Occupancy improved in HCMC’s serviced apartment market

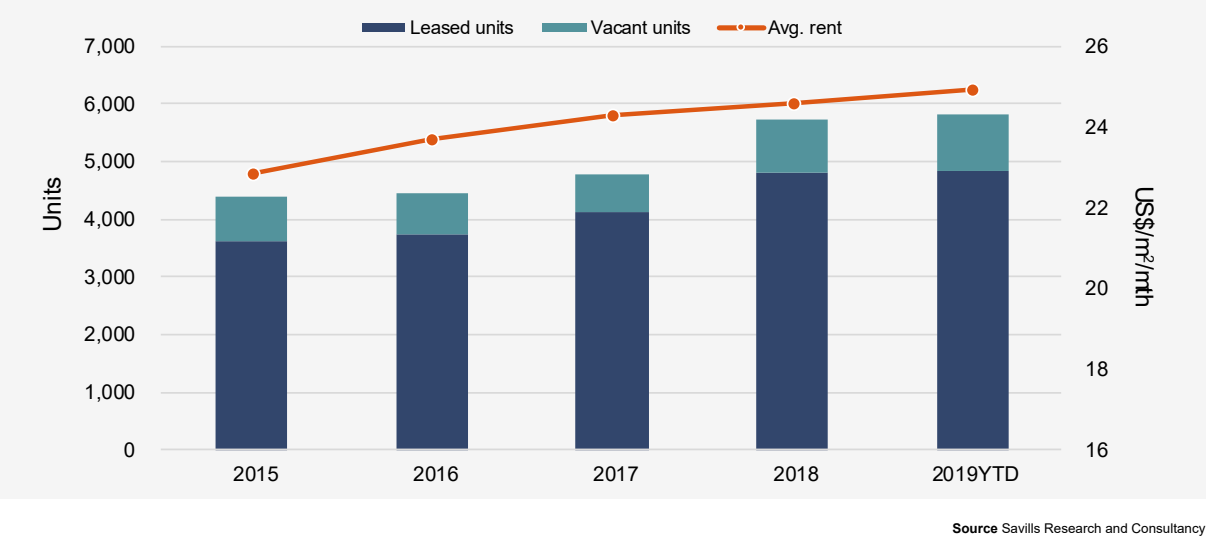

In Ho Chi Minh City (HCMC), the serviced apartment segment reached approximately 5,800 units came from 88 projects, stable quarter-on-quarter (QoQ) and year-on-year (YoY). One Grade C project operated by City House entered, providing 26 units. Serviced apartment projects managed and operated by chains performed well, but two Grade C projects withdrew from the market due to pressure from buy-to-let apartments.

Average occupancy increased by 2% QoQ and 4% YoY while rent was stable QoQ and up 1% YoY. Increased average rent YoY was the result of a rise in Grade B rent to US$29 per square metre per month, up 4% YoY. Grade B and C projects had average occupancy of 85% (up 2 percentage points QoQ and 1 percentage point YoY) and 82% (up 1 percentage point QoQ), respectively.

