Strong surge in the number of newly registered enterprises

In 1H19, roughly 67,000 enterprises were newly established, according to market research firm JLL. The registered capital hit a new level at VND 12.8 billion per newly established enterprise, up 27.7%. During 1H19, there were 4,000 new businesses registered in the real estate sector, growing 22.2% y-o-y and accounting for 6% of the total newly registered enterprises.

Additionally, there were 21,800 enterprises that stopped operations and were waiting for dissolution procedures. Of these, 11,000 enterprises had their business registration certificates revoked under the 2018 data standardisation programme to eliminate businesses that have been established but no longer operate.

There were 38,500 enterprises newly established in 2Q19, up 2.0% in terms of the number of companies and 30.8% in terms of the registered capital in the same period in 2018. This factor has a direct impact on the Vietnam office market.

Ho Chi Minh City continues strong development

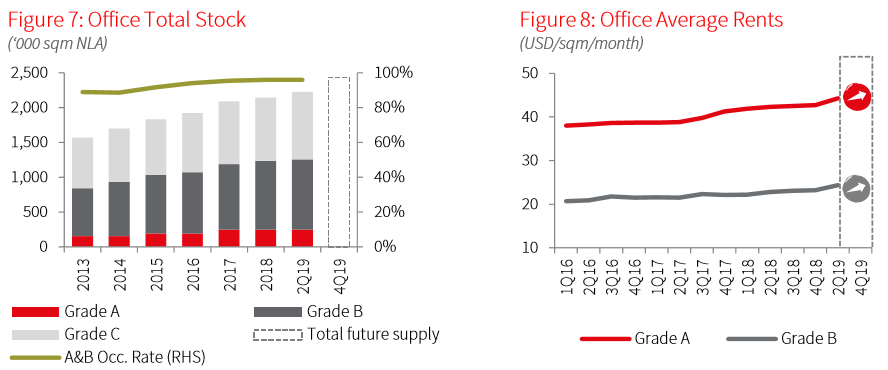

Despite a notable new supply entering the market, the occupancy rate in 2Q19 just recorded a slight decrease of 98 bps q-o-q and 67 bps y-o-y to 95.5%. This implied that demand on the market was strong and sufficient enough to absorb new supply.

In 2Q19, the HCMC office market welcomed 42,754 sqm of new supply from seven Grade B&C buildings, bringing the total HCMC office stock to 2,231,000 sqm (including Grade A, B and C). While the non-CBD sub-market has continuously recorded new supply since end-2018, the supply of Grade A and Grade B in the CBD remained restricted with no new supply recorded in seven consecutive quarters. Deutsches Haus Ho Chi Minh City is the newest building in the CBD, completed in 4Q17.

Deutsches Haus Ho Chi Minh City.

Grade A and Grade B average rents continued to rise in 2Q19, to USD 28.5 per sqm per month, up 2.5% q-o-q and 5.2% y-o-y. After a period of steady growth, Grade A rent in 2Q19 rose at a slower pace, at 1.2% q-o-q. Meanwhile, the average rent of Grade B sharply increased by 3.5% y-o-y, mainly driven by the acceleration in CBD rents.

In 2H19, the market is expected to welcome a wave of new completions, which may result in a decrease in overall occupancy rate. Flexible space is expanding, concentrating in citywide office clusters.

In the short term, demand is set to pick up on the back of positive economic prospects. However, the prevailing global economic uncertainty may compress office demand. Besides, the enriched new supply coming on stream in the next three years will put some pressure on the performance of the existing supply. Accordingly, developers should be flexible in leasing strategy to capitalise on the market.

Green and sustainable office concepts are making way to becoming an inevitable trend of future completions.

(Photo: JLL Research)

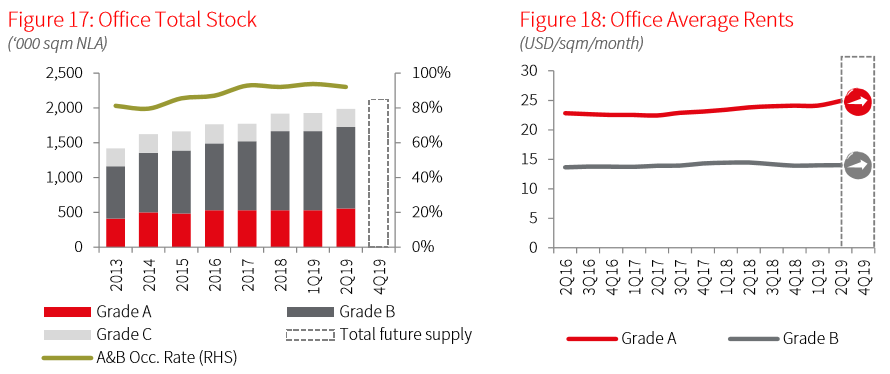

Hanoi office market maintains healthy growth

The occupancy rate of the Hanoi office market fell slightly to 92.3% due to new opening buildings entering the market. During 2019, 21,500 sqm of office space was newly absorbed, with nearly two-thirds credited to Grade B office square. Leasing activity was mainly involved in Grade B buildings, especially those in the outer parts of the city, owing to insufficient supply in the CBD area. One of the most notable deals was recorded in Truong Thinh Building in Cau Giay, an outskirt district, with 1,100 sqm taken up by a single tenant.

(Photo: JLL Research)

A new Grade A building in the CBD, Thai Holding Tower in Hoan Kiem (25,000 sqm), came on stream in 2Q19, the first Grade A building to complete since 2016 in the Hanoi office market. Additionally, following two quarters with no new supply, the Grade B segment recorded 30,600 sqm newly added to the basket, the majority located in the non-CBD area. At end-2Q19, the total supply of Hanoi office space stood at approximately 1,986,000 sqm, with Grade B contributing up to 60% of the total stock.

Thanks to stable demand, paired with limited supply, Grade A office space enjoyed the highest upswing with a growth of 4.1% q-o-q and 5.7% y-o-y. However, the rent contraction in the Grade B segment of 2.8%, a result of lower-than-average rent in new buildings in non-CBD, that offset the increase in Grade A segment and kept the overall market rent unchanged on yearly basis. In the CBD area, owing to limited supply, average rent in the sub-area recorded significant improvement of 3.9% q-o-q and 3.5 % y-o-y.

TNR Tower - one of the few Grade A buildings in Mid-town Hanoi. (Photo: Savills)

For 2H19, the office market is expecting more completions, all located in non-CBD districts. The buildings are concentrated on Cau Giay and Nam Tu Liem districts, the two rising office clusters of Hanoi. Thus, the average rents in the non-CBD area will remain stable or increase moderately. Meanwhile, the buildings in the CBD may still enjoy a better rise, which in turn continues to help the overall market rents inch up.

The uncertain global economic outlook may impact market sentiment in upcoming period.