Hanoi condo expanding to new residential areas

In the third quarter of 2019, there were nearly 6,100 units launched from 18 projects in Hanoi, down by 33 percent over the last quarter, leading to a total of 26,800 newly launched units during the first nine months of 2019, up by 37 percent compared to last year. Launched projects in this quarter are mostly located in the West of the city accounting for 77 percent of total new launched units. Noticeably, Hanoi residential market shows a clear trend of decentralization given increasing new projects launched in the farther districts such as Thanh Tri and Hoai Duc districts.

In terms of sales performance, more than 4,800 units were sold during the third quarter of 2019, down by 32 percent from the previous quarter. Although there has been a decrease in the number of sold units in this quarter, the ratio of sold units to the new launch was on par with the previous quarter showing stable market conditions.

In terms of pricing, the average primary pricing in the third quarter of 2019 has been stable in comparison with the previous quarter but recorded an increase of 3 percent compared to the same period last year, averaging at US$1,337 per square meter.

In the last quarter of 2019, it is expected that there will be approximately 7,000 units launched making the total new launch in 2019 of around 33,000 units, up by 9 percent over the previous year. New supply will mostly come from township developments such as Vinhomes Ocean Park, Vinhomes Smart City or Park City. Primary pricing is expected to experience an upward trend reach near US$1,360 per square meter on average at year-end. Providing active sales and marketing activities and improvements in product offerings, sales momentum is forecasted to maintain at a positive level achieving around 85 to 90 percent of the total new launch during the year.

HCMC new condo supply improved and expected

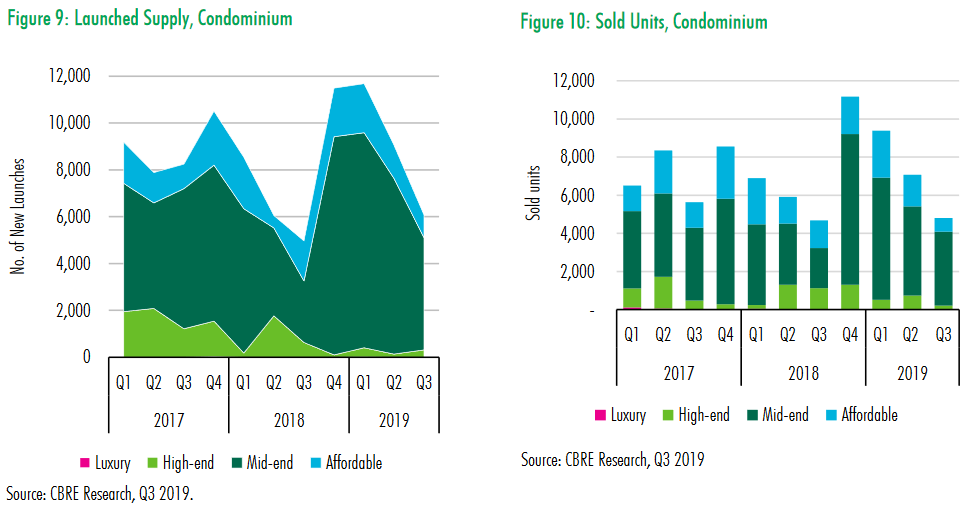

In the third quarter 2019, new launch supply in terms of unit showed a significant improvement compared to the first and second quarter. This brought the supply in the first nine months of 2019 close to the number of last year. However, new launch supply only came from ten projects, which did not show a recovery of the whole market since it was only half of last year’s (10 projects compared to 21 projects last year) due to issues from slow licensing process. There were 13,072 units launched in quarter 3 of 2019, an increase of 217 percent over the previous quarter and 107 percent over the previous year. New launch supply in the first nine months of 2019 reached 21,619 units, a decrease of 3 percent from the same period last year. Most of the new supply was launched in July and September to avoid the “ghost month” in August. New launch projects generally achieved high sold rate, even though their primary price increased over 10 percent compared to old projects in the surrounding area.

In terms of segment, mid-end segment accounted for the highest proportion of new launch units in the third quarter at 87 percent, followed by high-end at 10 percent. This proportion led to the most common selling price of around VND32-40 million per square meter which is equivalent to VND2.2-2.8 billion per two-bedroom unit. The third quarter of 2019 recorded one new launch in luxury segment which is The Crest Residence with 240 units and launching price of around US$5,500 per square meter. There is no new launch supply in the affordable segment for the last two quarters.

