According to Savills Vietnam, the US-China trade war, additional investment and new free trade agreements have all had a positive effect on Vietnam’s industrial sector.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) entered into force in January while the EU - Vietnam Free Trade Agreement (EVFTA) was signed in June 2019. This historic and ambitious agreement will eliminate 99 percent of customs duties and has raised interest in industrial property.

Regional Comprehensive and Economic Partnership (RCEP) negotiations are underway and expected to be finalised at the end of 2019. The agreement will increase cooperation between ASEAN countries and the six Asia-Pacific states with existing free trade agreements.

By enabling the latest production technologies and increasing workforce training, the government is actively easing qualms around viability, labour shortages and rising costs for a more transparent business environment.

Unpredictable developments of the US-China trade war have made many foreign companies move to Vietnam to set up new factories. This has brought a new breeze to the local industrial real estate market.

They included many factories from China operating mainly in the fields of electronics, textiles, footwear and spare parts production, such as Hanwha, Yokowo, Huafu, Goertek, Foxconn, Lenovo, Nintendo, Sharp, Kyocera and Oasis, according to the report.

In early 2019, Hong Kong firm Goertek, which assembles Apple's AirPods headset in China, spent $260 million to build a new factory in Que Vo Industrial Park (IP), Nam Son commune, Bac Ninh city. This is one of firm's moves to avoid strong U.S. tariffs on products made in China.

At the end of last year, Hanwha, which is one of the world’s 500 largest corporations, opened its 9-ha Hanwha Aero Engines aircraft spare parts factory in Hoa Lac Hi-Tech Park, with a total investment of $200 million.

Previously, the Japan-based Yokowo Group also spent $18 million on its 3.6ha factory in Dong Van 2 IP, Ha Nam province.

Even Chinese companies themselves are unsettled by the battle of the world's two largest economies with domestic production chains.

