Giga Mall Thu Duc.

Customization will be the key to rise from a centrally clustered market in Ho Chi Minh City

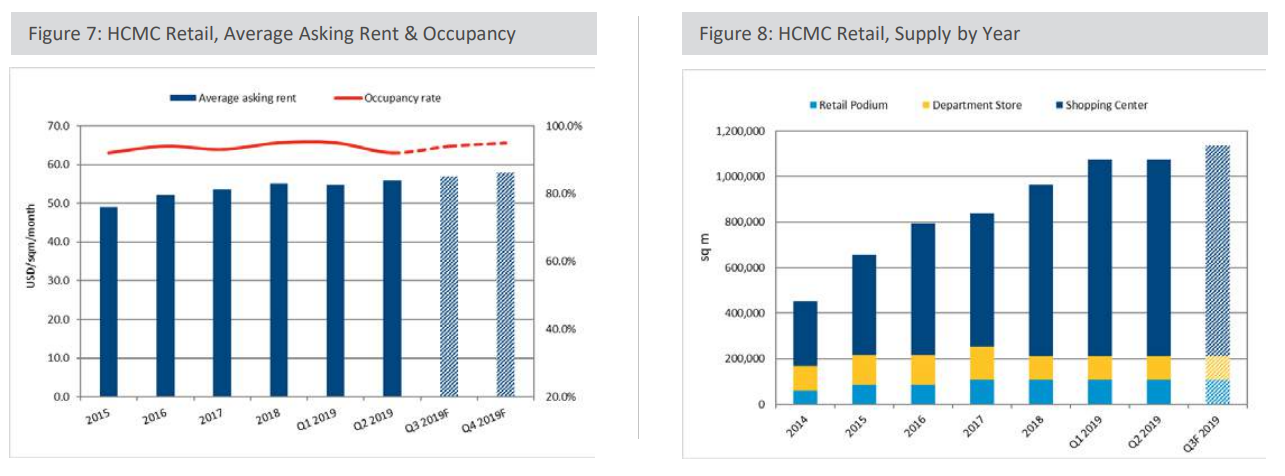

Shopping malls, department stores, and retail podiums in HCMC has traditionally concentrated in the CBD, with properties in the central districts accounting for 80% of the total supply in the city. The average asking rent for these properties has long exceed 100 USD/sqm/month. Elsewhere in the city, however, the retail sector has remained relatively undeveloped, with their average asking rent stabilizing around the 30 USD/sqm/ month mark. Due to the low vacancy in retail space across the city, average asking rent has increased by 1.5%-2% quarter after quarter.

Current total supply of the retail sector in HCMC is close to 1.1 million sqm. Of that figure, shopping centers account for roughly 89%, while department stores and retail podiums account for about 5%, respectively. After Giga Mall, TNL Plaza (15 thousand sqm) was the second shopping center to open outside the CBD in 2019. This shows that the decentralization of the retail sector is well underway.

(Photo: Colliers International Research)

By the end of Q2 2019, the average occupancy among retail properties was 92.7%, with shopping centers leading the sector at 94.0%, followed by department stores at 93.0%, and retail podiums at 91.0%. This shows that demand for high-quality retail space in Ho Chi Minh City is still very high, especially with the penetration of more international brands into Vietnam in the upcoming years.

By the end of 2019, five shopping centers will have delivered 200 thousand sqm of retail space to the market, and they will move further away from the CBD. As consumers become savvier and demanding, shopping centers will also have to adapt and change their approach. No longer is the traditional retail model applicable, the retail sector must focus on delivering a more distinguished and tailor-made experience in order to both attract more consumers and set themselves apart from the competition in this increasingly heated market.

