The 3rd wave remains strong but the 4th wave is coming along

December 2009, Megastar premiered the blockbuster Avatar, marking the first time a 3D movie was released in Vietnam. However, the leading film distributor only lasted for two years when the conglomerate CJ bought it out and rebranded the chain to CGV, which began a new era of the entertainment retail space. 10 years later, CGV is now the No.1 chain and still expecting double-digit annual growth.

The above is a prominent case of a South Korean giant jumped into Vietnam’s consumer market in the early 2010’s and still expanding widely, besides large retailers like Lotte or Emart. These retailers, either aggressively or conservatively, are still planning for expansion without hesitation.

However, this retail trend is getting overshadowed by a hot money supply coming to the banking & finance industry––or you might want to say––South Korean investors are not only providing products/services, but also going to Vietnamese consumers and say: Here’s more money to spend. Ka-ching!

Lotte is a great example when its unit Lotte Finance has bought out Techcom Finance (a division of the leading bank Techcombank), while Lotte Mart just opened its third Hanoi store in Cau Giay district in early 2019.

Lotte Finance further bolstered its commitment in Vietnam’s financial market as it was the first financial institution from South Korea to become an official member of the Vietnam Banking Association. Per Kim Jong Geuk, general director of Lotte Finance, this was just the starting point, “Becoming a member of the VBA places the foundation for co-operative relations for mutual development between Lotte Finance and other financial companies, banks and businesses”.

Lotte Finance’s general director Kim Jong Geuk (left) receives the decision of being admitted to the Vietnam Banking Association. (Photo courtesy of the company)

Other South Korean financial behemoths gearing up for expansions in Vietnam can be named following Woori Bank, NongHuyp Bank, and Industrial Bank of Korea. These banks are to be approved by the State Bank of Vietnam to hike their charter capital and open more branches across the country.

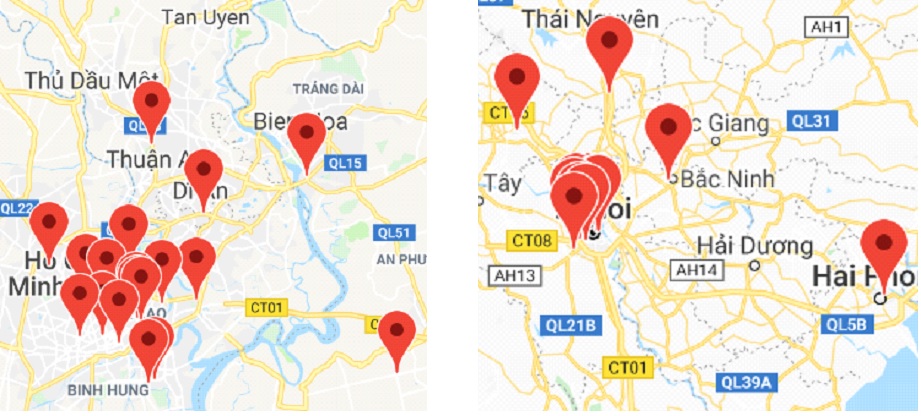

There is one bank that stands out from the crowd in this 4th wave of investment: Shinhan. It has made its way into Vietnam since 1993 but only become notable in the Vietnam’s banking map when it acquired ANZ’s retail operations in 2017. In 2018, the bank continued to fill its shopping cart with the acquisition of Prudential Finance. Now Shinhan is operating 30 locations (out of 125 branches and transaction offices of foreign banks in Vietnam) and more to-be-approved by the State Bank of Vietnam.

Shinhan’s compact distributions in the South (left) and in the North (right).

