Buyers sentiment improve in Hanoi apartment market, excluding high-end

The market witnessed a healthy revival with sales outstrip launches during 3Q19. Sales volumes grew up by 67% q-o-q, driven by sturdy end-user demand as a result of favourable buying conditions. Smaller, cheaper units continued to destock at the fastest pace. Other key factors affecting sales included proximity to existing or upcoming infrastructure and attractive amenities. In terms of location, East suburb drove the growth in offtake of units, as sales recorded four-fold increase compared to 2Q19.

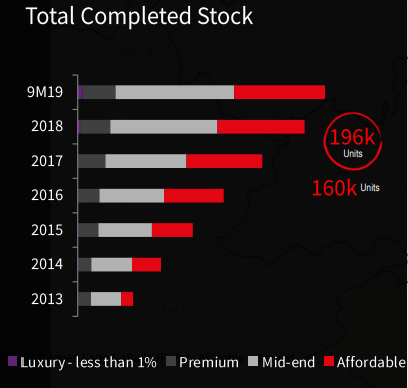

Supply of apartment in Hanoi in the first three quarters (3Q) this year reached 267,800 units, a record high compared to 196,000 in the previous period, JLL has said in a latest report. Total supply in 3Q/2019 rose 36.63% compared to that in the first nine months 2018 and 67.37% compared to that in 3Q/2017. The supply was resulted from strong new completions which hit more than 36,000 units in a number of projects launched in the previous years.

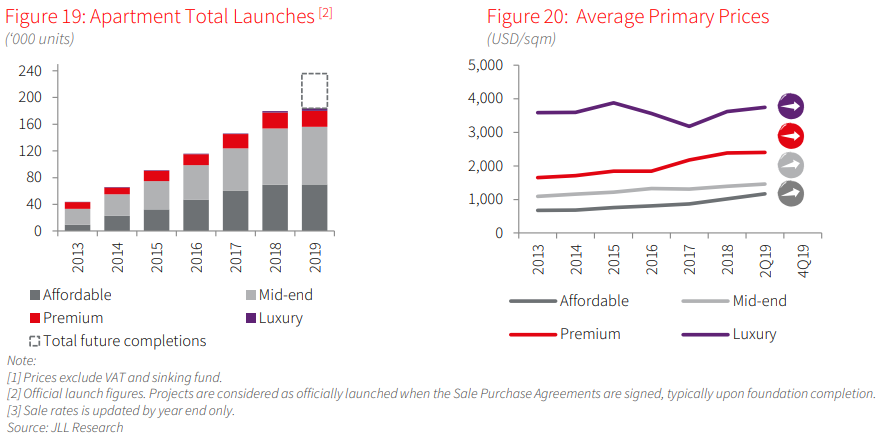

Between January and September, new launches were only 6,400 units, falling 22% from the same period last year, improved 8.7% q-o-q. In total, only 4 projects with total of 850 units were newly released in the quarter. More than 70% of the new launches came from Vinhomes Ocean Park in Gia Lam District and Vinhomes Smart City in Nam Tu Liem District. In Premium segment, supply remained limited in 3Q19 with only one new project in Tay Ho District, launching 32 units. No new luxury unit entered the primary market in the quarter. Of the total, mid-end segment accounted for the large part, followed by affordable housing and premium apartments. Luxury units were recently found with the ratio of less than 1% out of the total stocks.

In terms of sales, the number of sold units was 9,346, down 10% on year, the report showed, adding that the East suburb witnessed significant demand growth. The majority of demand for apartments came from end-users thanks to favorable buying conditions, improved infrastructure and attractive amenities, JLL said in the report.

The average primary price increased by 6.5% y-o-y to US$1,473 per sqm during the nine-month period, up 3.5% q-o-q and the increasing trend has maintained in recent quarters. Meanwhile, chain-linked price slightly increased 0.8% q-o-q, partially because developers focused on clearing their unsold stock, of that most have less favorable unit sizes or less desired views. Regarding secondary market, Luxury units boasted strongest growth with resale price up 2.4% q-o-q, in view of prime locations and high-quality projects.

