Hanoi and Ho Chi Minh City, home to 17 percent of the total population of the country, have greatly contributed to the market’s growth.

The firm predicted that supply is likely to rise in major cities to meet the market demand.

With a population of 94 million people, the third largest in ASEAN, but the lowest urbanization rate at about 36 percent, Vietnam’s real estate market has greater potential over regional countries, it noted.

Hanoi and Ho Chi Minh City, home to 17 percent of the total population of the country, have greatly contributed to the market’s growth.

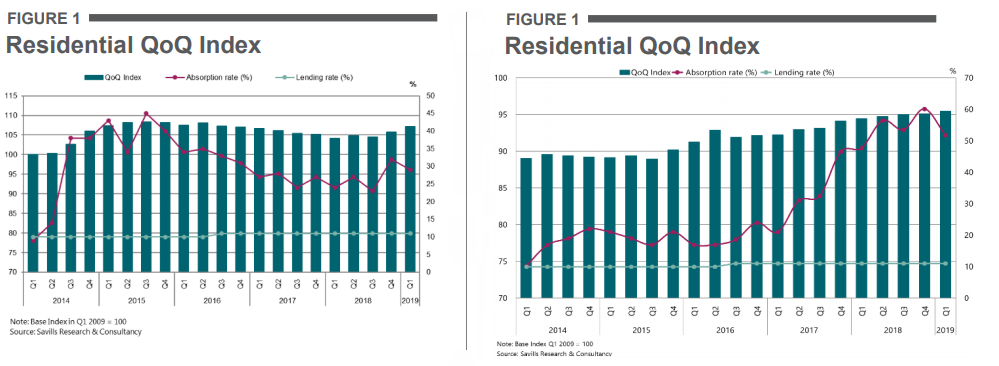

Residential Index

In Q1/2019, the Residential Index in Hanoi increased by approximately 1 point (pt) quarter-on-quarter (QoQ) and 3 pts year-on-year (YoY) to 107.2. Total transaction volume increased 70% YoY but decreased -14% QoQ. The average absorption rate was 29%, down -3 ppts QoQ but up 4 ppts YoY.

Strong demand resulted in high Grade B sales, accounting for a 70% market share and growth of 99% YoY, the highest amongst the three grades. Approximately 44,000 units from 34 existing and future projects will enter. With rapid infrastructure development in Gia Lam and Tu Liem districts, strong competition is expected.

Hanoi (left) and Ho Chi Minh City (right) residential index. (Source: Savills Research and Consultancy)

In Ho Chi Minh City (HCMC) Q1/2019, the Savills Residential Index was 95.4, stable QoQ and up 1 point YoY. Total transaction volume was 6,900, down -37% QoQ and -49% YoY, caused by lengthy period of national holiday in January and February. Absorption of 52%, down -8 ppts QoQ but up 4 ppts YoY.

All grades recorded a drop in total transactions. Grade C remained the highest contributor, representing 58% of total transaction volume. Until 2021, over 163,000 units are expected to launch; District 2 and 9 will account for 57% of future supply.

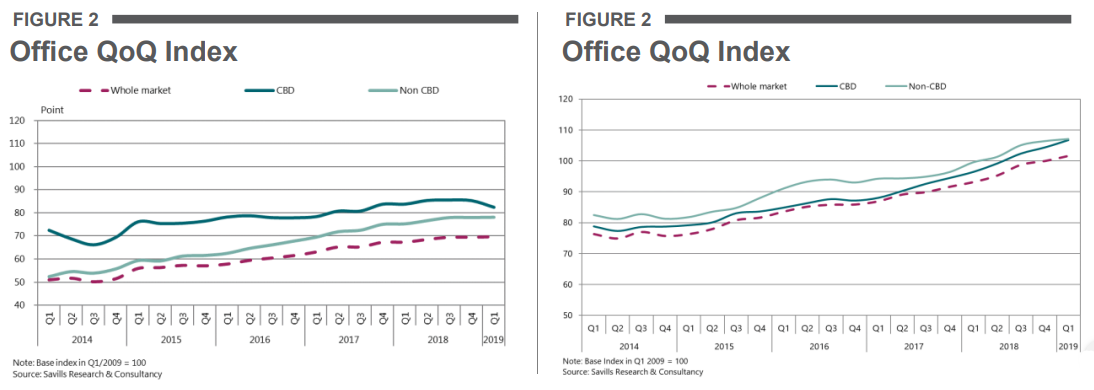

Office Index

For Hanoi in Q1/2019, the Office Index was 69.6 pts, stable QoQ and up 2 pts YoY as rent increased 2% QoQ and 5% YoY. The CBD index fell by -3 pts QoQ and -1 pts YoY, due to the soft performance of newly launched projects. The non-CBD index was stable QoQ and up 3 pts YoY.

One project in the CBD will come online in 2020, increasing rent. A surge of new non-CBD supply suggests a dynamic market in the future. Office buildings of higher grades in the non-CBD are attractive to occupiers, including those relocating from the CBD.

Hanoi (left) and Ho Chi Minh City (right) office index. (Source: Savills Research and Consultancy)

In Q1/2019 in HCMC, the Office Index reached 102, up 2 points QoQ and 9 points YoY. Improvements were due to quarterly increases in rent in both CBD and non-CBD. The CBD continued to outperform the non-CBD with occupancy reached 98%, stable QoQ and 1 ppt YoY and rent grew 2% QoQ and 10% YoY.

The CBD index increased to 107, up 3 ppts QoQ and 11 ppts YoY. The non-CBD office index reached 107, up 1 point QoQ and 7 points YoY. The increase of office index of both the CBD and the non-CBD was due to the QoQ increase in average rent. Total take-up was over 7,600 square metre, down -22% QoQ and -87% YoY due to low vacancy in Grade A and B.

The majority of supply sources in HCM City will be for low-income group.

According to Savills, in the 2014-2018 period, the transaction of apartments in Hanoi and HCM City increased sharply, with an average growth of 44 percent annually in HCM City. Budget apartment for low-income groups accounted for 60 percent of the total transactions in five years.

In 2018, housing transactions in Hanoi rose 20 percent over 2017, with the medium segment making up 61 percent.

The firm forecast that in 2020, the majority of supply sources in HCM City will be for low-income group, while supply for middle-income group will still lead the market in Hanoi.