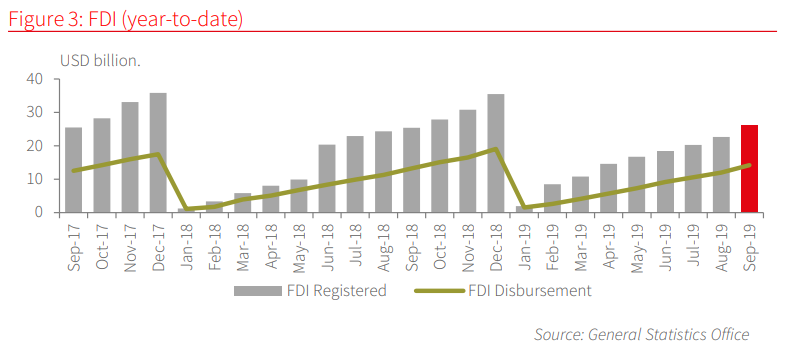

Vietnam’s FDI registered new growth

Total FDI pledged to the country reached USD 26.16 billion in the first 9 months of 2019, an increase of 3.1% y-o-y. Specifically, the total newly registered capital reached USD 10.97 billion, equivalent to 77.7% of the level recorded in the same period last year. FDI disbursement in 9 months was recorded at USD 14.22 billion, an increase of nearly 7.3% y-o-y. Among 19 investment industries, processing and manufacturing remained the most attractive sector, recording 18.09 billion USD, accounting for 69.1% of the total capital. Real estate, wholesale and retail sectors ranked second and third with USD 2.77 billion and USD 1.4 billion respectively. Hong Kong SAR (China) took the lead among 109 markets investing in Vietnam in JanSep period, with a total of USD 5.89 billion, followed by Korea and Singapore with USD 4.62 billion USD 3.77 billion respectively.

NKEZ remains an attractive manufacturing destination

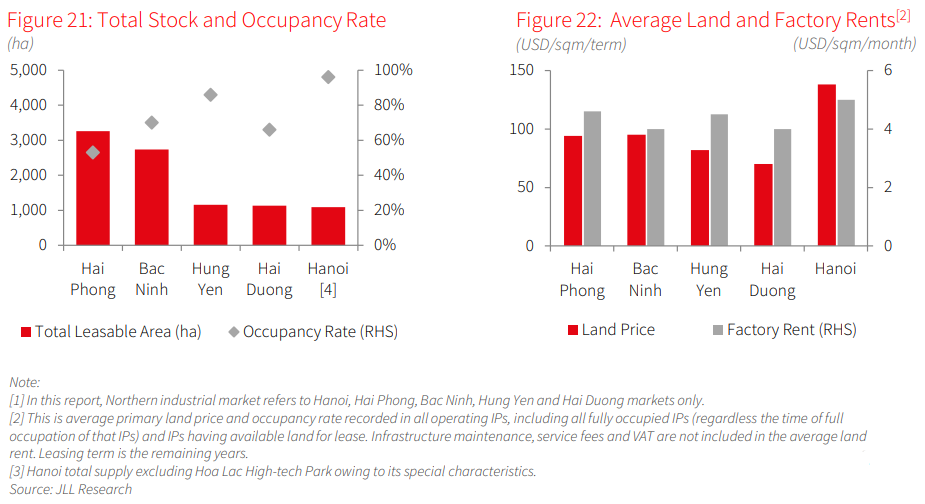

In the first nine months of this year, the occupancy rate recorded in all existing industrial parks (IPs) across the five most dynamic cities and provinces in the NKEZ, including Hanoi, Hai Phong, Bac Ninh, Hung Yen and Hai Duong, averaged 69 percent, an increase of 200 basis points compared to the previous data cycle in the first quarter of this year. The top rates were in Hanoi and Hung Yen.