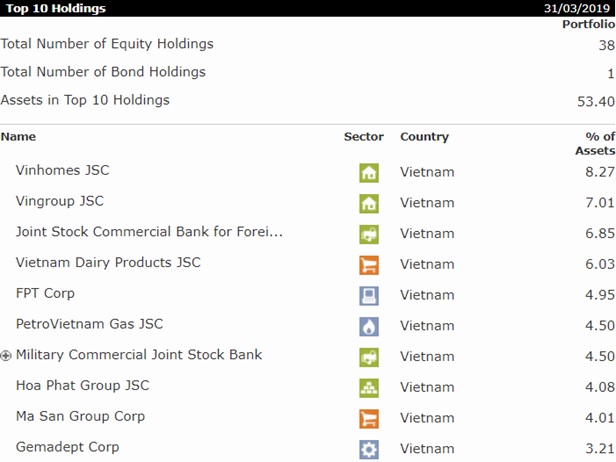

KITMC is another prominent case to be mentioned because the consortium, which consists of sub-funds with different investment goals and strategies, has poured money in most Vietnamese housing-related blue chips. The multi-billion-dollar master fund is now a shareholder in Vinhomes (residential developer), Gemadept (industrial developer), Coteccons (contractor), Hoa Phat (steel supplier), and Vietcombank (banking), making it one of very few foreign investors having tight connections with the Vietnamese real estate market.

Top 10 holdings of KIM Vietnam Growth Fund I (managed by KITMC), as of 31/03/2019. (Source: Morningstar)

Other segments of the financial sector like securities services and insurance industries have also received investments from the East Asia country. For the securities services segment, some newsworthy deals can be named like Mirae Asset’s acquisition of Tin Phat Fund Management or KB Financial’s stake in Maritime Securities. The insurance field has not seen a big transaction recently but according to sources familiar with the matter, Samsung Life is in talks with Bao Viet Insurance, and Hyundai Marine & Fire Insurance has agreed to buy 25% stake in Vietinbank Insurance.

South Korean financial institutions’ investments in Vietnam will likely get bigger, especially when the government is pushing for divestment from state enterprises and South Korea is a strategic partner of Vietnam. Thus, ongoing negotiations like KEB Hana Bank with BIDV are promising deals that investors might expect in the near future.

Heating up Vietnam’s mortgage market

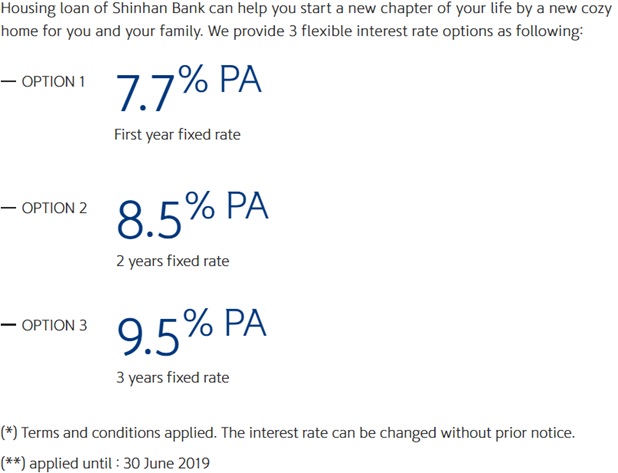

Shinhan Bank is clearly the leader among South Korean banks in Vietnam, and so is its mortgage program. The bank is promoting an attractive feature offering fixed interest for the first 3 years at quite fair rates.

Shinhan offers various home loan options.

On the other hand, Woori Bank seemingly does not want to be faded in the race to Vietnam’s mortgage market. The 120-year-old bank even constructed a combative feature offering the first 5-year grace period for principal payment, meaning borrowers only need to pay interest in the first 5 years of the loan.

A flyer introducing Woori Bank’s mortgage program.

It is worth it to remind that foreign banks have entered Vietnam for decades but mostly focused on B2B services. Even when they offered consumer programs, particularly mortgages, those were unappealing due to foreign banks’ strict policies and conservativeness. Thus, those programs offered by Shinhan and Woori, plus the current restrictions of local banks with mortgages, show a more open, emboldened approach to the Vietnamese mortgage market.