Clustering seems to be a missing piece of Vietnam’s industrial map puzzle and it is expected to become more popular as the Vietnamese economy moves up the value chain, according to Troy Griffiths, deputy managing director, Savills Vietnam.

Industrial property has great potential to influence land use changes and create value. However industrial property itself is subject to enormous influence from infrastructure, that comes down to primarily distance from source markets and distance to destination markets. As industrial land is relatively homogenous then these operational variables have great weight for occupiers.

In highly industrialized nations the downstream or co-location of sector specific industries then becomes important as operational efficiency can be achieved. That is having an ‘automotive cluster’ in a single location will be far more effective as each of the steps within the overall production sequence are closer and more tightly aligned.

Clustering is well recognized as creating advantage for sector specific industries. It also allows less competitive provinces or locations to emerge and compete effectively. At a policy level it is better to consolidate locations by industry thereby conferring advantage to the occupiers, rather than ad hoc and disparate industries spread throughout the country.

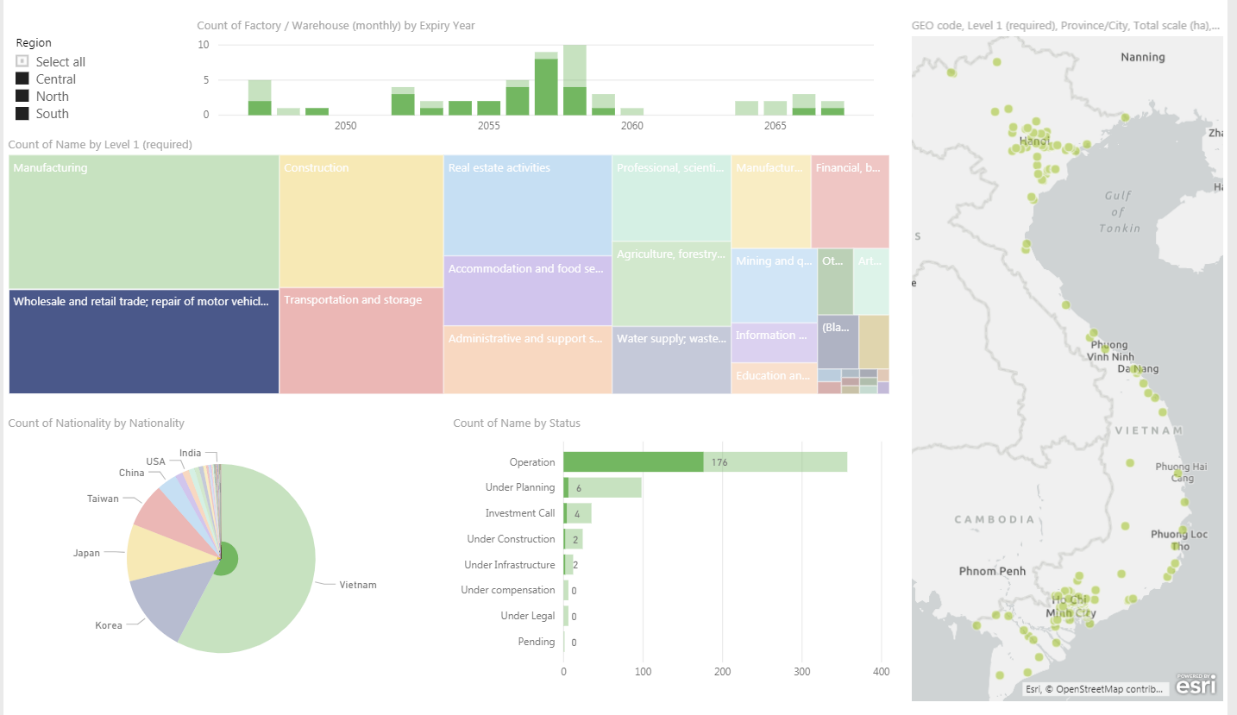

The charts above detail a VSIC level 1 “wholesale and retail trade, repair of motor vehicles, motorcycles” classification as 190 occupiers, without much clustering. They’re spread throughout the country with some small bias around Hai Phong.

Major international and domestic property players are now circling industrial land as this asset class comes into favor. Global trade, geopolitics and the delivery of infrastructure have all combined to change the nature of industrial property in Vietnam. Add to that the disruptive nature of logistics and modern retailing and we can see interesting dynamics at play.

Hai Phong is already established for electronics but now emerging as an auto cluster. With excellent infrastructure coming online and proximity to markets, then this will continue to be a standout manufacturing location.

Long An is under-priced and will benefit from the connectivity Ben Luc ring road 3.

Binh Duong is benefiting from its near proximity to Ho Chi Minh City and has seen rapid land price escalation, making adjacent locations more valuable.

The future lies in moving up the value chain to greater value add or tertiary industries. To this end look to Danang that’s a sleeper but has all the prerequisites.

New to market foreign entrants would be familiar with industrial clustering, as these are well-established within the locations they are moving from. This is generally guided through government policy, corporate income tax (CIT) incentives or strategic planning. In so doing the economic benefit can be spread throughout the country rather than concentrating at a single location.