WORK cafe in Ho Chi Minh City, a co-working space/coffee shop. (Photo: Pinterest)

Office market to welcome a wave of new supply

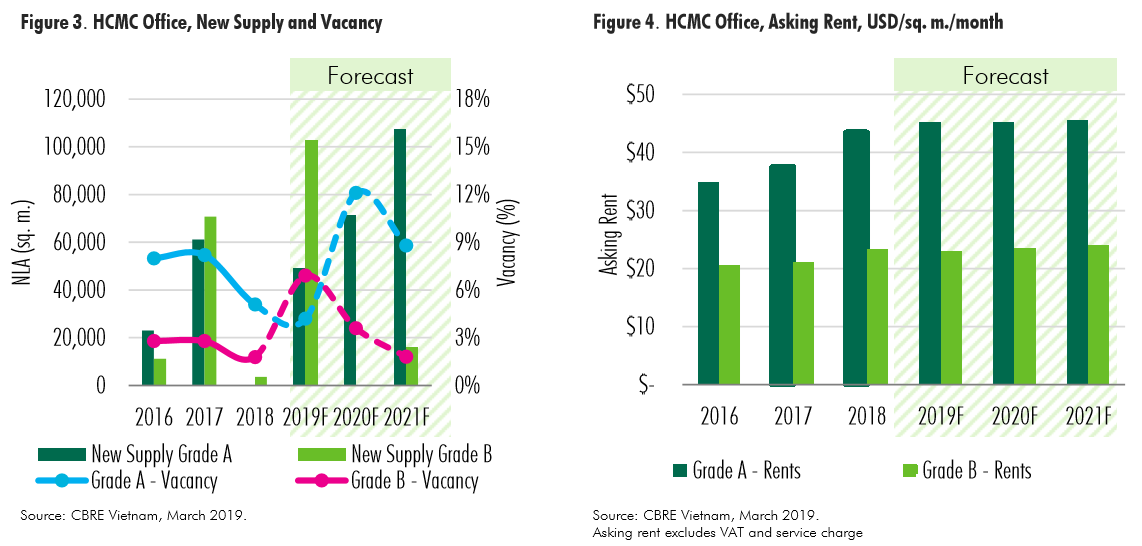

After a quiet year of 2018 with barely no new supply, HCMC’s market is ready to welcome a wave of new office buildings in 2019 and beyond.

In 2019 alone, nine new buildings, with more than 150,000 sq. m., will be launched across the city, of which two Grade A buildings will be in the CBD while all Grade B offices will be spread out to non-CBD and decentralized areas. This amount will mark the largest new supply added to the office market in the past five years.

From 2020 to 2021, the market expects to introduce additional high profile Grade A office buildings in the CBD area. Approximately 150,000 sq. m. NLA of CBD – Grade A offices will enter the market, lifting up the currently scarce Grade A office stock.

New supply volume over the next three years will be doubling the new supply that was launched in the past three years from 2016 to 2018. This will come from 15 new buildings of both Grade A and Grade B, adding a total of 347,000 sq. m. NLA to HCMC’s office stock.

Moderate rental growth prospects

The wave of new supply expected in the coming years will help ease the pent up demand of leasing office spaces. In recent years, the scarcity of office stock presents limited options to tenants looking to relocate, expand or lease new space. Additionally, the demand for expansion and leasing of large area has been gradually increasing. Hence, greater new supply over the next three years is much anticipated to ease such leasing demand. Increasing new supply, however, will put heavy pressure on landlords, especially of older buildings, as the market shifts to tenant’s market. Landlords would need to monitor the shift of negotiation power over tenants under such a circumstance.

Furthermore, the surge of office rents in 2018, with average growth recorded at 15.8% y-o-y, has affected the occupancy by the end of 2018, with Grade A vacancy slightly increasing by year end (from 3.7% in Q3 to 5.0% in Q4). Although it was a slight adjustment, this reflected tenants’ reaction over quickly increasing rental rates. Certain tenants at Grade A offices have restructured their business portfolios by downsizing or even contracting their spaces to relocate to Grade B offices and flexible workspaces, a move seen as resistance against rents surge. Landlords should be more prudent in rental policies in order to avoid negative reaction from tenants. Hence, rental growth of Grade A offices is expected to be only 4%, comparing against the 15.8% growth recorded in 2018, while its vacancy will continue to slightly decrease to 4% in 2019. In addition, no new Grade A building will be coming online until the end of 2019, thus, the market will continue to absorb vacant spaces from the existing Grade A offices.

On the contrary, Grade B rental growth might experience a minor downturn of 1.5% in response to a large number of new Grade B buildings coming on stream in 2019, which will also increase its vacancy rate to 6.9%.

Solid demand driven by workspace solutions

Despite the market welcoming greater new supply in 2019 and beyond, the market expects that most buildings will see healthy performance.

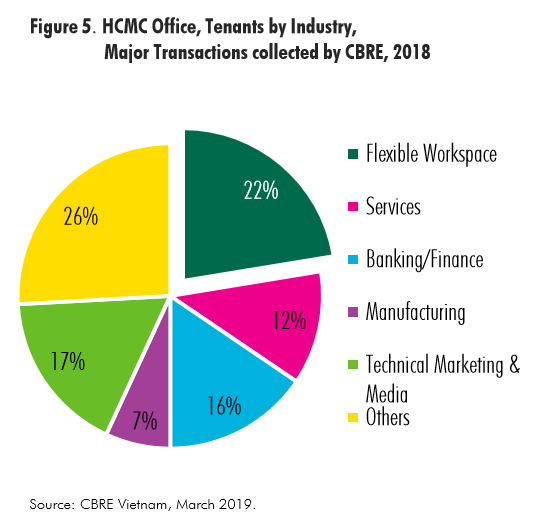

During the past few years, finance/banking and manufacturing companies have occupied the largest portion of total office demand. In 2019 and in the next few years, the office market will experience a restructure of demand when flexible workspace and tech firms are expected to dominate office demand and become anchored tenants of traditional offices. As of 2018, there were approximately 27 flexible workspace centers in HCMC with a total GFA of 37,780 sq. m., increasing by 109% y-o-y. Flexible workspace’s tenants are not only freelancers, start-ups or small-medium enterprises but also corporations. Demand for space from IT, Internet and Tech firms is expected to further grow, driven by expansion of both local and international companies.

Technology to reshape office usage

There is no denial for the advantages of applying advanced technologies into the workplace to make the management and operations of an enterprise more efficient. In the next few years, companies are expected to further technologize their operation systems to enhance efficiency; in certain cases this might allow employees to work remotely. The incorporation of technology into the workplace will create a revolution and reshape of office usage. Altogether, these evolvements are leading to changes in occupiers’ requirements for unit sizes and technical specifications. Under such a circumstance, landlords would be required to adapt, via the introduction and inclusion of technology, services, facilities and amenities in the office space, providing tenants with flexibility, convenience and wellness, on top of safety and security. Landlords who could deliver such requirements to meet the changing demand could futureproof their performance, although this might mean renovation works required.

Outlook

Rental growth expected to be more stable. Landlords will be more prudent in rental policies in response to strong growth of new supply

Space constantly being redefined and office space will become more flexible. The use of flexible space will then be the crucial factor of all firms’ business portfolios in response to the constantly evolving business context.