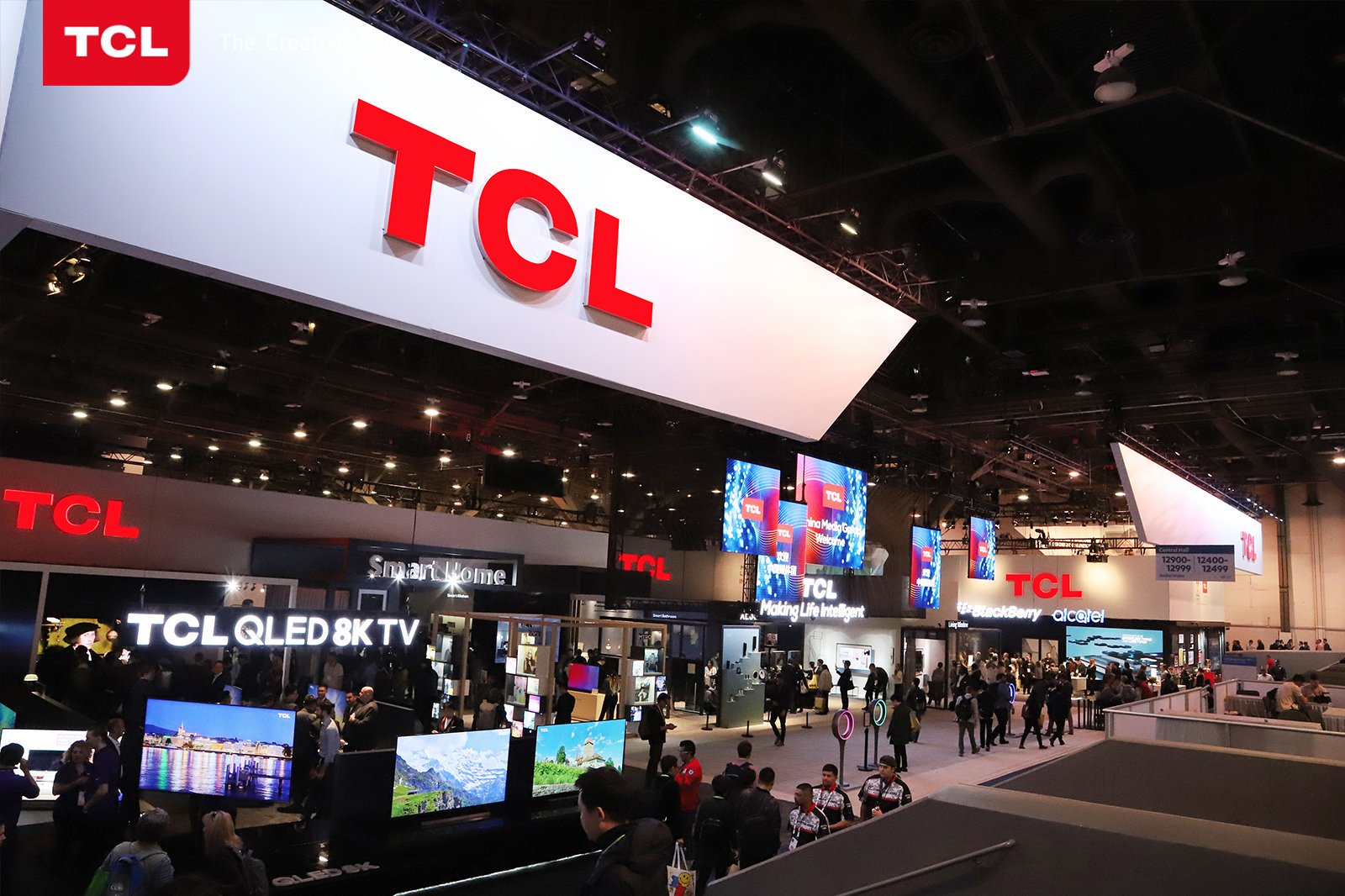

Earlier this year, China-based firm TCL quickly chose a 7.3ha site in Binh Duong province to set up a TV factory with an investment of $53.56 million. Meanwhile, the apparel giant Huafu also spent $362 million to build a factory in Long An to access cheaper materials, reduce labor costs and avoid tariff barriers.

The shift of TCL and Huafu shows that not only are multinationals concerned about high tax rates, domestic companies are also forced to find a "safe habour” for themselves.

The Asian Development Bank noted that Vietnam maintained the fastest growing economy in Southeast Asia this year, with a GDP growth rate of 6.8%. While this figure in Indonesia is 5.8%, Malaysia 4.5%, Thailand 3.5% and Singapore 2.4%.

Last year, World Bank also rated Vietnam as the 69th out of 190 economies that are easy to do business, above Thailand, Malaysia and Singapore.

In addition, factors such as abundant labor resources at affordable costs and lower factory construction costs than other countries in the region make businesses pay more attention to building factories in Vietnam.

According to Trading Economics, the average salary in manufacturing in Vietnam is $237/ month, while this figure in Malaysia, China and Thailand reaches $924, $866 and $412, respectively. In July 2019, Vietnam's PMI was 52.6, with industrial production growth of 9.6%, higher than other major economies in the region.

In the first quarter of 2019, the US continues to be the largest import market of Vietnam, accounting for 40.2% of total, according to US Census Bureau.

According to some firms seeking land for lease in Dong Nai, Binh Duong and Long An, rates were fairly high last year and in this year’s first half.

In particular, at VSIP 2 in Binh Duong, rates have picked up by some 30% against 2018, at US$100-120 per square meter. In Dong Nai and Long An, the rates are US$80-100 and over US$100 per square meter, respectively.

In a report released last week, the agency noted Vietnam had 326 industrial parks covering some 95,500 hectares of land, as of last June, with rentable land accounting for 69% (65,500 hectares).

Of these, 251 industrial parks (66,200 hectares) are in operation with occupancy rates averaging 74%. Besides this, there are 75 industrial parks (29,300 hectares) under construction or in the process of site clearance.

To meet the rising demand, ready-built workshops developed by secondary builders have been on offer, including BW Industrial, covering 247 hectares of land in various localities, in the January-June period. KTG Industrial covers 120 hectares of land, with eight workshops for lease in Dong Nai, Hanoi and Bac Ninh.

Besides this, investors with rubber farmland plan to convert it into industrial land to meet the demands of production firms.

“Although occupancy in key provinces grew year on year, available land coupled with an array of upcoming projects has seen foreign companies significantly increasing investment in Vietnam,” John Campbell, Senior Consultant, Savills Vietnam Industrial Services said.

“Manufacturers are showing interest in the Central Regions while developers are actively converting agricultural land to industrial usage, guaranteeing additional supply.”

The industrial sector is growing strongly with a tenfold increase in foreign direct investment (FDI) over the last decade. According to the Ministry of Planning and Investment’s statistics in the first half of this year, the industry received 1,723 newly registered FDI projects, with a total investment of $7.41 billion. In which, manufacturing segment attracted 605 projects, accounting for 71.2%, or $13.15 billion, up 39.8% year on year. These capital flows mainly come from companies based in Hong Kong, Korea and China.

According to Campbell, many projects will be set up in the country in the near future as investors in industrial property projects are getting farmland converted to industrial land. Central localities such as Thua Thien Hue, Quang Nam and Quang Ngai are receiving countless requests for conversions due to their competitive land lease rates.

Good land supply is facilitating incoming manufacturing projects and the rise of rental options with ready-built factories (RBF) and built-to-suit (BTS) solutions. Vietnam must be more selective with projects to move up the value chain, improve competitiveness and ensure sustainable growth.

Low labour costs and government incentives, particularly preferential tax rates, will continue to be critical drivers of FDI. However, to maintain the transition to higher-value industries, Vietnam must focus on the quality rather than the number of investments.

In addition, Vietnam needs to select projects carefully to increase its value chains and competitiveness as well as to develop sustainably.