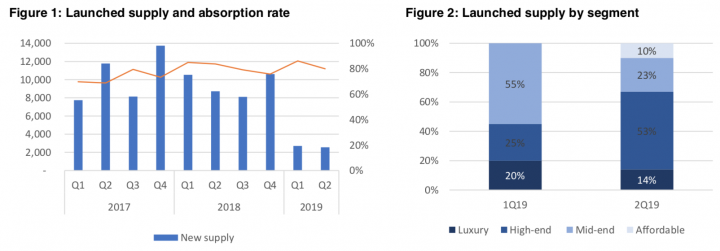

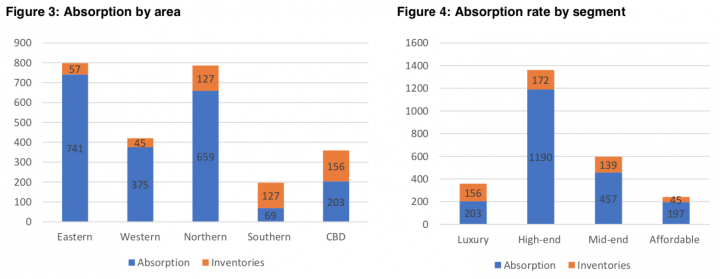

DKRA Vietnam’s figures show 12 projects providing 2,559 apartments in the second quarter of 2019, including three new projects and nine existing projects implementing subsequent phases, equal to 95 per cent of the previous quarter, 29 per cent year-on-year, and 22 per cent of the same period in 2017. New supply is at its lowest level for four years, since 2016. Absorption of new supply reached 80 per cent (about 2,047 units), equal to 88 per cent quarter-on-quarter and 28 per cent year-on-year.

Condominium market.

The Grade A and B apartment segments continued to account for a large proportion of new supply in Ho Chi Minh City. The east and the south of the city are still leading in new supply and the absorption of new supply. Secondary trading was quite good, with average selling prices increasing 5-7 per cent quarter-on-quarter due to pressure from a long-lasting supply shortage.

Condominium market.

Forecasts for 2H 2019

According to DKRA Vietnam, land plots will continue to be the top investment selection channel. New supply may increase but not exceed 2018.

In the apartment segment, supply and demand may increase but will be not strong. The east and south still account for a large proportion of supply. Grade A and Grade B apartments continue to lead the market, while the supply of Grade C apartments is scarce when there are not many new projects ready to the market.

Da Nang, Khanh Hoa, Phu Quoc Island, and Binh Thuan are still familiar destinations for hospitality real estate investments. Following the momentum from the second quarter, the supply of ocean villas and condotels in the next six months will increase.

The integrated resort model has received great attention from customers, in which the townhouse / shophouse segment is well received by the market.