Ho Chi Minh City CBD retail space remains limited

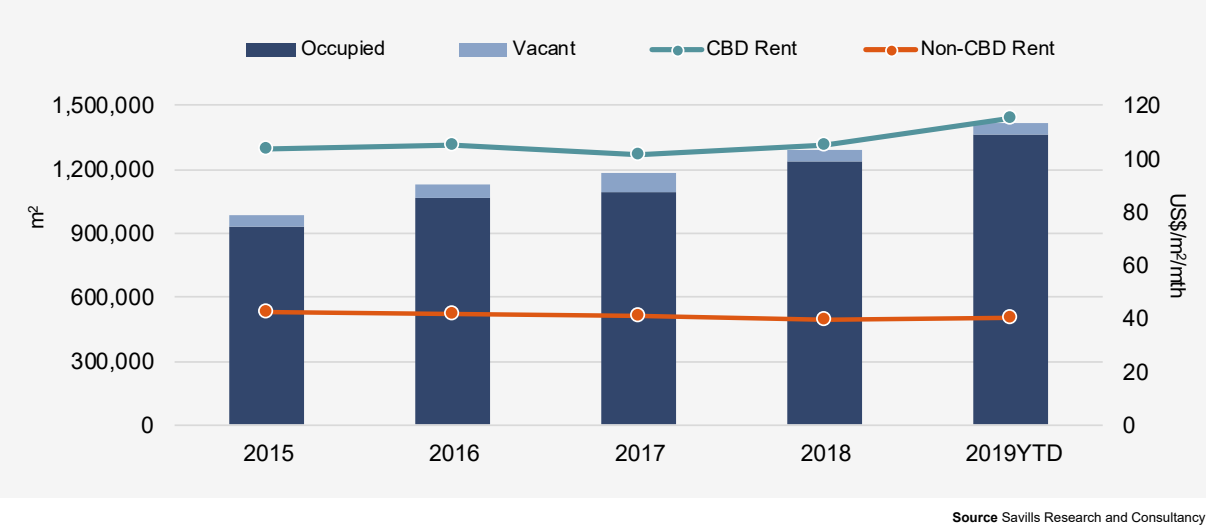

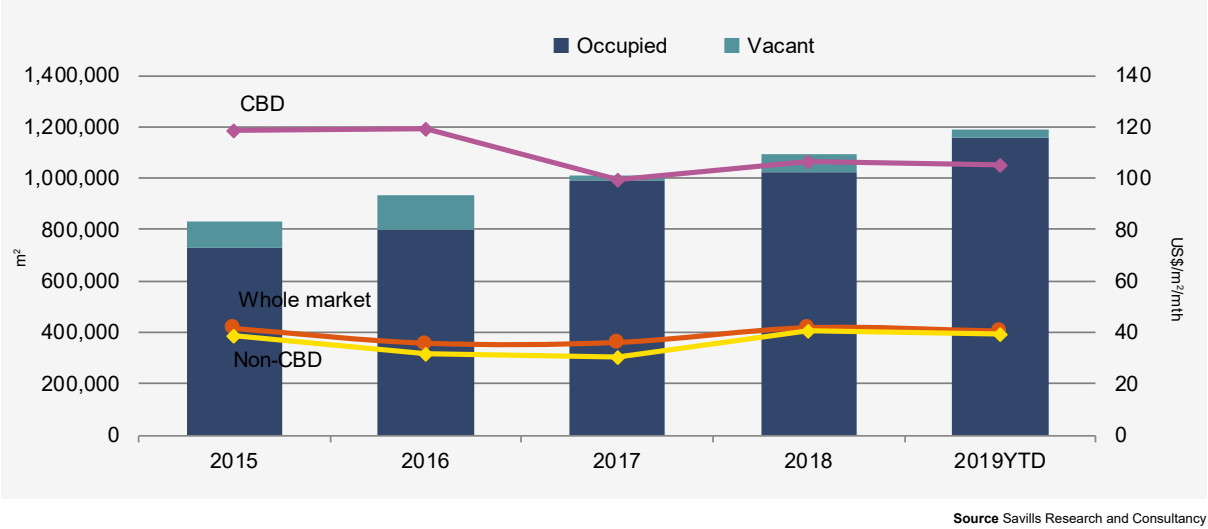

Retail stock grew 1% quarter-on-quarter (QoQ) and 13 year-on-year (YoY). By the third quarter of 2019, total city stock was over 1.4 million square metre due to the entry of two podiums and one shopping centre in the non-CBD. Despite new supply, occupancy remained high at 96%, up 3 ppts YoY, indicating strong demand.

“With F&B sector heating up, new international brands are entering HCMC, testing established local chains. This competition will ensure a healthy market environment and satisfied customers.”

Tu Thi Hong An, Associate Director, Head of Commercial Leasing

Due to shortage of supply in the CBD, landlords have been opportunistic by either increasing rents for new leases or replacing low-rent subsidiary tenants. Thus, the asking rent of newly released space and lease renewals in District 1 shopping centres surged by up to 30 percent. Moreover, Union Square will relaunch in 2020 and is expected to break CBD rent records.

Local F&B chains retained a strong position and continued to expand current brands. For example, Redsun, Golden Gate, Hoang Yen, Mesa and VIG are diversifying their portfolios by opening new locations with new brands. In addition, several well-known international F&B brands will enter the market, including Hawker Chan (Michelin-star brands), Coffee Club, Ding Tai Fung, Greyhound and Putien.

