The hotel market in HCMC is expecting entrances from prestigious brands targeting high-spending guests, which will intensify competition in the 5-star segment.

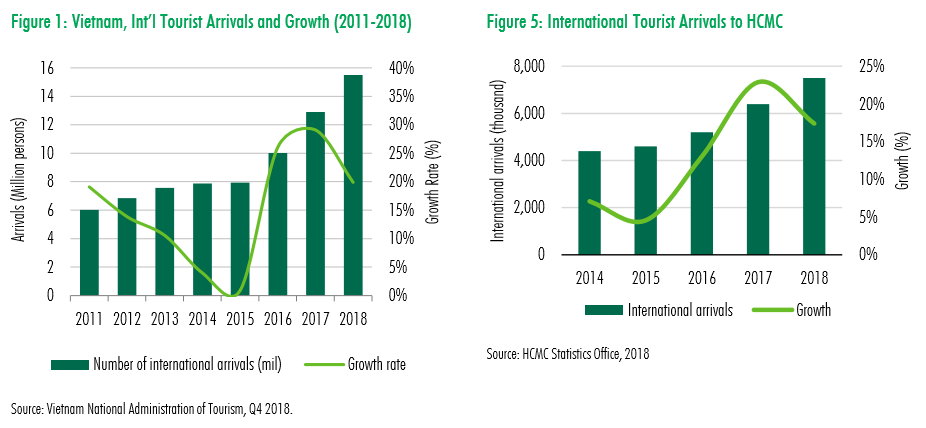

The number of international tourist arrivals to Vietnam in 2018 reached 15.5 million, an increase of 19.9% y-o-y - among the highest in Asia. The volume continued to be dominated by tourists from China and Korea, whilst Korea, Hong Kong and China are the highest growth source markets at 44%, 30% and 24% y-o-y, respectively. In 2018, the government extended its visa exemption policy for five European countries for another 3 years, in an effort to diversify foreign source markets. On the other hand, the number of domestic tourists in 2018 was recorded at 80 million, showing a moderate increase of 9%.

Vietnam’s hotel sector has greatly benefited from such positive developments in the tourism industry. Significant pipelines of hotels under construction across major destinations will present new options to tourists, while posing competition concerns to existing hotels.

Wave of new supply in 2019 and beyond

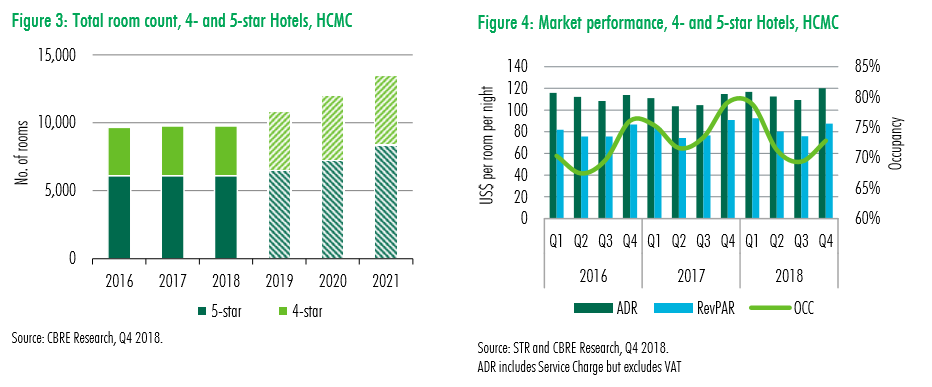

During 2018, the number of 4-5 star hotels in HCMC was stable at 45 properties, with 9,775 room count. Considering the fact that several hotels were going through interior renovation, supply level actually had a contraction in 2018.

However, with 6 properties in the pipeline, 2019 is going to mark an exciting year for the hotel market in HCMC with many firsts. Vinpearl Luxury Landmark 81, the hotel component of Vietnam’s tallest building, will be the first 5-star hotel in Binh Thanh District, and the first foray of the Vinpearl brand into HCMC. Melia Hotels chain is also looking to roll out the first Innside-branded property in Vietnam, which is located on Ton That Dam street, while IHG is going to open the first Holiday Inn in Vietnam in Tan Binh District. Lodgis, a major hotelier, is about to launch its new inner-city concept called Fusion Original, whose first property will be inspired by the scientist Darwin.

Looking beyond 2019, the market is also having a strong pipeline, with supply level expected to grow at a CAGR of 11% in the next three years.

