Experts expect the 2019 real estate market to be prosper on the back of FDI.

In January and February, foreign investors poured money into 18 fields, with processing and manufacturing attracting 6.93 billion USD, or 81.8 percent of total registered capital. Property ranked second with 478 million USD, 5.6 percent of the total.

The Ho Chi Minh City Real Estate Association said in recent years, property has been among the top magnets for FDI, which has become a very important source of funding as capital flow from domestic banks has slowed in recent years.

Chairman of the association Le Hoang Chau said FDI is not only an additional source of funding for the real estate market, it also creates many opportunities and value for property firms.

According to economic expert Nguyen Tri Hieu, FDI into Vietnam's real estate market has gradually increased in recent years. Real estate developers from Japan, South Korea and Singapore have been keen on developing projects in city center area or near important transportation infrastructure such as overhead railway, subway,…

On the other hand, many bottlenecks of legal procedures are also continuously removed. This is also a support to the real estate market to receive new investment flows in near future. Currently, real estate businesses have also actively sought out capital to replace bank loans.

Mr. Hieu analyzed: "Some businesses have restructured strongly to list on the stock exchange, and cooperate with foreign investment funds to implement projects. FDI also partly reduces the burden of capital obstruction on local enterprises when banks tighten real estate loans.”

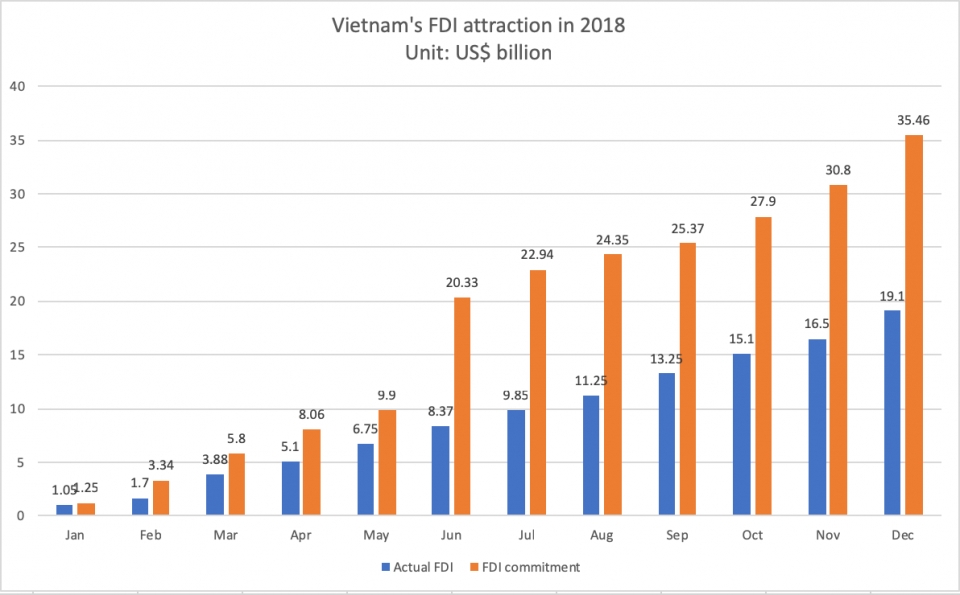

FDI flows to Vietnam in 2018 (US$).

According to industry insiders, foreign investors in Vietnam’s property market can be divided into two groups. The first is interested in cash-generating properties such as office buildings, shopping malls, serviced apartments and hotels in downtown areas.

Meanwhile, the second focuses on housing development. These investors are inclined to cooperate with local firms, especially those with available land, to develop apartments or villas.

According to Jones Lang LaSalle (JLL), FDI inflows of hundreds of millions of US dollars are ready to be poured into Vietnam real estate market. The growth of tourism industry is one of the potentials that attract foreign investors. Last year, the country saw a record of 15.5 million international visitors and 80 million domestic tourists. The tourism industry sets the goal of welcoming 20 million visitors by 2020.

In addition, infrastructure system keeps improving, with 2,000km of new highways, subway systems in Hanoi and Ho Chi Minh City and many expansion or construction projects for airports. Therefore, it is not a surprising thing investors and property developers are ready to pour money into this fast-growing market, JLL noted.

Tran Kim Chung, vice president of the Central Institute for Economic Management, explained that there remain some bottlenecks that emerged in 2018. Vietnam is increasingly integrating its economy into the world, while the fourth industrial revolution is also increasing its impact on the socio-economic landscape.

Therefore, according to Chung, the expansion of investment funds is of great importance and requires policies, such as the creation of regulatory frameworks, for condotels.

He added that financial policies on the property market do not yet exist. The trust fund could be the best possible solution, but it has yet to be adopted. It is also necessary to control the flow of FDI into the sector in a reasonable manner.

Experts expect the local property sector will continue recording growth in almost all segments, with industrial real estate the hottest in 2019, driven by the relocation of factories from China and the positive impacts of trade agreements.