Launches scarce in Saigon’s landed-property market

In the third quarter of 2019, 220 dwellings entered, down 65 per cent from the previous quarter and 62 per cent from the previous year, the lowest in the last four years. Limited land bank and tightened administrative procedures affected the launch of primary stock.

“Strong land price escalation has narrowed options for investors while limited supply within HCMC has benefited outer areas with a large amount of new supply on offer.” – Phan Thuy Hoang Kim, Marketing and Business Development Manager, Residential Sales

The Ho Chi Minh City Department of Planning and Architecture has submitted a proposal to further tighten land management to restrict speculation in the land plot segment. This proposal will improve the current Decision No. 60/2017/QD-UBND, which stipulates a minimum area for separate land plots; more launches will be affected in the short term.

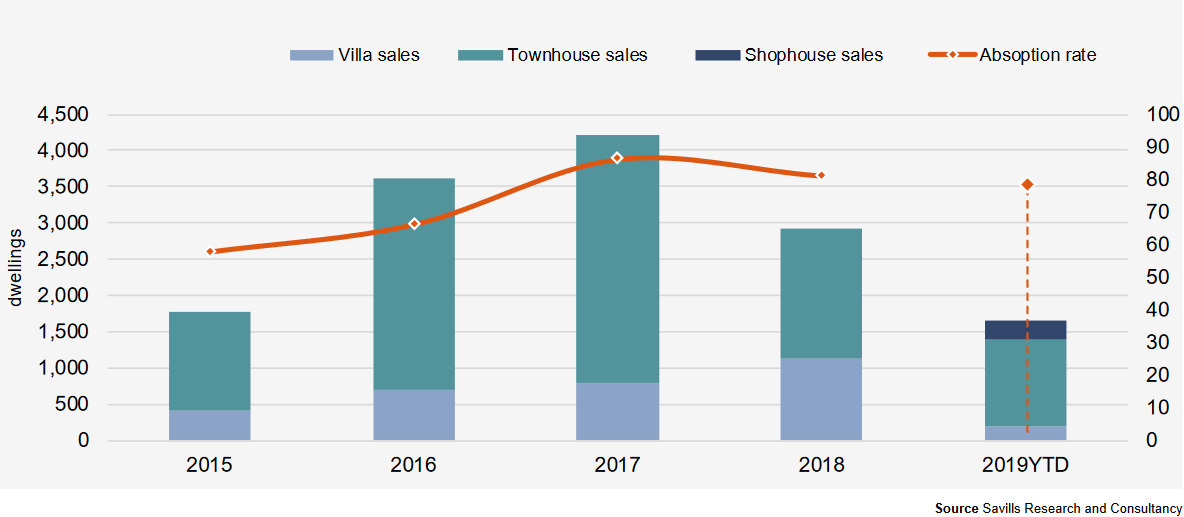

In the first nine months of 2019, there were nearly 400 villa/townhouse transactions, dropping 41 per cent over the last quarter. Absorption was 47 per cent, decreasing 5 percentage points compared to the last quarter. The lack of new supply and high-priced inventory limited choice. Over 75 per cent of primary supply was priced at over US$300,000 per dwellings. The majority of active projects had stable primary prices; several projects in prime locations with good construction status increased by over 10 per cent compared to the same period last year.

Land plots had strong sales and absorption, prices continued to increase in suburban areas such as Cu Chi, Binh Chanh and Nha Be.

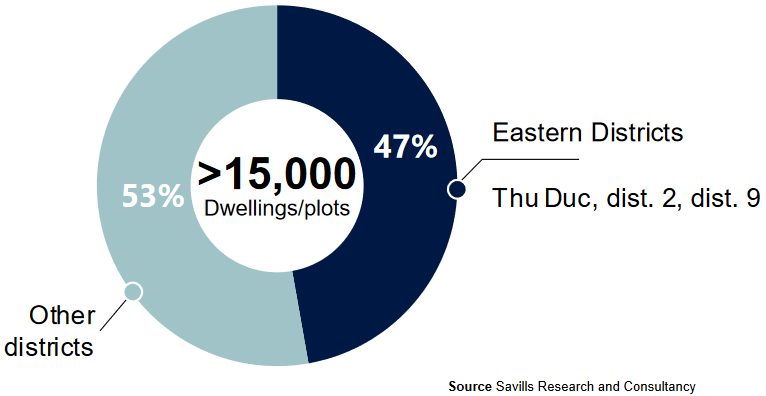

The Eastern area will continue to drive the market, with a good land bank, local investment and key infrastructure development. Notable infrastructure includes Metro Line 1, Ring Road 3, Hanoi Highway expansion and connecting bridges. The Eastern area accounted for 62 per cent of sales this quarter; over 7,000 dwellings/plots will enter till 2022, accounting for 47 per cent of future supply.

Until 2022, 15,000 dwellings/plots will come online. Future supply is mainly located in suburban areas and developed in new large-scale townships. Local developers will continue to be the key players in the landed property market.

Hanoi’s villa and townhouse new supply dropped

Following a boom of supply in the second quarter of 2019, there were only two newly launched projects the third quarter, providing 70 dwellings, down 95 per cent from the previous quarter and 72 per cent from the previous year. This quarter usually has the lowest launches due to ‘Ghost Month’ (lunar July) and the ‘third quarter effect’. Gia Lam continued to lead the primary supply with a 20 per cent share.

Performance decreased with 520 sales, down 76 per cent compared to the last quarter and 33 per cent to the last year. The market has a promising outlook with quarterly absorption of 41 per cent, up 10 percentage points over the last year. Most projects from reputable developers providing well-designed products and high-quality facilities. The best performing districts were Gia Lam and Long Bien, accounting for over 50 per cent of transactions this quarter.

“The Eastern area dominated sales, driven by improved infrastructure and a nearer CBD location compared to the more developed Western market.”

The slight change in primary prices came from the shift in the allocation of primary supply from active projects. Remaining supply from active projects with higher than average prices increased the overall market price. Average secondary prices were stable, up 0.5 per cent over the previous quarter for villas, 2.4 per cent for townhouses, and 3.2 per cent over the last quarter for shophouses.

In the nine months of 2019, there were 6,000 newly established real estate enterprises, up 5.8 per cent compared to the same period last year. From the forth quarter of 2019 onwards, over 130 villa/townhouse projects across 18 districts will enter. Future supply will mainly be outside of Hanoi’s centre.