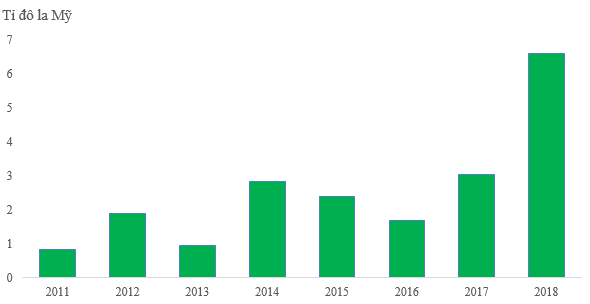

FDI into real estate rose sharply

Statistics of the Foreign Investment Agency, accumulated until the end of 2018, stated that real estate had drawn nearly US 6.6 billion of FDI, twice as last year. Accordingly, the property sector ranked second only to the processing and manufacturing industry.

In the context of limited domestic bank credit, FDI flows are seen to be a timely and valuable support for project developers. According to Chairman of Ho Chi Minh City Real Estate Association (HoREA) Mr. Le Hoang Chau, FDI is not only a supplementing source of capital, but also creates many opportunities and values for realty businesses.

FDI capital into real estate in the period of 2011-2018. In 2018, FDI hit the record of US 6.6 billion. (Source: Foreign Investment Agency)

“FDI is an extremely valuable additional source of capital for the estate industry. When domestic enterprises receive FDI, we also take in world-class architectural styles and utility services. We can learn management techniques and improve information transparency. This is definitely a good sign for the client,” said Le Hoang Chau.

“FDI also brings a shift of workforce to Vietnam. 2018 marked the first time that the exploitation rate of luxury and grade B office segment in HCMC reached over 96% and 90%, respectively. Demand for industrial real estate also continues to rise sharly.”

Chairman of HoREA forecasted that the property sector will further draw FDI in 2019, especially in the context of the US-China trade war and Vietnam joining CPTPP.

“Firms need to creat a network with foreign investors. Currently, Korea and Japan are the two biggest capital providers for Vietnam’s real estate market. In addition, realty businesses need to attract potential financing from the US and Australia,” Chau emphasized.

... but was it enough?

Evaluating the benefits of real estate FDI, CEO of Bizlight Entrepreneur School Dr. Bui Quang Tin said that this source of capital will contribute to bring in international standards, leveling up Vietnam’s property market and sharing many financial burdens. However, Tin is concerned with the downside of FDI that it is not enough and not helping the market develop to its expectations.

During cooperation, when capital is insufficient, investors make an excuse of complicated procedures to reduce the scale and extend the estimated time of the project. In some cases, conversion land use purpose for profit or for prime locations has been found in foreign companies.

The CEO stressed that challenges to both local businesses and the host country will be brought in along with FDI because land is a valuable resource. “Therefore, the long-term benefits of the country, the domestic property firms, and the living environment of future generations should be at the forefront when considering the preferences of FDI projects.”

“Administrative agencies need to reevaluate and withdraw projects that are slow to implement or behind schedule to make place for potential investors,” Dr. Bui proposed a possible solution.