HCMC office rent hits decade high

Overall net absorption recorded more than 50,000 square meters, mainly contributed by newly completed buildings, namely Lim Tower 3 and Phu My Hung Tower. Amid strong demand and limited upcoming supply, landlords became more aggressive in asking rents and leasing strategy, focusing on selecting high-profile and sustainable tenants. Co-working operators kept expanding quickly, contributing largely to the net absorption during the quarter.

Lim Tower 3, Phu My Hung Tower and Viettel B building entered the market in fourth quarter of 2019, bringing up HCMC Grade A and B office stock to 1.306 million square meters, up 7.3 percent quarterly and 11.3 percent yearly. Although three new buildings supplied the market in the fourth quarter, Grade A and B market continued to tighten with vacancy rate recorded at 6.5 percent at end-2019 and they failed to satisfy high demand in Vietnam’s largest city. In the current market, only one Grade A building (Lim Tower 3) and ten Grade B buildings that can provide a contiguous space larger than 1,000 square meters.

Rental rates for Grade A and B offices increased by an average of 1.1 percent from the previous quarter and 7.4 percent from the previous year to reach a decade high of US$29.1 per square meter a month in the fourth quarter of 2019. This was supported by strong demand and higher rental rates in newer office developments. Also, landlords continued to have strong bargaining power this quarter given the restless rental growth amid limited stock.

In 2020, JLL forecasts total stock in HCMC Grade A and B office market would rise by 15.4 percent to 1.5 million square meters with the completion of nine buildings, mainly from the Grade B segment. Meanwhile, majority of the Grade A offices in prime location deferred their completion date to beyond 2021 owing to prolonged approval process. Demand is likely to slow down in 2020-2022 compared to 2017-2019 period, as global economic uncertainty may affect tenants’ rental budget while the rental of Grade A buildings is currently at high level. Co-working is gaining popularity, not only for start-ups and SMEs. This trend is expected to continue in the future.

Hanoi office market sees launch of only Grade B buildings

In the quarter, demand for both Grade A and B submarkets remained stable which was recorded via a higher net absorption from that in the previous quarter, the report showed. Meanwhile, the occupancy rate of the market continued to increase and reached 93.0 percent, in which Grade A submarket achieved the rate of 94.0 percent. The positive net absorption of Grade A offices was mainly attributed to TNR Tower and ThaiHoldings Tower, the two latest additions to the market. In addition, Grade B buildings recorded higher net absorption than Grade A due to its abundant supply.

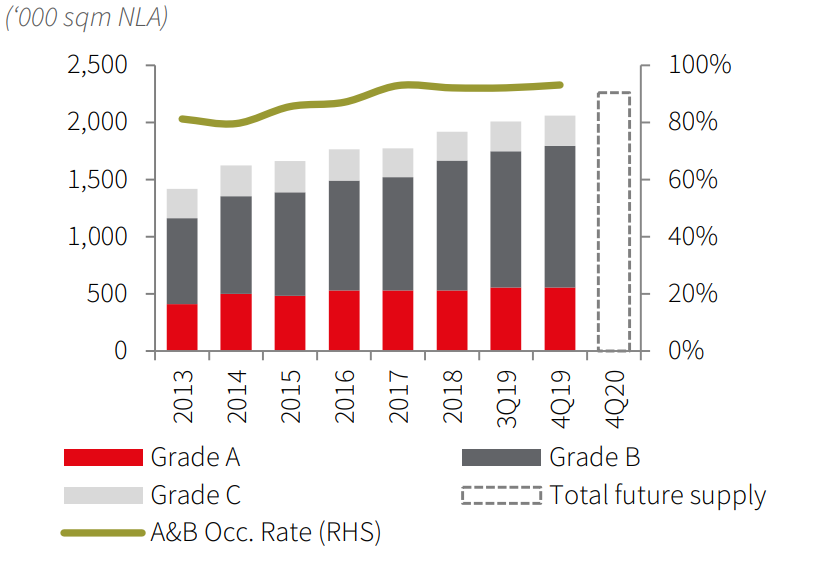

While there was no new supply in Grade A submarket, Grade B continued to welcome two new buildings in the fourth quarter of 2019, Coninco Tower and Peakview Tower, which helped to raise the total supply of Hanoi office market to reach almost 1.8 million square meters. Both new buildings were located in Dong Da District, one of the main office clusters of Hanoi. In 2019, this district has also welcomed the largest amount of new supply. However, the leading professional services firm in real estate and investment management said with high construction quality and reasonable prices, the two buildings achieved an impressive occupancy rate in the first quarter of opening.

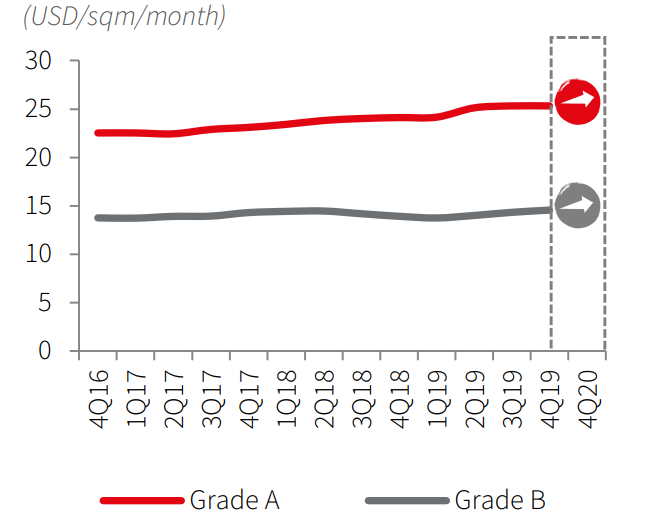

In terms of rental, the average rental rate of Hanoi both Grade A and B office increased moderately by 0.3 percent during the fourth quarter, resulting in a considerable growth of 6 percent on year. Positive demand helped sustain the growth throughout 2019, however, the pace started to show signs of weakening toward the year-end period. By location, during 2019, central business district (CBD) area, in which Dong Da district took the lead, rose faster than the new office clusters including Cau Giay and Nam Tu Liem districts, since the majority of supply were located in central areas. In addition, the new additions in the CBD area with high quality also benefited the trend.

Accordingly, JLL said the market is expected to welcome a large amount of new supply in both Grade A and B in 2020, of which Capital Place is the most notable one. Capital Place should set new standard for the office market, based on its first-class quality. Demand is believed to stay steady, with relocation and expansion being the main drivers. However, with a large supply pipeline, landlords should employ a flexible strategy to quickly react to the changes in the market and tenants’ needs.

Vietnam in 2019 saw rising office rent in both HCMC and Hanoi due to low supply as its rapidly growing economy and increasing foreign investment demand more business space.