The year of 2019 has been a good year for Vietnam’s industrial park industry, as leasing demand remained strong on the back of robust inflows of foreign investment capital, according to Viet Dragon Securities Company (VDSC).

Foreign direct investment (FDI) commitments in the January – October period totaled US$29.11 billion, up 4.3% year-on-year, while disbursement of foreign-invested projects in Vietnam totaled US$16.21 billion during the period, representing an increase of 7.4% year-on-year, according to the Ministry of Planning and Investment.

Investors have poured money into 19 fields and sectors, in which manufacturing and processing continued to attract substantial attention with investment capital of US$18.83 billion, or 68.1% of the total registered capital, followed by real estate with US$2.98 billion or 10.2% of the total, and retail and wholesale, science and technologies.

In the North, Bac Ninh and Hai Phong are bright spots for attracting FDI while Dong Nai and Binh Duong play a key roles in the South. During the first nine months of 2019, industrial park companies achieved impressive business results, especially developers who own large-scale land banks for lease, stated VDSC’s report.

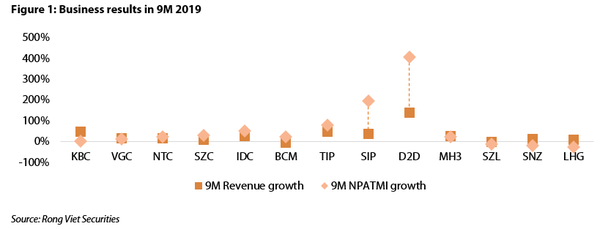

According to VDSC, revenue and net profit after tax and minority interests (NPATMI) have been clearly differentiated among some industrial park players. In the January – September period, the growth in the sector was dominant by smaller-scale developers in the South, likes Tin Nghia Industrial Park Development (TIP), Industrial Urban Development No.2 (D2D), and Saigon VRG Investment (SIP). However, growth drivers did not come from leasing activities for this group.

Some players even suffered negative earnings growth like Sonadezi Long Thanh (SZL), Sonadezi Corporation (SNZ), and Long Hau Corporation (LHG), due to decreases in respective core businesses.

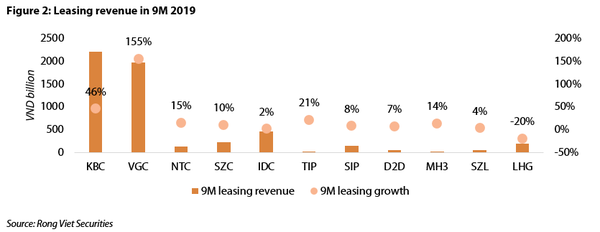

All southern smaller-scale group, including D2D, SZL and TIP had almost no room left for lease, while a major part of LHG’s earnings came from re-leasing activities.

Meanwhile, Kinh Bac City Development (KBC) and Viglacera (VGC) achieved the best performance in core businesses during the first nine months of 2019, in which KBC had a 46% hike in leasing sales while VGC got 151 hectares leased out, up 155% compared to the same period of 2018.

As of present, both KBC and VGC have huge leasable land banks at 953 hectares and 1,182 hectares, respectively, which are located in favorable standings, mostly in Bac Ninh province and Hai Phong city in the North.

Similarly in the South, Investment and Industrial Development (BCM) and Phuoc Hoa Rubber (PHR) own enormous area of industrial land with more than 1,000 hectares each and located in Binh Duong province.

In addition, Nam Tan Uyen (NTC) and LHG are expected to put into operation new industrial parks in the name of NTU3 and LH3 in the next period, respectively, which should boost growth in revenue. Sonadezi Chau Duc (SZC) also owns huge land bank available for lease in Vung Tau province, with leasing revenue in the third quarter increased by 30% year-on-year, thanks to its core business.

Besides leasing activities, some players also have plans to utilize the residential areas next to the industrial zone. This is considered a short-term catalyst for growth for these developers, especially small-scale firms.