International experts have questioned which countries would likely be the beneficiaries of the trade war between the US and China and Vietnam remains the pointed one so far.

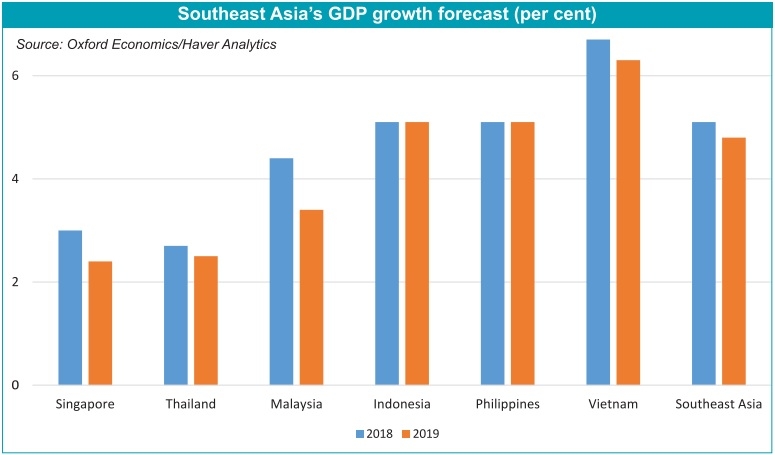

Vietnam's GDP growth rates compared to its regional peers. (Photo: Oxford Economics/ Haver Analytics)

As China moves away from its low-cost manufacturing base, Vietnam has appeared to be the potential destination for multinational groups, and many others are eyeing the possibility of shifting their locations here.

The Southeast Asian country has long been able to accommodate international giants such as Intel, Samsung, Adidas and Nike and it certainly is an alternative to China. According to Forbes, one in ten of the world’s smartphones is produced in Vietnam.

When the US-China trade conflict rubbles on, it pushed companies out of China and towards Vietnam, the neighboring country with advantages on labor, business environment and incentives.

Forbes reported that a recent survey by the Guangzhou-based American Chamber of Commerce showed Chinese companies were losing market share to companies across Asia, but particularly to those from Vietnam.

Andy Ho, chief investment officer at VinaCapital Vietnam Opportunity Fund, told Forbes that companies are looking to relocate for manufacturing while construction materials companies are building factories in the country and others are moving their supply chains here.

The process is on the way as Vietnam welcomed US$19 billion worth of foreign direct investment (FDI) in 2018. In the first quarter this year, foreign investors commited to pour US$10.8 billion into the country, up 86.2% on year, and marking the highest capital inflow for Q1 in the past three years.

Firm evidence through figures

Policies, governance, and incentives

It’s a flaw giving good remarks for Vietnam through economic data bypassing its policies. The government of Vietnam has repeatedly ordered its ministries to keep perfecting the legal framework to remove hurdles and local authorities to tackle problems to facilitate investors.

Accordingly, the business environment has been much changed through the provincial competitiveness index (PCI) which is designed to assess and rank the performance, capacity, and willingness of provincial governments to develop business-friendly regulatory environments.

The PCI, with support from international osuch as the World Bank, the US Agency for International Development (USAID), and the Asia Foundation (TAF), contributes to enhancing transparency and competitiveness, pushing local governments to create an enabling and level-playing business environment to attract domestic and foreign investors, according to Victoria Kwakwa, World Bank’s vice president for East Asia and Pacific.

In addition, each locality has offered investment and tax incentives to attract foreign investors, making the business environment more competitive and more favorable to the investors.

