Consumer price index

Average CPI in 1Q2019 increased by 2.63% compared to the corresponding period in 2018, this is the lowest increase in the first quarter within the last 03 years. Average core inflation in the first quarter of 2019 increased by 1.83% over the similar period last year.

Retail sales

In 1Q2019, the estimated retail sales of consumer goods and services in Vietnam reached approximately USD 50.8 billion, an increase of 12% over the corresponding period in 2018. Retail sales of goods in this period increased by USD 39 billion, 76.8% of the total amount, and up by 13.4% over 1Q2018. Sales of travelling, accommodation and catering services recorded a combined USD 648.8 million, 12.8% of the total; and sales of other services gained USD 528.5 million, 10.4% of the total.

Performance

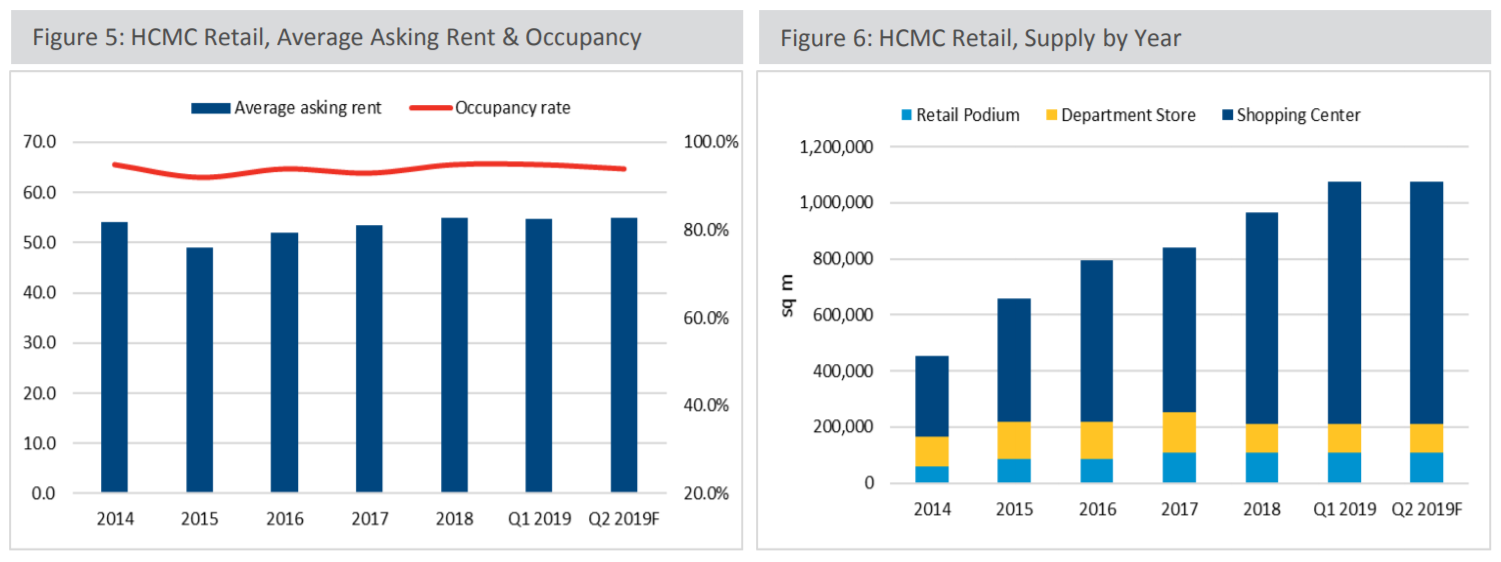

The retail market in Ho Chi Minh City’s CBD has little to no vacancy, and asking rent continues to increase by 1.5% per quarter on average. Meanwhile, with addition of Giga Mall, the retail market in non-CBD areas have seen a strong uptick in occupancy, but only slight increases in average asking rent.

