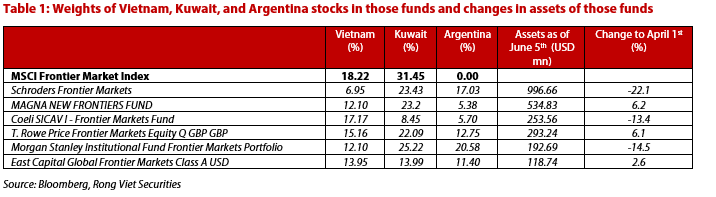

Six biggest funds, managing a combined of US$2.4 billion in assets, that benchmark to MSCI Frontier Market Index, may add Vietnam market weights in the near future, according to Viet Dragon Securities Company (VDSC).

These include Schroders Frontier Markets, MAGNA NEW FRONTIERS FUND, Coeli SICAV I - Frontier Markets Fund, T. Rowe Price Frontier Markets Equity Q GBP GBP, Morgan Stanley Institutional Fund Frontier Markets Portfolio and East Capital Global Frontier Markets Class A USD.

However, the inflow may not be big as investors are still concerned about trade war and other global uncertainties, stated VDSC, citing a significant decrease in assets of some funds since April 1 to back up its prediction.

Additionally, the brokerage said there is a trend that assets has flooded into haven assets such as US treasuries. Furthermore, some funds held more cash now.

VDSC said the weights of Vietnam and Kuwait stocks were still lower in those funds than in MSCI Frontier Market Index, which could be considered the main reason for such trend.

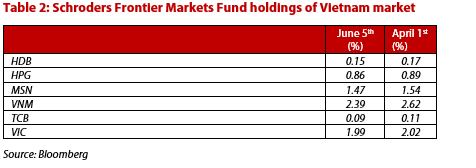

Even though funds may increase Vietnam weights, only selected stocks instead of all VN30 members would benefits. Schroders Frontier Markets Funds, for example, had only six Vietnam stocks, including Ho Chi Minh Development Bank, Hoa Phat Group, Masan Group, Vinamilk, Techcombank, and Vingroup.

According to VDSC, those funds had a similar trend performance with MSCI Frontier Market Index except for Coeli SICAV I – Frontier Markets Fund and East Capital Global Frontier Markets Class A USD.

Regarding to fund structure, Vietnam stock market's weights declined in most funds during the period from April 1 to June 5, except for Coeli SICAV I - Frontier Markets Fund that increased slightly to 17.17% from 16.93%.

East Capital Global Frontier Markets Class A USD reduced significantly Vietnam weights in its portfolio by 2.7%. This fund added Masan Group with a 1.67% of its assets while cut FPT (-1.55%), Vinamilk (-1.09%), Phu Nhuan Jewelry (-0.72%), Airports Corporation of Vietnam (-0.33%), and Vincom Retail (-0.33%).

The largest fund that benchmarks MSCI Frontier Market Index - Schroders Frontier Markets Fund shortened weights of most Vietnam stocks. In which it cut Vinamilk by 0.23% to 2.39% during the same period.

MSCI Frontier Market 100 Index is a subset of MSCI Frontier Market Index. Ishare MSCI Frontier 100 ETF, a passive fund, tracks MSCI Frontier Market 100 Index. This funds already rebalanced on May 28 and its structure is similar to MSCI Frontier Market 100 Index’s structure. Thus, VDSC did not expect any major change in this fund.