HCMC Office Market

Traditional Office Market

In Q1 2019, HCMC office supply remained scarce when the market only welcomed two new Grade B buildings with total NLA of 19,800 sq. m. The two buildings are Thaco Building (District 2) and OneHub Saigon 1 (District 9).

Despite the limitation of existing supply, rental rates of both Grade A and Grade B stayed relatively stable or even decreased slightly in some projects. The average asking rent of Grade A was US$46.31 psm pm, a decrease by 0.2% q-o-q, and Grade B rental rate was US$23.44 psm pm, an increase by 0.5% from the previous quarter.

The main reason behind stable rent of both grades is the upcoming wave of new supply (more than 165,000 sq. m. NLA in 2019 from eight buildings). The wave of new supply in 2019 has been boosted by the accelerated construction of the city’s pipeline infrastructure projects such as the Metro Line No.1 and the new Mien Dong Bus Station.

Although still under-contruction, new buildings have started pre-commitment lease while offered competitive rental rates and incentives. Therefore, the leasing market has stayed more balanced than 2018. In Q4 2018, when Grade A rental rate hiked up, some tenants began to contract their spaces or relocate to Grade B offices or even to flexible workspaces for cost saving initiatives.

In general, HCMC office market has a healthy performance with vacancy rates of both Grade A and Grade B lower than 5%. In Q1 2019, Grade A vacancy rate was 2.6%, down 2.4 ppts q-o-q. Vacant spaces from tenants whom contracted their leasing spaces in Q4 2018 have been filled up and new spaces were continued to be quickly absorbed. On the other hand, Grade B vacancy rate reached 3%, slightly up 1.2 ppts q-o-q thanks to quick absorption rate from two new Grade B buildings (Thaco and OneHub Saigon 1)

Due to the healthy performance of traditional office market and limited vacant spaces, head lease/sublease business has been growing in recent years, including Pax Sky, Dragon Fly, Todd’s Realty and GIC Office. These operators are usually lease the entire stand-alone building (usually Grade C or basic standard office) from an independent landlord and sublease to small tenants.

Besides flexible workspace, insurance companies can become one of the anchored tenants of office market in the next three years. According to a statistic of Swiss Re Institute Sigma, Vietnam is one of the five countries that have low penetration rate, but its insurance premium growth rate is even higher than other developed countries, indicating plenty of opportunities for growth and that the insurance market in Vietnam will likely continue to develop further in the future.

From 2019 to the end of 2021, HCMC office market is expected to welcome 16 new office buildings with more than 400,000 sq. m. NLA. The market is expected to have higher vacancy rates and a slower rental growth for both Grade A and Grade B while rents of Grade A will remain high.

In 2019 alone, rental growth of Grade A is expected to reach 4% and its vacancy will decrease to 4% due to new Grade A supply will only be launched by the end of 2019 or the beginning of 2020. Grade B asking rent is expected to slightly decrease by 1.5% and its vacancy is forecasted to increase by 6.9% due to a large Grade B supply coming on stream this year.

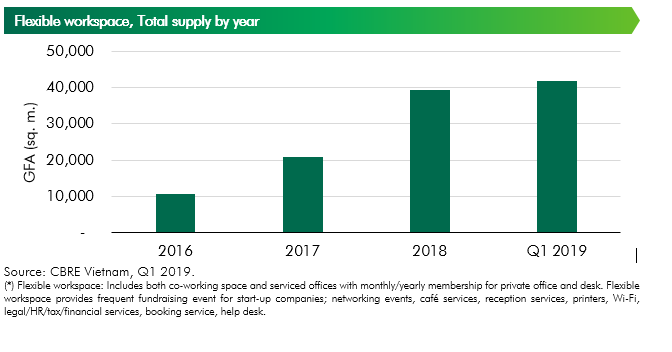

Flexible workspace*

Unlike traditional office with stable growth, flexible workspace market has been expanding at a fast pace. In Q1 2019, the market welcomed two new flexible workspace venues, including Toong - Ham Nghi and Up - Le Meridien with a total GFA of 3,100 sq. m., increasing the existing supply by 6% q-o-q, and 101% y-o-y. In addition, the two “major players” in the market, Toong and Up, have been expanding their brands internationally, in which Toong has opened its first two foreign venues in Laos and Cambodia and Up is planning to expand into Malaysia, Thailand and Hong Kong.

The rapid expansion of flexible workspace market was partly due its healthy performance. As of Q1 2019, rental rates of the fixed desk and private office sectors increased by 3 – 8% q-o-q with occupancy rate reached more than 80%.

Hanoi Office

In the first quarter of 2019, one Grade A office entered the market, Thaiholdings Tower with 24,545 sq.m NLA, increasing Grade A stock in the CBD by 10%. This is the newest Grade A supply after three years without new supply and the newest office supply in the CBD-submarket. By the end of Q1 2019, total office space in Hanoi reached approximately 1.3 million sq.m, in which Grade A accounts for only one third of the total stock.

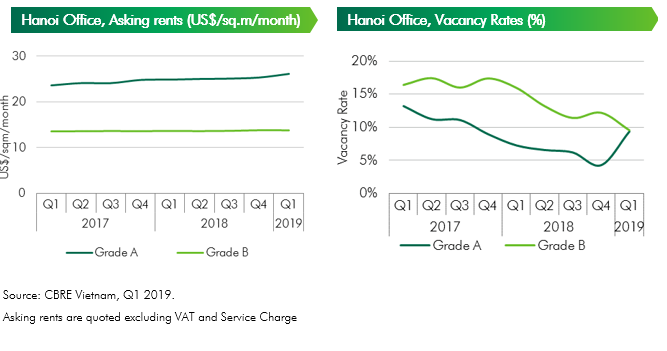

During the review period, Hanoi office market still saw relatively strong demand, primarily from local IT/Tech and flexible office providers as well as foreign insurance companies, with net absorption of 21,600 sq.m, up by 9% y-o-y. Vacancy rate for Grade A went up by 5.0 percentage point (ppts) compared to the previous quarter due to new supply, staying at 9.4%, while that of Grade B went down by 2.6 ppts q-o-q, reaching 9.6% - the lowest level over the past three years.

Asking rents of Grade A buildings in this quarter posted an increase of 3.2% q-o-q, achieving US$26.2/sq.m/month (exclusive of VAT and service charge). Grade B buildings, on the other hand, saw rental rates to remain at a level similar to the previous quarter of US$13.8/sq.m/month.

From 2019 onwards, tenants will have even more options to consider given a quickly increasing volume of office supply to be introduced from both Grade A and B. Approximately 138,000 sq.m is expected to come on stream throughout 2019. It is also worth noting that about 62% of this expected supply is in the West submarket, which continues to strengthen its position as the largest office supply hub of Hanoi.

Locations such as Midtown and West submarkets will continue to appear in the prioritized option lists of IT firms and Insurance/Bank branches. Meanwhile, MNCs, Embassies and Financial sector companies will have new options in the CBD for their expansion or relocation plans. In terms of demand, on the back of strong economic fundamentals, the financial and IT/Tech sectors remain in good shapes and stable demand drivers. Besides, CBRE forecasts that the flexible space providers will continue to be a major source of leasing demand in 2019 given the increasing needs of improving space efficiency of corporate clients.