In NKEZ, a large portion of rising demands are coming from manufacturers moving out of China due to the lingering trade war and investors who are looking to diversify their manufacturing portfolios. Possessing strategic location and a synchronised infrastructure system, NKEZ stands out to have suitable features for these enterprises to set their new operation, Nguyen Hong Van, JLL Vietnam’s Director of Markets, said at a press conference in Hanoi.

Ranked 3rd among the top 10 most dynamic cities in JLL’s City Momentum Index 2018, Hanoi is swiftly evolving with major infrastructure updates, including a modern metro line on the way. Stephen Wyatt, Country Head of JLL comments “Hanoi is only behind HCMC in terms of corporate presence, the city has great potential to become the biggest investment hub in Vietnam. Congestion, pollution and transparency are among the top concerns from investors right now.”

The capital city possesses a strong demographic background with a young and tech-savvy population. E-commerce is among the most major threats to traditional retail malls, thus, retail spaces that are willing to work on brand image and revise leasing strategies achieved strong performance with high occupancy rate, while other malls were struggling to retain customer. Urbanisation and the development of surrounding industrial areas have driven a large population of people from nearby provinces to move their lives to Hanoi. Land supply running scarce coupling with delayed approval procedure have led investors to look beyond the city to find opportunities.

Sufficient supply to capitalise the demand

With an increasing proportion of FDI pouring into the north over the past decade, Hai Phong, Bac Ninh, Hung Yen and Quang Ninh are also fast becoming focal points for investment apart from Hanoi, according to JLL Vietnam.

Up to the third quarter of this year, the total leasable industrial land area stood at 9,371 ha, of which the largest supply was in Hai Phong, followed by Bac Ninh, according to JLL Vietnam.

Bac Ninh and Hai Phong, the two leading industrial markets still have sufficient vacant land areas to capitalise on rising demand. Further, new supply from subsequent phase of existing IPs and newly developed ones in strategic locations have also offered more options, making these two provinces remain the most desirable areas in the North Vietnam.

Land price accelerates

The average industrial land price in the third quarter hit 95 USD per sq.m per lease term, an increase of 6.7 percent year on year (y-o-y), Van said.

Aside from Hanoi as the economic centre with the highest price, Bac Ninh and Hai Phong still post leading price thanks to their strong industrial foundation with well-known tenants, strategic location and established synchronous infrastructure system. Hai Duong and Hung Yen still kept their price at reasonable level. Average monthly rents for factory ranged from USD 4.0-USD 5.0 per sqm per month. This rent level remained flat compared to the 1Q19 update.

Potential for other real estate developments

The strong development in the manufacturing sector across the provinces has also brought with it the great potential for the establishment of other real estate sectors. This has been proven by strong investment pouring into the real estate market in the northern provinces as witnessed recently.

The BCI Asia statistic shows that, after Hanoi, Hai Phong, Bac Ninh, Quang Ninh and Hung Yen are the top provinces in terms of the number of real estate developments. Apart from Quang Ninh, well-known for its Ha Long Bay and Van Don Special economic zone, the other three provinces have consistently led the north area regarding industrial developments.

Bac Ninh, Hai Phong markets are strongly driven by residential projects being developed to capitalise the growing housing demand from an increasing number of migrants and expats working in the provinces. Unlike Bac Ninh and Hai Phong where most developments concentrate in the city centre, most projects in Hung Yen cluster alongside its boundary with Hanoi, to benefit from the existing demand in this big city. Being home to Ha Long Bay, Quang Ninh has been hot on the radar of many well-known developers, focusing on vacation and tourism-related properties.

It has been reported that 615 ha was planned to be launched during the next 12-month period. Steady price growth for industrial land in the North of Vietnam is expected through end-2019 due to strong investor appetite. New investors – largely from Asian countries such as Japan, South Korea or China will remain keen on Vietnam’s industrial property. Since the wave of manufacturers shifting out of China still post no sign of cooling down, the investment will continue to pour into Vietnam, especially to the five key industrial cities of the North.