Improved infrastructure facilitates further development of Hanoi’s non-CBDs

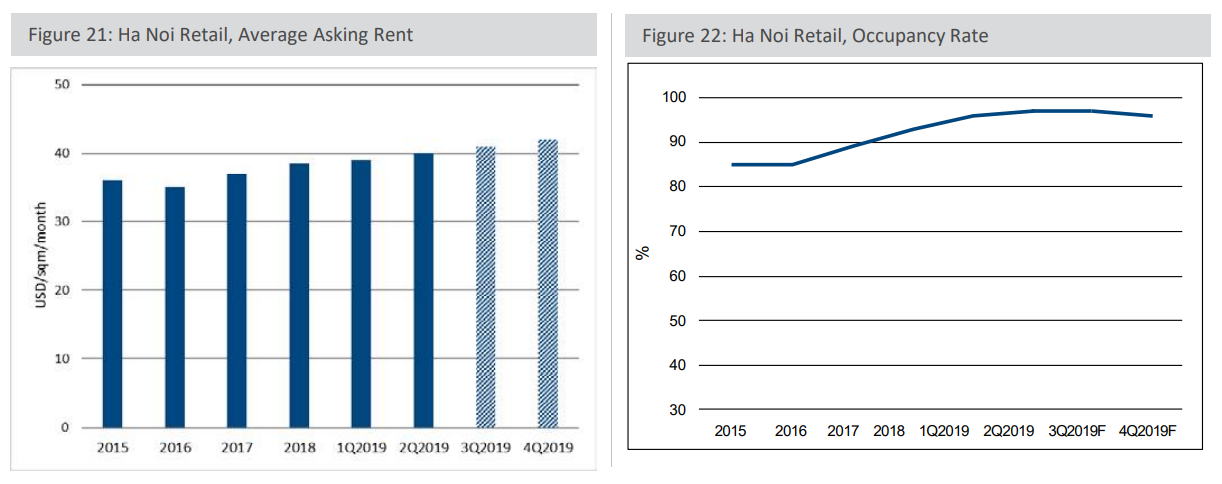

For the time being, retail space in or close to the CBD of Ha Noi will continue to attract strong interest. The occupancy rate is expected to remain consistently high and average asking rent will continue to grow steadily. In the long run, however, similar to in HCMC, non-CBD areas of Ha Noi will see the emergence of high-quality retail properties.

In the second quarter of 2019, the market welcomed 3 new supply sources, supplying more than 80,000 m2 and two of these three supplies come from Vincom Group (Vincom Tran Duy Hung and Vincom Skylake), the rest belongs to Sungroup (Sun Plaza). As of Q2 2019, Hanoi’s total retail stock reached more than 970,000sqm. Retail podium segment once dominated the market in the early 2000s, later on, shopping mall gradually developed with a large area, diverse industries, F&B services bring convenient for customers. Shopping mall segment in Hanoi has started to grow rapidly since 2012 with 5 projects launched in that year, supplied to the market with 102,800 m2 NLA, accounting for 54% of the total supply at that time. Until now, shopping malls dominate the supply, accounting for 76% of total stock, followed by retail podium and department stores with 13% and 11% respectively. While the CBD is a prime location for both local and international luxury fashion, suburban districts are led by supermarkets, fast-fashion brands, F&B and entertainment services.

Sun Plaza Thuy Khue.

Since 2008, Vietnam has implemented a number of economic reforms leading to greater integration with the regional and global economies. This has also resulted in higher foreign direct investments. Vietnam has also begun its transition from a low-income to lower middle-income country, relative to ASEAN peers. This increase in income will likely lead to a subsequent rise in purchasing power and growth in consumer retail spending. Apart from positive trends and macro forces, there have also been government efforts to liberalize the legal landscape to further facilitate ease of doing business in Vietnam. The increase in brands entering market and the alteration from shopping centers to entertainment centers partly reform the market in the next few years.

In the near future, no project will be implemented in the central districts of Hanoi, which will help boost the occupancy rates and rents of retailers in this area. On the other hand, large shopping malls will be allocated in non-CBD areas, most of which come from large retailers such as Aeon (Aeon Mall Ha Dong – 74,000 sqm and Aeon Mall Giap Bat) and Lotte (Lotte Ciputra Mall – 200,000 sqm). Improved infrastructure and transportation in the south and east is expected to lead to further popularity of non-CBD retail centers. Prime rates are forecasted to continue to rise amid supply constraints for prime retail in the CBD. The shortage of prime land for development makes it unlikely for notable prime retail supply to be added.