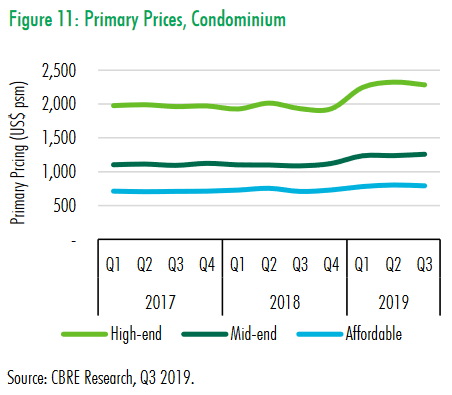

Sales momentum continued to be positive in quarter 3 of 2019 with more than 90 percent of new launch units having been absorbed. In the third quarter, there were 13,386 sold units, an increase of 191 percent compared to the last quarter and 113 percent to the same period last year. Most of the sold units in the review quarter were recorded from Vinhomes Grand Park project in District 9. This project was prepared for over a year before the first launch event with the highest number of new launch supply in one launching phase of nearly 10,000 units.

Thanks to the new wave of supply in mid-end segment, average price on the primary market was stable compared to the previous quarter and was recorded at US$1,852 per square meter, an increase of 15 over last year. Increases in primary price were observed across the market for both remaining stocks and new supply. In term of location, District 2 and District 9 recorded highest price escalation of 5 to 10 percent from the previous year.

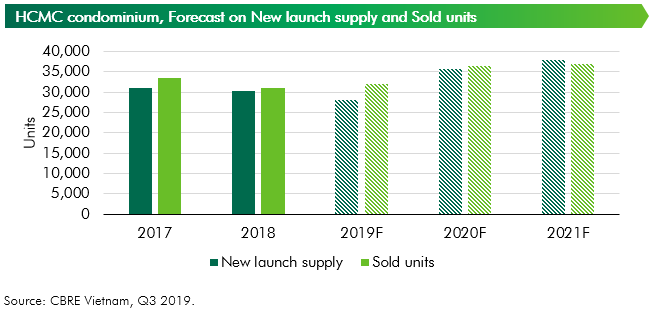

In the last quarter of 2019 and 2020, the market is expected to welcome 42,000 units from new projects in fringe districts: The West with AIO City, Akari City and D-Homme; and the South with subsequent phases of Eco Green Saigon, Sunshine City Saigon and new projects including Sunshine Diamond River, Lovera Vista.

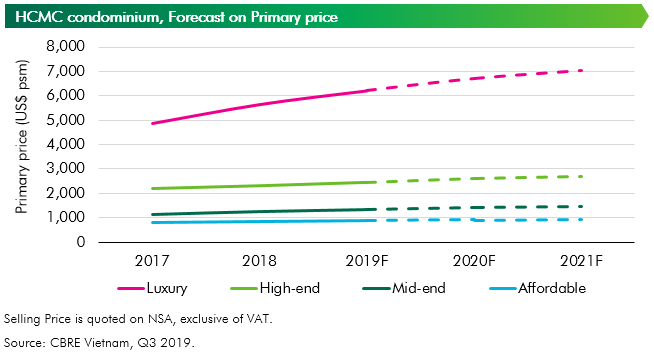

Primary prices will increase slightly thanks to the new supply. Luxury segment is expected to have price increase of 10 percent from the previous year due to limited supply. Prices for high-end and mid-end segments will increase by 6 percent and 5 percent compared to last year, respectively, due to new supply and the high price level in 2019. Affordable segment will have a modest growth of 3 percent over year.

Looking forward, Ms. Duong Thuy Dung, Senior Director of the Valuation, Research and Consulting department, notes: “Condominium market has changed significantly since 2015. These changes are important and necessary to build up a sustainable market. In 2019, government’s stricter stance toward the real estate market and credit tightening have reduced the low-quality supply and helped the market to absorb the remaining inventory. Despite of limited official launching events, developers still actively generated market interest via real estate expo, township development events, topping out ceremony in under construction projects, etc. This slow period is being utilized by developers to review and adjust their business and product plan, as well as land acquisition pipeline. With these activities, the market is expected to be more dynamic in the next few quarters.”

In addition, the remaining issues including flooding, air pollution and traffic congestion had a negative impact on living quality in big cities. As a result, new township developments in the East and the West area that offer full range of facilities and good connectivity will receive high interest from the market.