By the end of this year, the total supply is likely to climb to 10,789 units, surging 35% on year. The future launches will mainly come from existing projects, including those developed by BRG Group and Vingroup which are known to have upcoming suburban projects in the pipeline. Several new projects with more than 1,000 units are anticipated to enter the sales market over the next quarter.

Going forward, JLL forecast the prices will be stable for the remainder of the year thanks to upbeat sentiment from buyers. For that reason, developers will focus on quality over quantity of new launches to ensure good sales. Approximately 93% of 23,100 residential units from the scheduled completions in 2H19 are already sold out, underpinned by upbeat sentiment from buyers. Price growth across the apartment market is set to stabilize over the remainder of 2019.

In short, developers will expand out into suburban areas due to limited developable land in the inner city.

Ho Chi Minh City’s apartment prices continue to reach a new high

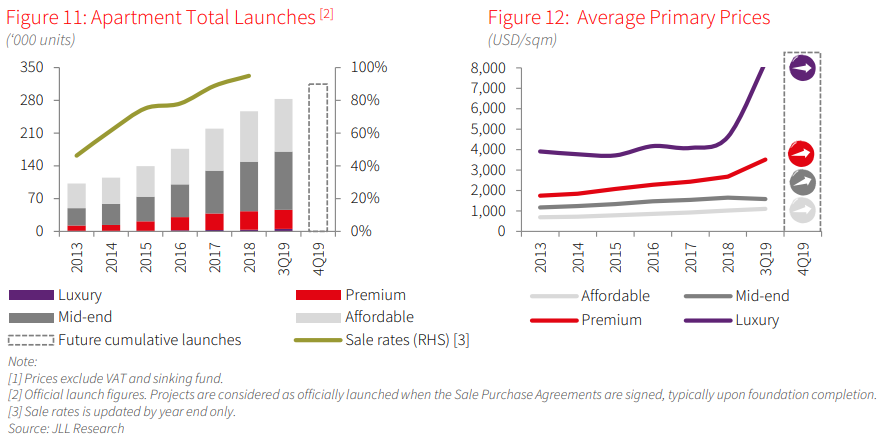

Sales totalled 17,248 units in 3Q19, from 14 projects. Meanwhile, large-scale Vinhomes Grand Park project contributed more than 60% of taken units. This large-scale mid-end project has started soft launch since end- 2017 and has been pushed forward with good sale strategy. This led to a good sale rate recorded with more than 10,000 units sold when the project was considered officially launched in 3Q19. Mid-end projects with a launching price of USD 1,200-USD 1,700 per sqm remained the top performers. Investors, the main demand source for high-end apartment, started to shift their investment to villas/townhouses to enjoy a better capital gain, given the same investment amount.

Official launches reached more than 17,000 units with a predominant contribution from the Rainbow phase of Vinhomes Grand Park project (more than 10,000 units). It should be noted that this project has been put on the market (under soft launch) two years before its official launch. Apart from this short-term factor, the market generally witness limited supply due to the continued prolonged approval process experienced recently.

The average price rose 23.8% y-o-y to USD 2,067 per sqm. High-end apartment reached a new high, at USD 5,320 per sqm, an increase of 64.9% y-o-y, driven by new high price level in new launches paired with currently restricted supply on the market. On a project basis, the primary price grew by 20.6% y-o-y on average, driven by high-end segment. The chain-linked growth in high-end apartments was 34.7% y-o-y, while that in low-end segment was 16% y-o-y.

About 6,000 units expected to be official launched during 4Q19, taking the total 2019 new launches to 31,000 units. Because of the government’s tight control in granting land use rights and construction licences, the projected supply pipeline in 2020 is subject to greater uncertainty and varies between 40,000 and 50,000 units.

Demand remains high and price growth is mostly positive in low-priced sectors. Meanwhile, high-end apartment expected to witness a slow down in demand, especially investment demand, as selling price reach a new high level making the investment in high-end apartment less attractive.