Since January 2017, this is the third time that Hanoi has taken the number one spot globally in terms of Grade A office yield in central core area, with 8.57% yield rate.

Noteworthy, the same report by Savills in 2017 showed the second position of Ho Chi Minh City. However, most recent statistics revealed a fall of yield rate from 7.39% to 7.36%, which lowered this city to 4th place.

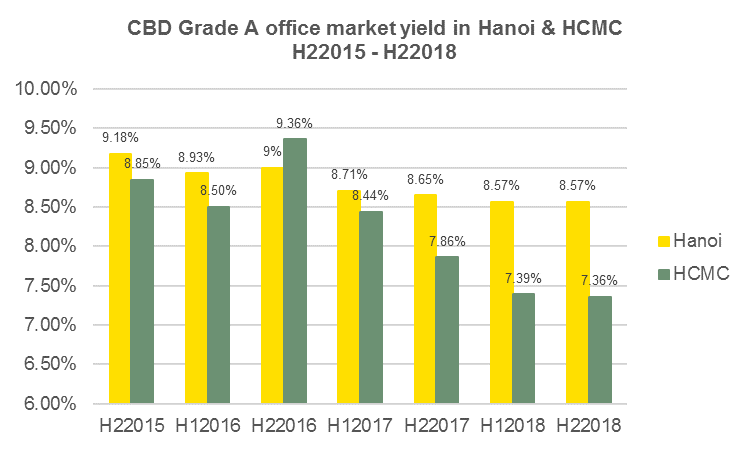

Statistics of Grade A office yields in Hanoi and Ho Chi Minh City from 2015 to 2018.

Evaluating the investment prospects of cities in Vietnam, Ms. Hoang Nguyet Minh, investment manager of Savills Hanoi said: “High yield rate indicates an interesting correlation level between profit from premise leasing and capitalized value of office building. So the fact that Hanoi and Ho Chi Minh City are having the world’s highest yield shows very positive prospects of office rental rate as well as leasing capacity in the two markets”.

The past 5 years have witnessed quite a flourishing operation situation for Ho Chi Minh City with average rent increasing 8% year-on-year and the leasing capacity reaching 97%. Meanwhile, the increasing level of rental rate in Hanoi was 3% yearly in the fourth quarter of 2018 with a stable leasing capacity of 95%. Grade A office segment in non-central area has also had an improved operation situation.

“It is understandable when these two markets have been captivating attentions of foreign investors, especially those from Singapore, Japan and Korea. The number of transactions made in 2018 was very limited despite high demands. This is due to the restrictions on the number of projects for sale”, Ms. Hoang Nguyet Minh shared.

Office is the largest capital-attracting segment with a total investment of about 340 billion USD worldwide during the second half of 2017 to the second half of 2018.

According to Savills Research Consultancy, previous global office yield publications noted a downward trend in yields of both Hanoi and Ho Chi Minh City from 2015 to 2018.

“This tendency is due to the limited supply of office space, leading to competition on project purchase prices between investors that pushes down market yields.. The office market in Vietnam is currently in the hand of sellers. In other words, if you own an office real estate project, this is a golden opportunity to sell it”, Ms. Minh added.

Savills also pointed out the fact that not only in Vietnam, but worldwide in the past 5 years, real estate has really become a preferred investment channel, especially in the office segment.

In fact, numbers provided by Savills global research team have proved that office is the largest capital-attracting segment in the world, with a total investment of up to 340 billion USD in only one year from the second half of 2017 to the second half of 2018.