Impressive economic data

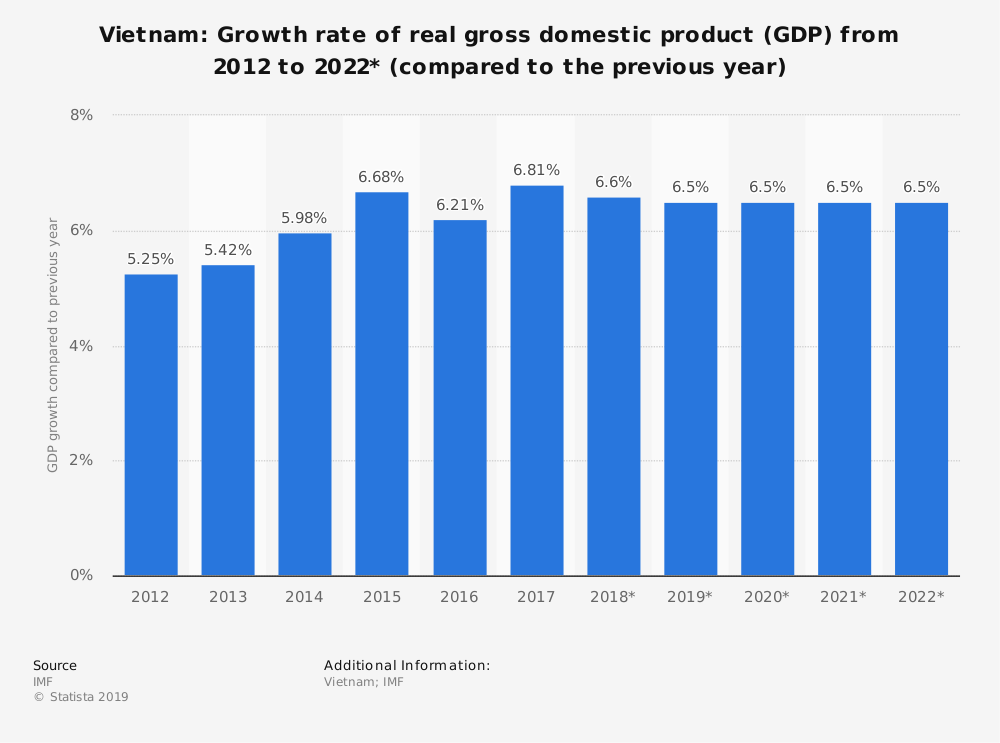

Vietnam's GDP growth rate through years. (Photo: Statista)

Vietnam’s gross domestic product (GDP), according to the International Monetary Fund (IMF), grew 6.6% in 2018 and would expand 6.5% in 2019.

Infrastructure has been much upgraded. Indeed, the country has made significant strides in building infrastructure to support its growth with wide networks of new roads, including expressways connecting the north and the south; upgrading ports, mostly deep see ones; and putting new aviation terminals into operation.

Upgraded infrastructure enables the country to develop different means of transportation and make the shipping of goods much easier across the country as well as for export.

In terms of electrification, up to 99% of the population use electricity as their main source of lighting, compared to 14% in 1993. Notably, the government keeps aware of ensuring enough power for economic development. Over the past years, more money has been poured into electricity projects and the country is also diversifying the power sources.

In the World Bank’s annual report “Doing Business” for 2018, Vietnam ranked 69 out of 190 economies in ten areas namely starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minor investors, paying taxes, trading across borders, enforcing contracts, and resolving insolvency.

Middle class and strong purchasing power

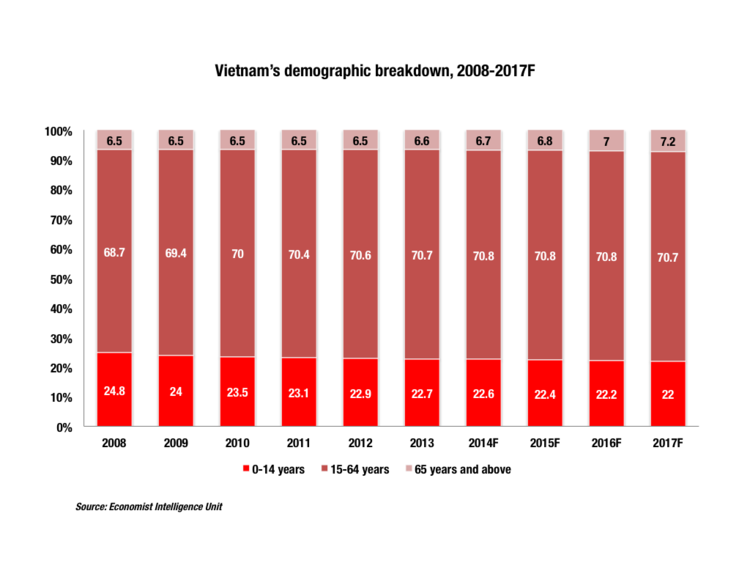

Vietnam's growing middle class through years. (Photo: Economist Intelligence Unit)

Andy Ho pointed out other attraction: a growing middle class which would grow 30% or one million more in the next year.

Forbes said that Asian fund managers are taking note. Mike Kerley, manager of the Henderson Far East Income trust, has been increasing his weighting in the country, saying that Vietnam is doing the right thing.

Obviously, it has created a manufacturing base, which is bringing jobs. It’s had written off non-performing loans while the currency has behaved very well and it has a strong current account surplus.

With the growing middle class, domestic consumption stories are of foreign observers’ focuses. Low cost airlines, for example, is the case in point as there are a lot of first time flyers in Vietnam and domestic travelling is increasing through the operations of airlines in the country.

Currently, there are 21 airports in Vietnam and it is a priority for the government, said Andy Ho.

There is plenty to support Vietnamese growth over the next few years, especially after it signed a big trade agreement with the European Union.