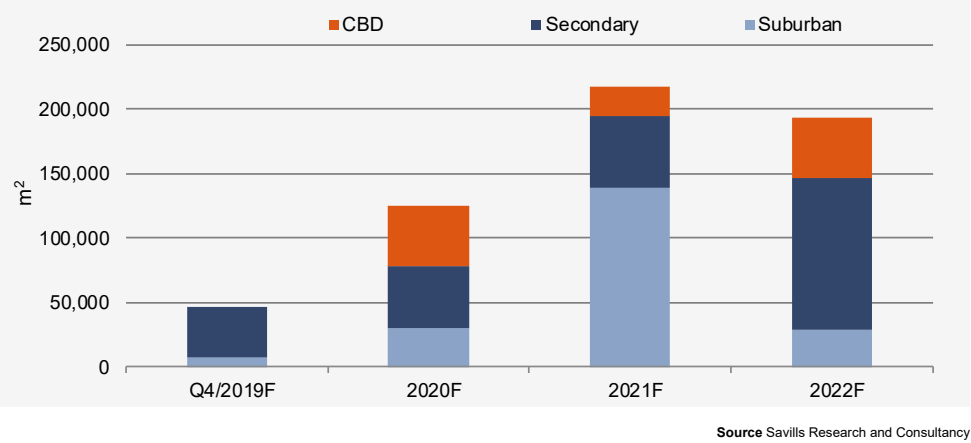

Until the end of 2021, future supply of over 390,000 square metre is expected to enter the market. The non-CBD will dominate with 82% of future stock. Prestige retailers may control their own brands within the CBD since recognizing the increasing amount of Vietnamese shoppers in their Singapore and Bangkok stores. However, as retail supply in premium locations is limited, rents are expected to rise.

There is less pressure in non-CBD areas due to the higher level of redevelopment. In these cases, it is mostly replacement stock, substituting the modern format for the obsolete buildings. As the result, sales levels will remain similar, therefore rents will also stay fine.

Hanoi consumer optimism increased

“Domestic competition continues to grow, this in turn fuels demand for quality retail property. The Secondary area and Shopping Centres will be refurbished to maintain competitiveness.”

Troy Griffiths, Deputy Managing Director

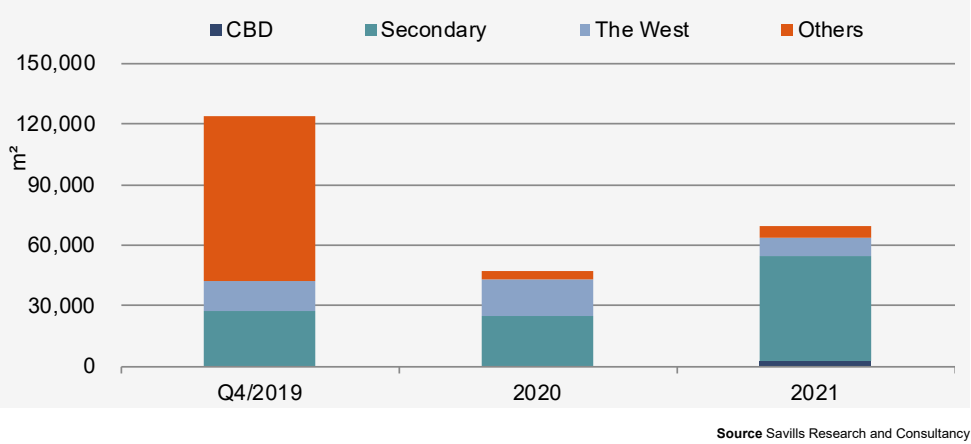

Total stock was approximately 1.5 million square metre, stable QoQ and up 12% YoY. The Secondary area maintained the largest market share, followed by the West. Average ground floor gross rent was down -2% QoQ and -1% YoY, whilst occupancy was stable QoQ and YoY. The West registered the strongest rent growth whilst the CBD had the highst occupancy increase. Highest take-ups occurred in the shopping centre segment and the West area.

Sales have increased by an average of 9% pa for the past five years. In the first nine months of 2019, sales reached approximately VND 254.1 trillion, or US$10.9 billion, up 12.7% YoY, reflecting higher demand and consumer optimism. Contributing to growth was consumer confidence regarding job prospects and personal finances, as well as the willingness to spend on big-ticket items. The continued improvement in key economic indicators has led the growth in categories such as travelling, out-of-home activities and technology or health-related products.

Entertainment was the leading category in terms of leased area with a 26% share, followed by Fashion & Cosmetics. Landlords have reduced their dependence on Fashion & Cosmetics, which explained a -4 ppt decline as compared to 2017. Meanwhile, the proportion of non-retail tenants such as spas, fitness centres, laundries, education centres and art galleries increased 3 ppts. Despite its less significant share, F&B attracted the highest volume of visitors and paying customers.

Until 2021, 23 projects with approximately 241,000 square metre will enter, mostly in the Secondary and ‘Others’ areas. Not until 2021 will the CBD welcome another project, whilst no new supply is scheduled in the East for the next two years. Most future projects will be in fast-growing residential and commercial areas with developing infrastructure and traffic systems.