South Korean companies are under fierce competition with their Japanese peers for shares in Vietnam’s retail market, which is fast emerging as a new Asian production and consumption hub.

A recent report by the Korea Trade – Investment Promotion Agency (KOTRA) suggested Vietnam’s retail market is growing at an annual rate of 10.9% in the 2013 – 2018 period, while most leading names in the market come from South Korea and Japan, ranging from convenience stores, department stores to e-commerce.

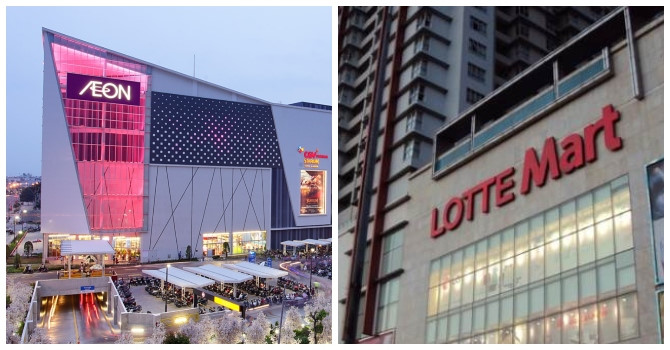

South Korean retail giant Lotte started its presence in Vietnam since 2008 and invested a total of US$390 million. The retailer currently owns 14 shopping malls, one department store and two duty-free shops across the country.

CJ Group, another South Korean conglomerate has been a force in Vietnam by operating in various fields from food, entertainment to e-commerce through brands such as Tous Les Jours, CGV, CJ Korea Express, and SCJ TV Homeshopping.

Japanese retailer Aeon, Lotte’s main rival, arrived in Vietnam in 2011 and has invested a total of US$190 million. It operates a number of shopping malls in three major cities namely Ho Chi Minh City, Hanoi and Binh Duong.

Recently, Aeon invested US$280 million to build its third shopping mall in Hanoi. Unlike its two existing shopping malls that are located in Hanoi’s suburban areas, this upcoming mall is constructed in an area of more than six hectares in Hanoi’s downtown in Hoang Mai district.

Aeon targets to have at least 20 shopping malls in Vietnam by 2025, said Yasutsugu Iwamura, CEO of AEON Japan and AEON Mall Vietnam in a meeting with Prime Minister Nguyen Xuan Phuc in June.

Toshin Development, backed by Japan’s leading department stores chain Takashimaya, is expanding business investments in Vietnam. The company previously focused on investing in major shopping malls and opened a 15-hectare Takashimaya mall in Ho Chi Minh City in 2016. In July, Toshin signed a contract to purchase 1.7 hectares near West Lake in Hanoi to build a Japanese-style culture and shopping center.

Convenience stores and e-commerce are also expanding rapidly across Vietnam, mainly thanks to rapid urbanization rate, higher income and young population. IGD Research ranked Vietnam at the top spot among countries with the highest expansion rate of convenience stores in Asia by 2021.

In addition to Aeon, Japan-based 7-Eleven has been operating in Vietnam since 2017 with nearly 40 stores. The company targets 1,000 new stores, mainly in Ho Chi Minh City and Hanoi. However, 7-Eleven is still far away from South Korea’s Circle K with a network of 370 convenience stores in Vietnam.

South Korea’s convenience store chain GS25 entered Vietnam last January and opened its first convenience store in Ho Chi Minh City through a partnership with Son Kim Group, one of Vietnam’s leading privately owned retailers. The joint-venture is planning to expand its network from current 50 stores to 70 by 2020 and 2,000 in the next 10 years.