Hanoi retail market is a rich but not yet fully exploited segment. (Photo: Shutterstock)

In Q1/2019, Vietnam maintained stable economic growth. GDP growth was 6.8%, mainly contributed by manufacturing and processing. Retail sales strongly grew, especially in Feb, whilst high tourist arrivals in Q1/2019 supported the services sector and consumer spending. CPI is below three percent. Export momentum continued with overUS$58.5 billion, increasing 5% YoY. The US is the largest market at US$13 billion exports, followed by the EU with US$10.2 billion.

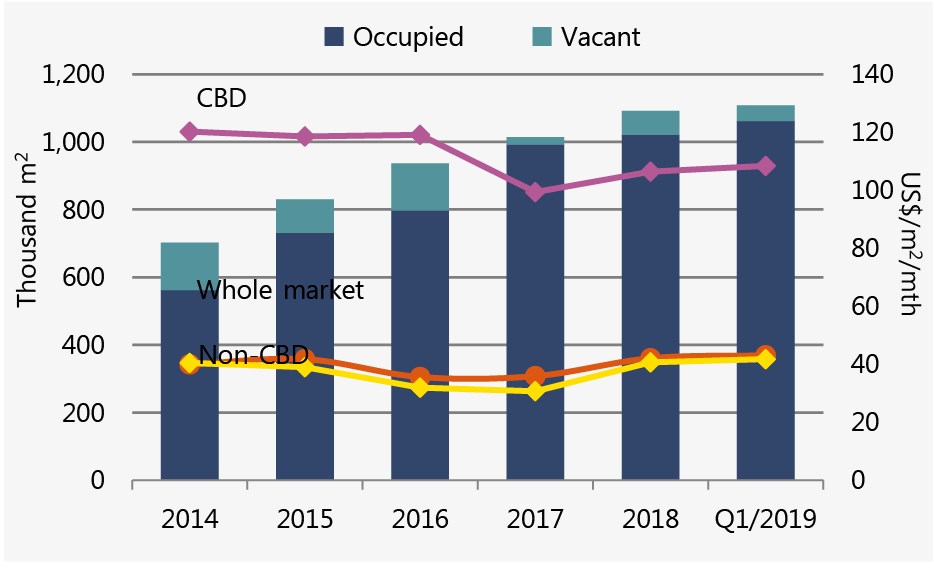

According to Savills market report, first quarter total supply was roughly 1.4 million square meters, an 1 per cent increase QoQ and 7 per cent YoY. Average rent was US $43 per sqmt per month, an impressive rise of 20 per cent compared to the same period last year. Lastly, occupancy rate saw a 2 ppts hike to a pleasing figure of 96 per cent.

Supply increased in the Secondary area. Shopping centres had highest occupancy increase, the largest rent rise was in retail podiums.

Future supply is mostly in the West. Although spaces in CBD are decisive to Hanoi retail market and can make it much more diversified and in demand, no new supply in the CBD and East is expected for the next two years.

“Global luxury brands have shown interest in Ha Noi; however, the market has yet to offer quality retail space matching tenants’ requirements”, said Mrs. Hoang Dieu Trang, Senior Manager, Commercial Leasing at Savills Vietnam.

Hanoi retail market performance in Q1/2019. (Source: Savills Research & Consultancy)

Vibrant Retail Podium Performance

Total stock was approximately 1.4 million m2 with the addition of 16,000 m2 from one project in the Secondary area, accounting for 46% market share. Average ground floor gross rent grew 2% QoQ and 20% YoY, whilst occupancy was slightly up 2 ppts QoQ but down -1 ppts YoY. Retail podiums in fast growing residential areas have performed well with high occupancy rate, which lead to a rising development trend of shophouse podiums.

Increasingly Diversified Tenant Mix

Many projects have transformed into community hubs, lifestyle centres and entertainment complexes. Entertainment providers have expanded rapidly to attract a wider demographic. Typical retail services such as spas, fitness centres, education centres and art galleries have been incorporated into many malls. The recalibration of F&B, fashion, furniture, electronics, and entertainment and non-retail offerings enhances mall traffic and will lead to higher sales.

E-commerce Continues to Rise

Consumer lifestyles are rapidly evolving, requiring retailers to invest in innovation to keep up with emerging trends. Retailers are expanding their social media presence to better engage shoppers. Robust growth of e-commerce is expected to continue, key players in Viet Nam are Chinese conglomerates. For 2019, Ha Noi targets e-commerce sales to comprise 9% of the total retail sales and e-business index to keep second rank nationwide. The city also expects that the population participating in online shopping would account for 68% of internet users, 85% of retailers and 25% gas stations would accept non-cash payment, and 95% of enterprises would have official websites.

Positive Outlook for Large-scale Projects

Until 2020, 22 projects with approximately 364,000 m2 will enter. Retail projects within residential complexes are expected to grow. Large-scale and professionally developed projects such as Lotte Mall and Aeon Mall Ha Dong are highly anticipated for their great impacts on the surrounding areas. Long-term economic prospects remain positive with strong consumer confidence, high GDP growth and an expanding middle class. With an improved trading landscape, the number of foreign retailers planning entry is anticipated to increase.