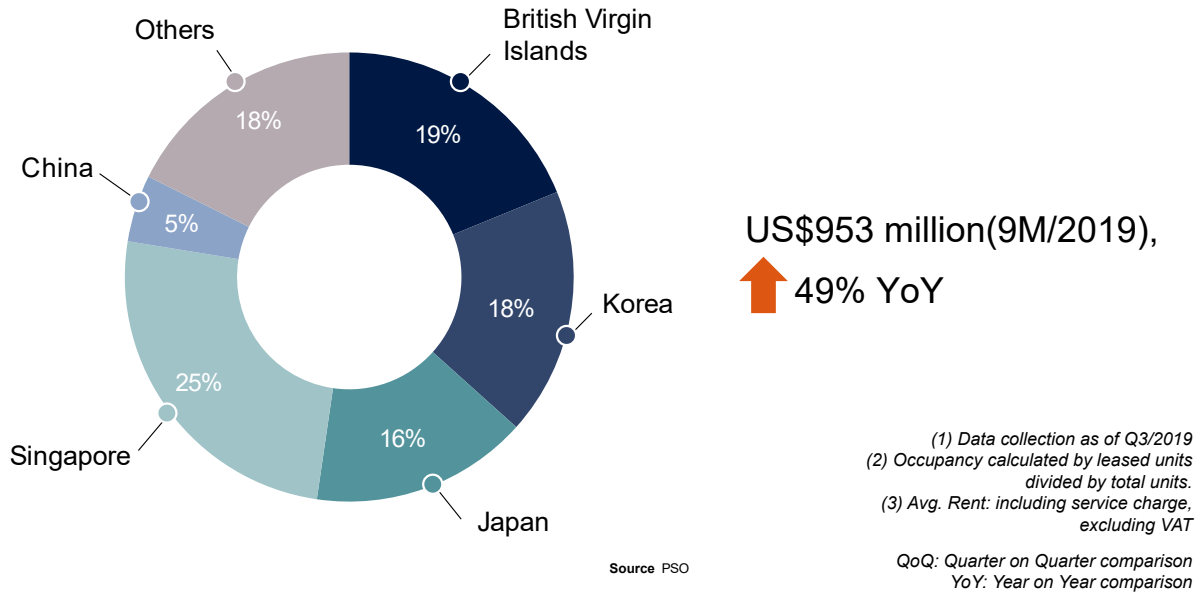

New FDI capital reached US$953 million, mainly from real estate, commercial and manufacturing industries. From 2015-2019, HCMC FDI has strongly increased, leading to a variety in tenant mix. Asian countries such as Singapore, Japan and Korea remain key tenants.

By 2022, 1,500 units will enter the market in response to the growing demand for long-term stays. Until the end of 2019, the CBD’s market share will increase by 2 percentage points due to the entry of two Grade B projects providing 200 units.

“On the back of strong FDI flows, the serviced apartment sector continues to perform well. This resilience will be tested in the face of increased disruption, completion from hotels and wave of investment apartments.” – Le Thi Quynh Le, Associate Director, Residential Sales.

Future supply will be mainly in the CBD and new urban areas (NUAs), which have many commercial buildings and shopping centers catering to high-end tenants. Stock in District 2, especially in Thu Thiem NUA, is expected to increase by 9 per cent pa each year, higher than the average of 5 per cent pa in the CBD from 2020 to 2022.

