Long-term contracts drives HCMC’s future solid growth

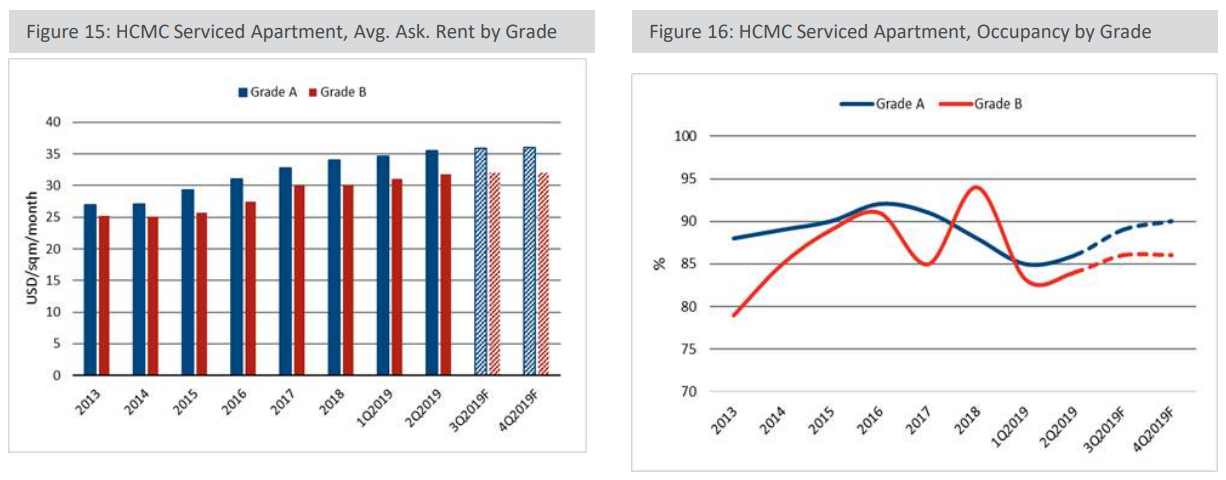

The growth trajectory for short-term rates for serviced residences was nigh-similar to that of hotels, with asset managers preferring to price their services and products at a slightly lower level than their hotel counterparts. This is likely to attract more interest in serviced residences and make them more widely recognized as viable alternatives to hotels. Long-term rates, on the other hand, have been growing at a steady pace (3% per annum), and there is no indication that this growth will slow in the upcoming years. In fact, it can be argued that given the projected growth of Ho Chi Minh City’s tourism industry and business activities, this growth rate will turn out to be a conservative estimate.

The majority of Grade A service apartments in HCMC are mainly focus on CBD, with large amount of office buildings, shopping centers, luxury to high-end condominium at District 1 and District 3. Recently, the upcoming service apartment are likely to located out of CBD such as Sonata Residence (District 7), Berkley Serviced Residence (District 2).

As more serviced residences become open to shorter-term accommodation, these properties are likely to be more widely recognized as reliable alternatives to hotels, and this sector is expected to see positive growth in the near future. As expected, long-term business contracts continue to be the main growth driver for serviced residences. For now, this sector is still “safe” from the disruptive effect of short-term lodging brokerage services such as Airbnb. Furthermore, as more travel and lodging aggregators host listings for serviced residences alongside hotels, this sector has gained access to a larger influx of customers who travel in groups or as a family. In fact, the average occupancy rates for this sector has gradually risen in recent years, with 2018 as the high point.

The serviced residence sector has thus far been operating in a silo, and more or less unaffected by the performance of the hospitality sector or buy-to-let apartments. However, the competition for customers will heat up in the upcoming years as more lodging brokerage services become available on the market.

Buy-to-let model stars in Hanoi’s serviced apartment market

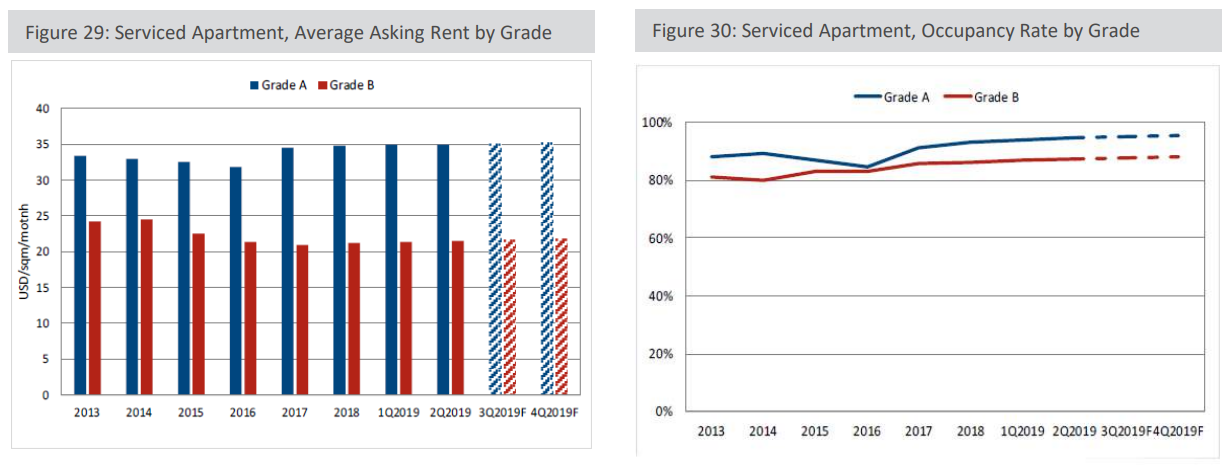

As of Q2 2019, serviced apartment market in Hanoi witnessed improvements in performance across both grades on the back of solid demand from both domestic and foreign visitors. While average asking rent for Grade A was stable, Grade B’s rent rose by 1%, standing at USD22/sqm/month. The market remained tight with healthy occupancy rates across all grades. Grade A’s average occupancy rate recorded 95%, while Grade B’s average occupancy rate staying at 86.5%.

There is no new supply in the second quarter of 2019. Currently, there are 44 serviced apartment projects of all grades, providing more than 4,500 units from studio to four-bedroom units and penthouses in Hanoi. In terms of location, Ba Dinh and Tay Ho Districts are major suppliers with more than 50% market share.

Hanoi, the capital city of Vietnam is showing its potential as a favorable investment destination for multinational corporations, embassies and international organizations, bringing a hope to a promising serviced apartment market over the next few years. This coincides with the statistical finding that FDI to the capital city increased in Q2 2019, facilitating growth of demand for serviced apartments as normal practice. In terms of tenant profile, the main sources of demand coming from Japan and Korea owning to a large amount FDI inflow from these countries invested in industrial zones in suburban provinces such as Bac Ninh, Thai Nguyen, Hai Phong.

In the upcoming quarters, Hanoi is expected to welcome 4 projects from Tay Ho District and Ba Dinh District. Under the pressure of future supply from the market, asking rents are expected to slightly drop in the coming periods, while occupancy rates in Hanoi serviced apartment market are forecasted to keep in stable due to sustainable demand. Additionally, buy-to-let model is becoming a new attractive investment channel, supported by its small amount of capital, flexibility and diverse options. This trend is forecasted to grow in the coming years, which is more likely to create more competition to the service apartment market.