HCMC Landed Property

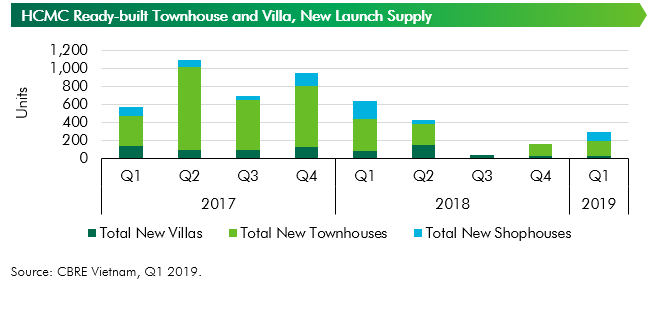

The shortage of new supply in ready-built townhouse and villa market in HCMC continued in Q1 2019. In the first three months of the year, HCMC’s landed property market welcomed 296 new units (28 villas, 167 townhouses and 101 shophouses) from three projects: Pier IX (District 12); Senturia South Saigon (Binh Chanh District) and CityLand Park Hills - Phase 5 (Go Vap District). Pier IX and Senturia South Saigon are new projects which launched their first phase. Total new supply in Q1 2019 increased by 83% q-o-q but only equivalent to 42% of new launch in Q1 2018.

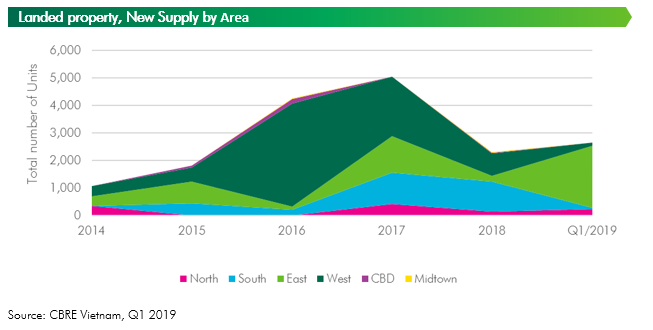

The cumulative supply’s growth rate as of Q1 2019 was only about 2%. While the growth of market scale in HCMC is declining strongly, the market in bordering areas of HCMC are attracting attention from buyers and real estate developers with relatively cheaper selling price and larger supply. Local land fever at the beginning of the year in some areas of Dong Nai such as Nhon Trach, Long Thanh; or District 9, District 12, Binh Chanh District of HCMC has revealed a shift in the market focus to sub-urban and bordering areas more clearly. In Q1 2019, new launched projects in sub-urban areas of HCMC such as Binh Chanh District and District 12 have quoted higher selling price than their market average.

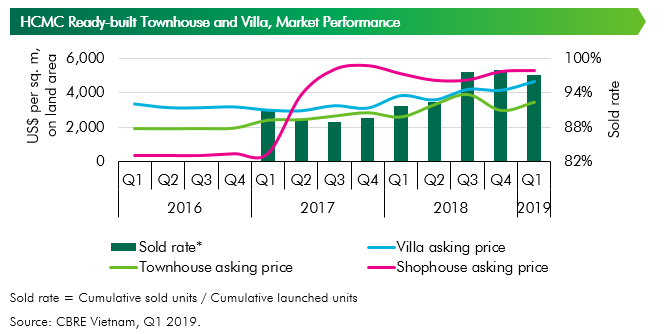

Due to the impact of the delay in licensing process of new projects and the decreasing clean land bank in HCMC, developers concentrate on product with high value. In Q1 2019, shophouses accounted for 34% of the total new supply and continued to have very high prices, such as CityLand Park Hills (Go Vap District) offering this product at US$10,670 per sq. m land. Absorption rate of newly launched projects in Q1 2019 was 84% of total newly launched units. In general, accumulated sold rate (Cumulative sold units / Cumulative launched units) was 96% in Q1 2019. Decreasing inventory together with limited new supply are leading to active secondary market.

Specifically, asking price of ready-built villa and townhouse in Q1 2019 went up by 12% q-o-q and 16% q-o-q respectively whereas shophouse’s asking price slightly increased (1% q-o-q). If there is no positive changes in the licensing process, the cumulative supply growth of the market in 2019 will remain low (below 5% per quarter). The shortage of new supply in primary market will keep sold rate at a high level (over 80%) and primary asking price is expected to increase by 4%-5% after each launching period.

In general, the market of ready-built townhouses and villas of HCMC is shifting its focus to the sub-urban and bordering areas of HCMC, including Dong Nai, Binh Duong and Long An province. Positive updates on infrastructure projects connecting HCMC with neighbouring provinces are the main factors for price increase in these areas. Competitive selling price and diversified products are key advantages for these emerging markets.

Hanoi Landed property

Q1 2019, contrary to the previous quarters, witnessed the increasing excitement of the landed property market in Hanoi with the introduction of five new projects. A total of 2,641 newly launched units were recorded, the highest level of new supply by quarter during the last three years.

In terms of location, the market has been expanding further from traditional areas. While the West still accounts for the largest proportion of total supply, we are observing the formation of residential areas in suburban districts, especially in the East and the South. 86% of the new supply in the first quarter of 2019 is located in the East, while the West provides just a minimal proportion of 3.7%.

Impressive sales performance is achieved during the reviewed quarter despite the massive stock of new launches, which indicates the improving market sentiments for landed residential properties in Hanoi. Approximately 2,128 units were sold during the first quarter of 2019, an increase of 45% q-o-q.

In terms of market performance, secondary prices for villas in Q1 2019 averaged US$3,924 per sqm, with VAT and construction costs all included. This figure posted an increase of almost 3% comparing to the preceding quarter, and a moderate rise of 2% y-o-y.

In line with the geographical diversification in the supply of Hanoi landed property, notable changes regarding villa secondary prices in emerging locations such as Ha Dong, Gia Lam, Hoai Duc and Long Bien were observed. Prices in such areas are seen to be following an upward trend given the entering of well-known developers with high-quality, comprehensive projects and the improvement of surrounding infrastructure.

The recent establishment of many well developed large-scale projects have further intensified the competition within the supply of landed property in Hanoi. Looking into 2019, high quality products, consistent management and reputable developers will remain key factors affecting both end-user buyers and investors. 2019 is also set to welcome a great volume of new supply in the landed residential market with many following phases of previously launched projects are expected to come onboard.