Room rates and occupancy remained at healthy levels

Average ADR in 2018 reached US$115, an increase of 5.7% y-o-y whereas occupancy averaged 73.1%, 1.8 ppts lower than the previous year’s. The slight decrease in occupancy of 4- and 5-star hotel segment in HCMC could be attributed to the lack of large scale events comparable to APEC 2017, and the increasing availability of non-hotel accommodation options.

Average RevPAR in 2018 was recorded at US$84, a y-o-y increase of 3.2%. Hotels that are managed by professional operators witnessed the strongest performance improvement in 2018.

Market performance is expected to come under pressure in 2019 given the strong influx of new supply, yet the continued growth of tourist arrivals may help to balance out.

Continued strong growth of tourist arrivals

In 2018, HCMC recorded a total of 7.5 million international arrivals (an increase of 17.4% y-oy) and 29 million domestic arrivals (an increase of 16.1% y-o-y). Major international source markets continued to be Northeast Asian countries (China, Korea, Japan, Taiwan) and the U.S. Tourism growth for Vietnam in general, and HCMC in particular, is expected to continue for the foreseeable future, supported by the rapid growth of local low-cost carriers, Vietnam’s continued easing of visa requirements and strong appetite for outbound travel from Asian countries.

For 2019, HCMC Department of Tourism targets to reach 8.5 million international arrivals (y-o-y increase of 13%) and 32.8 million domestic arrivals (y-o-y increase of 13%). In Q1 2019, HCMC tourism authorities organized many tourism promotion activities in Western Europe in order to entice more tourists from this area.

Strong investment interests, yet limited operating stocks for sale

As Vietnam’s economy and its tourism industry are still uptrending, core hotel assets in gateway cities such as HCMC or Hanoi are highly sought after by institutional investors. In HCMC in particular, there is strong interest in hotel properties located in District 1 - the main tourist district - however, there are limited available stocks. In 2018, only one hotel transaction was recorded, which is the purchase of the boutique Tajmasago Castle (located in Phu My Hung, District 7) by Chloe Hospitality from Khaisilk. [1]

As the hotel business is very capital- and expertise-intensive, future hotel development landscape is expected to be strongly influenced by pioneering development platforms formed through joint venture such as Lodgis and Indochina Kajima, which can leverage economies of scale.

Outlook remains upbeat

In the mid-term, the hotel market in HCMC is expecting entrances from prestigious brands targeting high-spending guests such as Mandarin Oriental, Ritz-Carlton, Okura Prestige, Hotel Indigo and Hilton, which will intensify competition in the 5-star segment, but at the same time help to bring the market in general to a new level. On the other hand, the market will also witness introduction of new urban concepts such as Fusion Original (by Lodgis), Sage (by Next Story Group) and Wink (by Indochina Kajima), which aim to meet diversifying needs of modern tourists, especially the millennial population.

Announcements of future hotel openings in decentralized areas such as Holiday Inn Saigon Hitech Park (District 9) or Movenpick Kenton Node Hotel (Nha Be District) are early signs of decentralization trend in HCMC hotel market. With Metro Line No. 1 expected to be running from 2021, connectivity between CBD and the East of HCMC will be significantly enhanced, which presents opportunities for hotel development in the East. Thu Thiem area, zoned to be HCMC’s future CBD, is expected to be a development hotspot for hotels in the coming years.

Along with future supply coming up from 2019 – 2021, as well as competition from channels like Airbnb and Luxstay (which are getting their supply from a significant influx of high-end condominiums), 4-star hotels are expected to face more pressure in the future. Those who can successfully create a unique offering, however, will continue to stay ahead of the competition.

Enhanced connectivity to Vietnam's various destinations▪ Cam Ranh International Terminal was opened in Jun 2018, expected to bring the Nha Trang Cam Ranh market to new heights. ▪ Van Don International Airport (first privately-run airport in Vietnam), Ha Long - Hai Phong Expressway and Ha Long - Van Don Highway were inaugurated in 2018, opening many new opportunities for Quang Ninh market. ▪ Bamboo Airways was launched in Jan 2019, becoming the third budget airline in Vietnam, mainly serving destinations of interest to its parent company FLC Group. ▪ In Dec 2018, AirAsia announced plan to open another budget airline in Vietnam in partnership with a local company. ▪ Vietnam Airlines is expected to open the first direct flight connecting Vietnam and the U.S. by end of 2019 or early 2020. |