(Photo: Colliers International Research)

Increasing future supply signals positive growth in Danang’s retail market

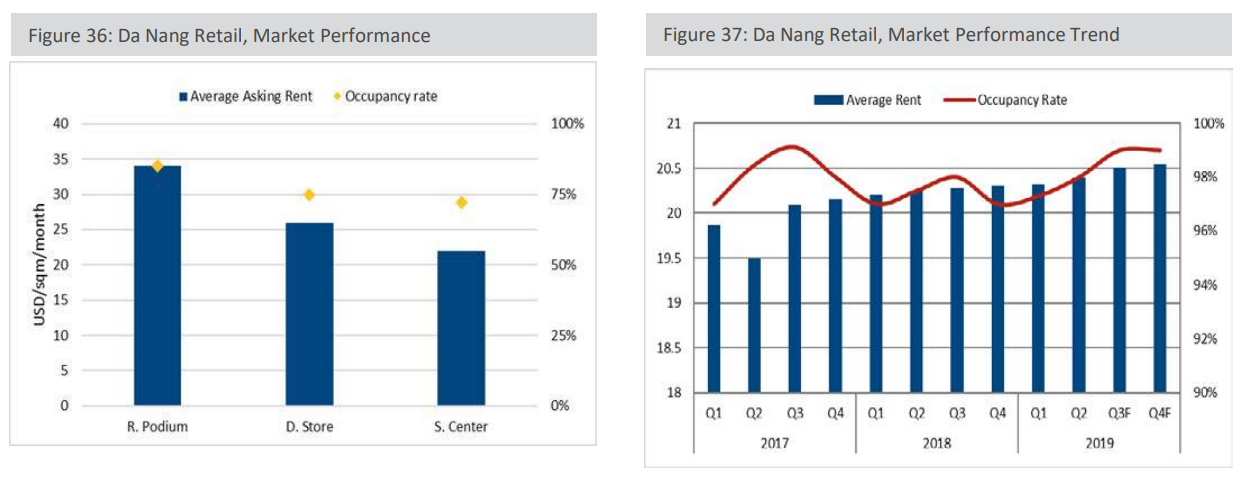

In general, retail market in Da Nang is developing relatively stable, the average rent increased 4% q-o-q, reaching 20.4 USD/sqm/month. Retail Podium and Department Store performed well with 100% occupancy, while Shopping Mall also shows a positive growth with 97% occupancy.

(Photo: Colliers International Research)

The review quarter recorded no new retail project introduced to the market. The total retail stock was 76,451 sqm, stable on a quarterly basis. Son Tra District is still the largest supplier of retail space at 36,800 sqm, accounting for 45% of retail stock, followed by Hai Chau and Thanh Khe District at 40% and 15% respectively. Up till now, Ariyana is the latest Shopping Mall in Da Nang, with 10,000 sqm NLA. Retail market in Da Nang is still small with only eight properties so far. At the end of 2019, Da Nang will welcome new shopping mall – VV Mall with 35,000 sqm of NLA and highest rental rate (37USD/sqm/month) of the region. Even though VV Mall has not yet completed, the occupancy is recorded high, this project is expected to be a remarkable shopping mall in Da Nang.

Retail market in Da Nang is benefit from tourism, in the first six months, Da Nang recorded 2,715 million passengers, increased 19.4% compared to same period in 2018. In order to promote tourism, Da Nang has organized many festivals and events not only attracts domestic but international tourists such as Carnaval, Danang International Fireworks Festival 2019, Danang International Food Festival 2019, Beach Tourism Festival 2019,…Besides, in April 9, Jetstar Pacific announced to open three new air routes connecting Da Nang city with Vinh city, Thanh Hoa province and Phu Quoc island, this contributes to attracting more tourism in the city.

VV Mall Danang.

In the following years, retail market in Da Nang will welcome more projects coming online, Wyndham Soleil (with 5,000 to 6,000 sqm of NLA) is under construction. Up till 2021, total NLA of Da Nang is expected to reach 200,000 sqm. With the significant growth of number of international tourist in Da Nang in the first quarter (approximately 1.8 million passengers), the retail market will positively grow.