Grade A and Braded operators topped Hanoi market

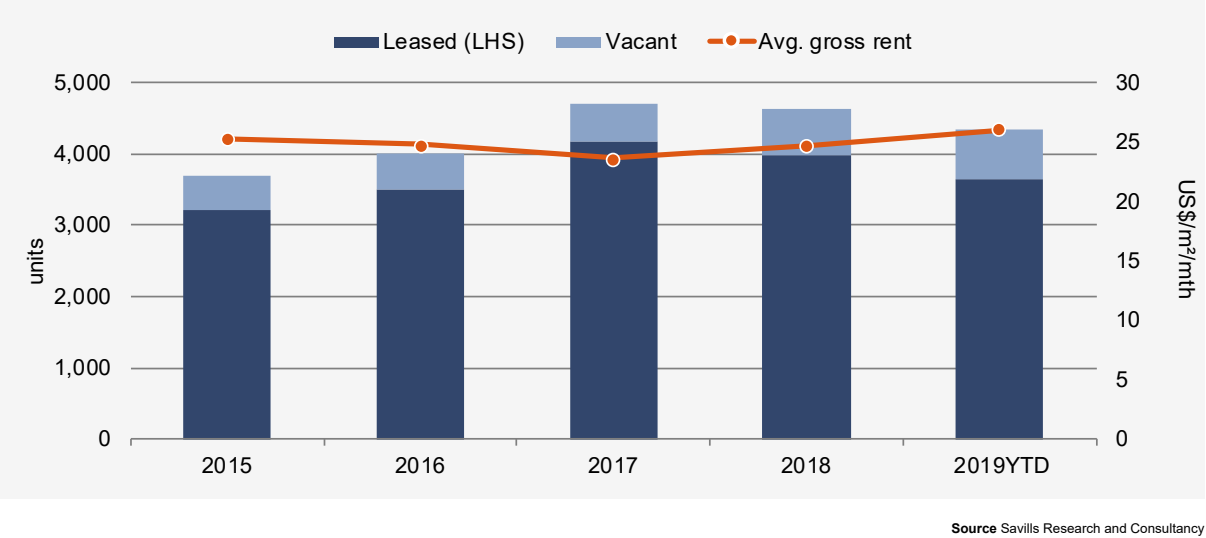

The serviced apartment segment in Hanoi witnessed solid performance by Grade A and branded operators in the third quarter of 2019, according to Savills Vietnam.

The market had 4,330 units, down -8 per cent QoQ after the closure of two projects and the entry of one. Grade A had the strongest take-up while Grade B and C suffered decreases in leased units. Average market-wide rents increased 4 per cent QoQ and occupancy remained high at 84 per cent. Within the Grade A segment, branded operators charged 19 per cent higher for rent than non-branded counterparts.

The trend of compact units saw the market share of studios and one-bedroom units rocket from 16 per cent in 1996 to 46 per cent in the third quarter of 2019. Tenants are not only expatriates and corporate executives with long-term leases but individual business, MICE, and leisure travelers with requests for short-term stays. Cooperating with dynamic online travel agents, over 90 per cent of serviced apartment operators now meet monthly and daily requests instead of only annual contracts.

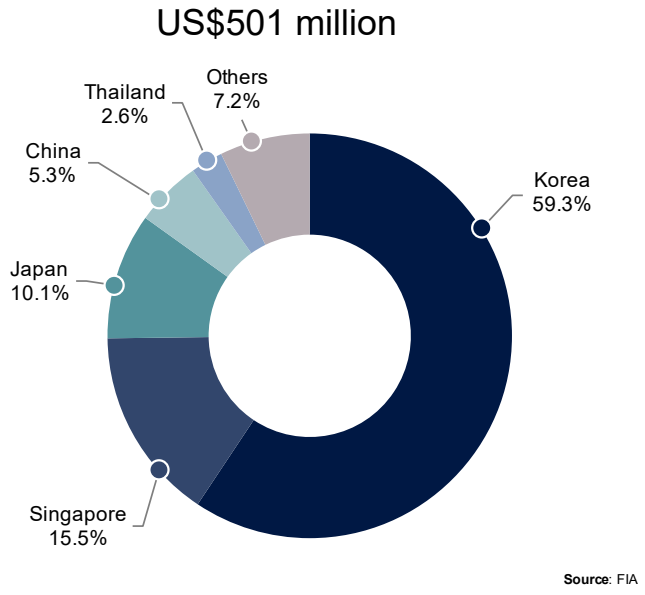

“Despite providing the largest supply source, Grade A demand retained strong, especially powered by robust FDI inflows.” – Hoang Dieu Trang, Senior Manager, Commercial Leasing

In the first nine months of 2019, Hanoi retained the most robust attraction to lure US$6.1 billion or 23 per cent of registered Foreign Direct Investment (FDI) to Vietnam. Amongst the on-going U.S.-China trade tensions, Vietnam jumped from 23rd to 8th place in investment attraction, according to the Best Countries to Invest In rankings 2019 published by the U.S. New and World Report. Beside traditional Japanese and Korean tenants, other Asian expatriates from Hong Kong, Singapore and China are expected to escalate demand.

Four projects with approximately 1,000 units will enter in the last quarter of 2019; three branded operators are positioned in Tay Ho and one player will enter in Hai Ba Trung. There is no future stock registered in Hoan Kiem due to scarce land bank.