HCMC's retail market performance and supply. (Source: Colliers International)

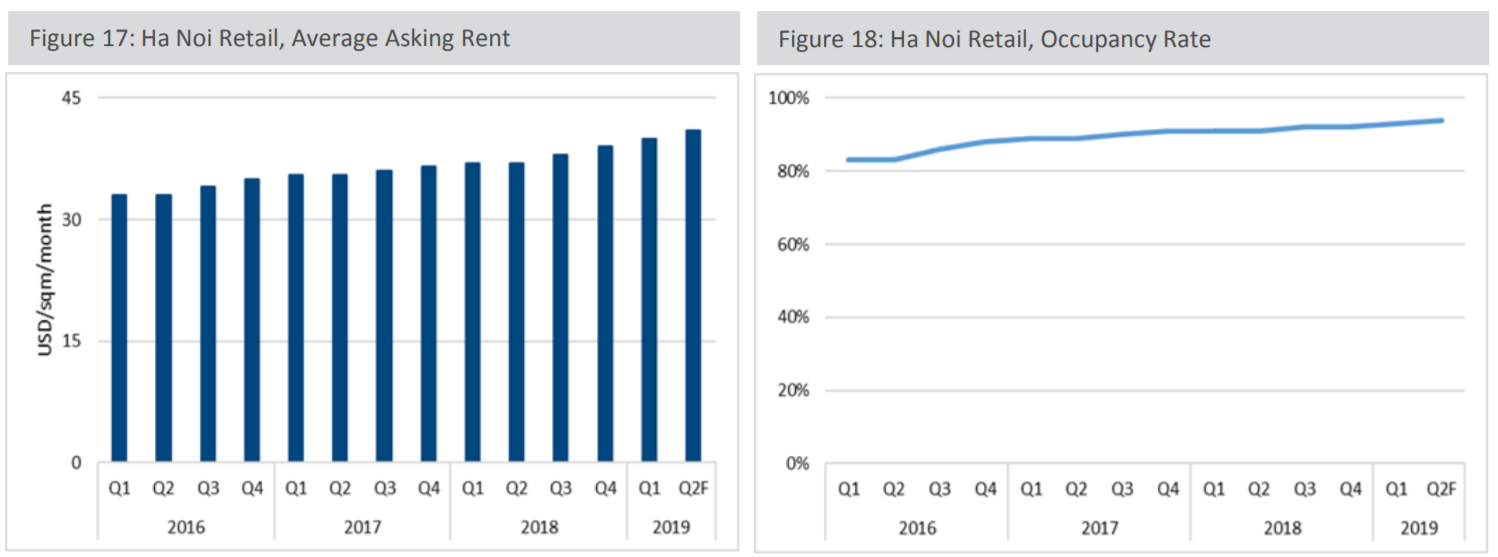

For the time being, retail space in or close to the CBD of Hanoi will continue to attract strong interest. The occupancy rate is expected to remain consistently high and average asking rent will continue to grow steadily. In the long run, however, similar to in HCMC, non-CBD areas of Hanoi will see the emergence of high-quality retail properties.

Da Nang’s economy, like that of Vietnam, is growing at a fast pace. Thus, the spending power of the average Vietnamese will increase strongly, making the country a very attractive market for foreign brands.

Supply

Giga Mall in Thu Duc, which opened in January, was the latest entrant in the retail market in HCMC with 110,000 sqm of leasable area. As asking rent among retail space in the CBD of HCMC has risen to extremely high levels, non-CBD areas are going to see more and more large-scale retail developments.

No new retail property came online in Hanoi in 1Q2019. The demand for high-quality and premium retail space continued to remain steady and on the rise. Shopping centers dominated the retail landscape in Hanoi, followed by retail podium and department stores. While high-end and luxury brands converge in the CBD, the outer areas of Hanoi are inhabited by local and smaller brands.

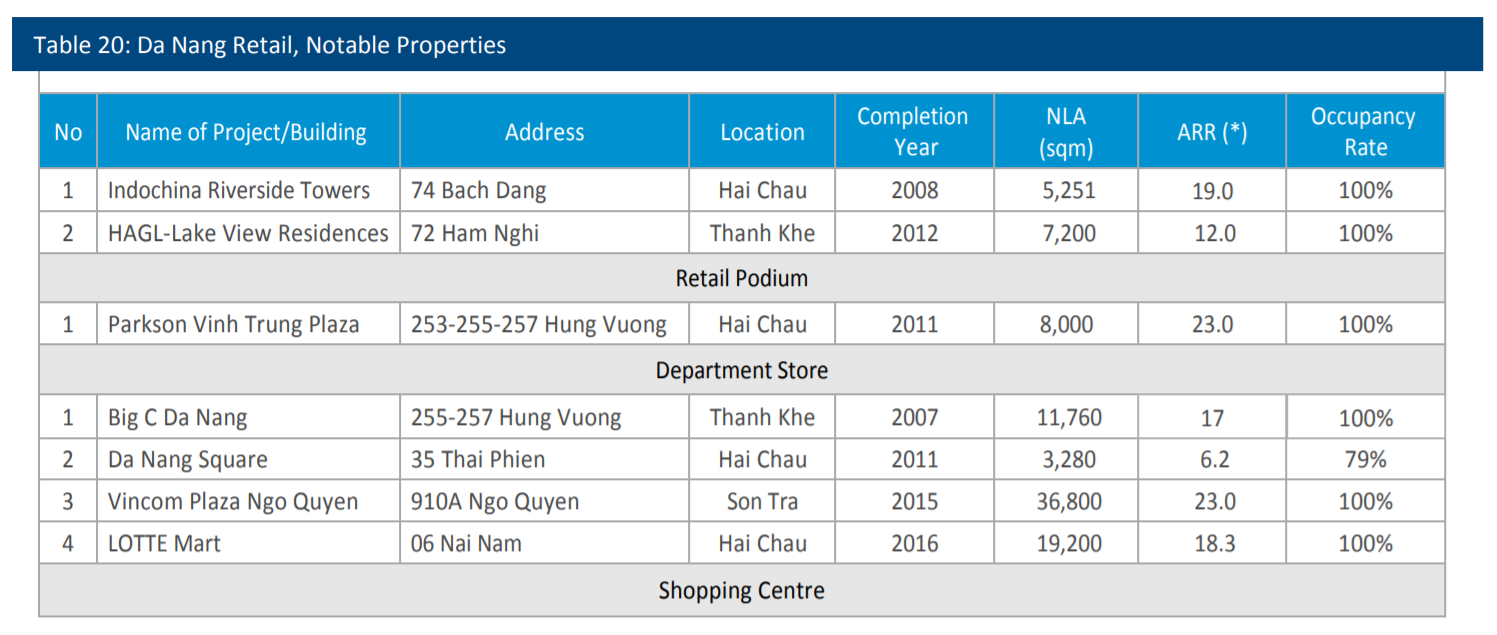

In 1Q2019, the retail supply in Da Nang remained unchanged at over 76,000 sqm of leasable area. The city’s retail supply is spread across three districts, namely Son Tra, Hai Chau, and Thanh Khe. Son Tra District contains more than 36,000 sqm of retail space – approximately 45% of the total market in Da Nang, while Hai Chau District and Thanh Khe District contain 40% and 15% of the retail market, respectively.

(Source: Colliers International)

Demand

Retail supply in the CBD of Ho Chi Minh City will continue to be limited as the only upcoming developments in this area are office spaces, each with their accompanying retail podium. Thus, occupancy rates and asking rent among CBD retail spaces will continue to climb.

Vietnam’s economy continued to improve in 1Q2019, and the country is well on its way to transition from a low-income to middle-income nation, in the ASEAN context. This has led to a strong increase in consumer purchasing power, which has, in turn, positively affected consumer retail spending and retail space demand in Hanoi.

Hanoi's retail rent and occupancy rate. (Source: Colliers International)

A great deal of international retailers is planning to penetrate the local market to introduce their products to tourists and local customers in Da Nang and enhance their brand image in Vietnam.

Outlook

The retail market in HCMC will see a decentralization. In the near future, 08 additional projects are opening by 2020, bringing to the market an extra 300,000 sqm of leasable area, the vast majority of which will be located in non-CBD areas. Furthermore, the rise of online shopping has forced retailers to adapt and shift their focus to experiential retail.

More international brands are entering Vietnam than ever, thanks, in part, to the liberalization of Vietnam’s regulatory and social environment. This increase in brands will entice consumers to spend more, and with the shift from solely retail-focused to more comprehensive entertainment experiences, the retail market in Hanoi will blossom in the near future.

Regarding the market outlook of Da Nang City, retail podiums serving the shopping needs of residents in high-rise developments are being better received, while high-end shopping centers and department stores may still have difficulty in achieving good sales from local consumers. However, increasing international arrivals over the years will give a brighter future for the retail market.